Sukuk investors in trouble as Beximco’s rosy reports fade

Bad news for Beximco Sukuk investors: their gain from the Shariah-compliant bond-like instrument next month is set to drop to 9 percent -- below the 12.3 percent yield from five year-tenure treasury bonds and the 10.87 percent inflation rate in October.

This is due mainly to the plummeting financial performance of Beximco Ltd, the determinant of sukuk payment streams.

Beximco's current poor performance contrasts with its financial reports in FY21 -- the year the Shariah-compliant instrument "Beximco Green Sukuk al Istisna'a" was announced to raise Tk 3,000 crore.

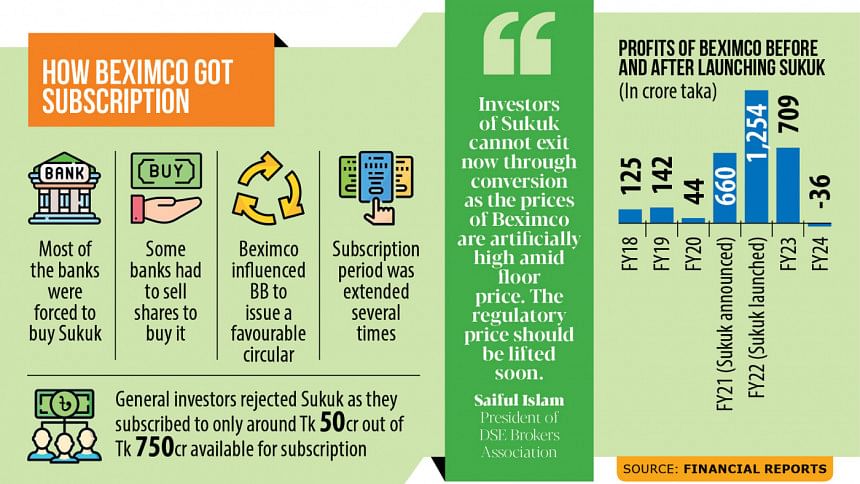

That year, Beximco's profits soared 1,400 percent year-on-year to Tk 660 crore. In FY22, profits rose further to Tk 1,254 crore, according to Beximco's financial reports.

Then the fall began, with the company registering a Tk 36 crore loss in FY24.

This abrupt performance curve has left banks, other institutions, and individuals to question whether Beximco painted a rosy picture to attract investors to the country's first private sukuk.

In FY21, the conglomerate declared a 35 percent cash dividend based on its high profits. The year after, a 30 percent cash dividend was paid to Beximco shareholders.

The sukuk's coupon rate -- the interest rate paid to investors -- is linked to the company's cash dividend. Higher dividends in those years translated into higher coupons -- which were above the yield of treasury bonds at the time.

In the first year, the sukuk coupon rate was around 12 percent whereas the treasury bond rate was languishing at 3.92 percent.

Despite this, investor interest in the Beximco Sukuk was not as strong as expected. Therefore, Beximco Ltd's Vice-Chairman Salman F Rahman extended the subscription period multiple times.

Yet, full subscription was not achieved.

Amid this, the Bangladesh Bank (BB) stepped in and issued a circular allowing banks to buy private sector-issued green sukuk from their special funds, which were formed to invest in the stock market.

The central bank allowed banks to set up a Tk 200 crore fund for stock market investments by borrowing from the BB to increase liquidity in the market.

Top officials from six banks confirmed to The Daily Star that they were pressured by Salman F Rahman, an adviser to former Prime Minister Sheikh Hasina, to invest in the sukuk.

Two officials said they had to sell other shares to maintain the exposure limit before buying the sukuk.

Minhaz Mannan Emon, a former director of the Dhaka Stock Exchange (DSE), said general investors rejected Salman's scheme. As a result, out of the Tk 750 crore available for general investors, they only subscribed to around Tk 50 crore.

"However, institutional investors were forced to invest. So many of them had to sell other shares," he added.

This ultimately impacted the market, he said.

In September 2021, the DSEX, the prime index of DSE, crossed 7,356 points for the first time, while DSE turnover crossed Tk 2,000 crore on average.

Within four months, the index began to decline, along with turnover.

Over six months, the average DSE turnover dropped to Tk 700 crore, while the index fell by more than 1,000 points.

However, Saiful Islam, president of the DSE Brokers Association (DBA) of Bangladesh, disagreed that the sukuk investment made the market illiquid as most investors were institutional.

He claimed they did not transfer funds from the stock market to the sukuk.

In early September this year, the Bangladesh Securities and Exchange Commission (BSEC) formed a committee to investigate alleged irregularities related to the issuance of two bonds by the company: Beximco Green Sukuk Al Istisna and IFIC Guaranteed Sreepur Township Green Zero Coupon Bond.

How Beximco's sukuk rate will fall

A 9 percent base rate against the sukuk's face value is guaranteed each year. If Beximco's cash dividend for the year exceeds 9 percent, the sukuk offers additional payments, according to the sukuk prospectus.

One-tenth of the percentage point excess that Beximco Ltd shareholders receive as cash dividends over the sukuk base rate will be added to the sukuk payment rate.

If Beximco Limited shareholders receive higher dividends, sukuk investor returns will increase.

Beximco is not providing any cash dividend this year, so sukuk holders will receive the lowest rate of around 9 percent in the next payment in December this year.

Several banks invested in the sukuk and some of them did not receive the first coupon payment on time as the issuer failed to provide the funds within the stipulated period.

For instance, Rupali Bank invested Tk 200 crore in the sukuk. But Beximco delayed its payment, according to a top official of the bank.

The bank is now concerned about whether it will receive the remaining funds within the stipulated time.

Floor price weighing on sukuk investors

DBA President Islam, who is also a director of BRAC EPL Stock Brokerage, said the imposition of a floor price on Beximco's stock is impacting sukuk investors as they cannot convert their funds into shares, prices of which have been kept artificially high.

Sukuk investors are allowed to convert 20 percent of their funds into Beximco Ltd shares each year. Considering the 20-day average trading price of the company, sukuk investors will receive shares at a 25 percent discount rate.

However, the conglomerate's stock price has been stuck at the floor of Tk 115 for many months.

"If the floor price is lifted, it will likely fall, so sukuk investors cannot even exit through conversion due to the regulatory decision to keep the floor price," Islam said.

He recommended lifting the floor price as soon as possible.

Similarly, Former DSE director Emon advocated for lifting the floor price as it is seriously hurting sukuk investors.

"Those who wanted to convert the bond into shares and exit have no option to sell shares thanks to the floor price."

He described the decision to keep the floor price active on Beximco Ltd as a bad one, saying, "If you have breast cancer, you have to cut the breast; there is no other option. If you continue, it will rot the entire body."

Although lifting the floor price might impact the index, there is no other option but to lift it, as it has many other negative consequences, he commented.

For instance, holding the shares artificially inflates investor portfolios, allowing them to obtain higher margin loans. On the other hand, sukuk investors will incur losses if they convert now.

"Who will take responsibility for the loss?" he questioned.

Mohammad Rezaul Karim, spokesperson of the BSEC, said the commission has not made any decision regarding lifting the floor price from Beximco Ltd.

If any sukuk holder requests the BSEC, the regulator would consider it, he added.

What Beximco says

Mohammad Asad Ullah, company secretary of Beximco Ltd, declined to comment on the matter.

In its latest financial statement, Beximco Ltd claimed that the company incurred losses in FY24 due to plummeting orders in both domestic and international markets, coupled with external shocks like the Russia-Ukraine war and domestic challenges such as a US dollar shortage and soaring gas and electricity bills.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments