Economic expectations: Did govt fall short?

When an interim government was sworn into office following the ouster of the Awami League regime just 100 days ago, there was an air of expectation that the Prof Muhammad Yunus-led administration would take steps to salvage a scam-ridden financial sector and rescue an ailing economy.

To achieve this, the interim government formed numerous taskforces and panels to take stock of existing policies and measures and analyse their effects on banking, taxes, the capital market and the overall economy.

Measures were also taken to stabilise the exchange rate and to stem the fall of the foreign exchange reserves while the boards of 11 crisis-hit banks were restructured to protect the interests of depositors.

The central bank has also decided not to prop up troubled banks by printing money and instead facilitated liquidity support from the interbank money market, allowing well-off lenders to lend to struggling ones. Some of the initiatives, such as stopping the practice of lending US dollars from the forex reserves and allowing market forces to determine the exchange rates and interest rates, are already bearing fruit.

Stability has prevailed in the forex market over the last three months, with reserves hovering around $19 billion.

The central bank's strategies to incentivise remittance earners to use formal channels have also paid dividends.

Remittance inflows jumped 80 percent year-on-year in September to $2.4 billion, followed by a 21 percent rise year-on-year in October to $2.39 billion.

A rise in export earnings relative to import expenditures was also seen, enabling the country to reduce pressure on the external accounts.

At the same time, various ailments continue to persist.

Inflation, a major concern for the general populace for over two years, remains stubbornly high and hit a three-month high of 10.87 percent in October. Food inflation was even more intense, hitting 12.66 percent the same month.

The central bank has continued to hike the policy rate to contain rising prices, doing so thrice since taking responsibility in mid-August.

The latest, in late October, marked the 11th time since May 2022 that the policy rate, which makes money more expensive for banks, was hiked.

This jump in the policy rate, from just 5 percent in May 2022 to 10 percent by October 22 this year, has led businesses to voice complaints about rising interest rates on loans.

Furthermore, although the vicious cycle of extortion appeared to have been broken following the political changeover, such unscrupulous practices have returned, with even "higher rates" being charged by other parties.

This has worsened the business climate and contributed to increased costs of production.

The interim government inherited an economic outlook darkened by double-digit inflation, massive capital flight, shrinking reserves and a heavily strained banking system -- a legacy of Sheikh Hasina's regime.

So, taskforces were formed to address key issues. For example, the Bangladesh Bank and the Bangladesh Securities and Exchange Commission (BSEC) took steps to prevent any further damage to their respective sectors, forming several taskforces and investigation committees.

Chief Adviser Yunus formed a committee to prepare a white paper on the state of the Bangladesh economy while the planning ministry formed a taskforce to develop strategies to boost the economy and mobilise resources for equitable and sustainable development.

In total, several committees were formed and are preparing their tasks. Most were asked to submit reports within three months, meaning that some are due by the end of this month while some will take a little longer.

However, no significant steps aside from changes to the top brass of the Insurance Development and Regulatory Authority were taken to revive the insurance sector.

Prof Muinul Islam, a former president of the Bangladesh Economic Association, said the interim government came to power at a time when significant capital had been siphoned abroad, foreign exchange reserves were depleting fast, and the local currency was depreciating significantly.

"It managed to stop all of these," he added, crediting the interim government's success in combating the US dollar crisis.

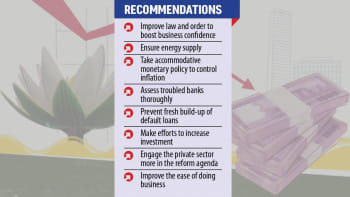

"However, inflation is still high and the law-and-order situation is not up to the mark," he said, expressing hope that the rise in prices could be tamed within January or February.

Regarding the ongoing reform activities, Islam said: "I cannot comment on the matter before they complete their activities. After reports are submitted, this government will start reforms. Some reforms may be left to be implemented by the next elected government," he added.

People are still facing serious problems in getting their deposits back from about a dozen ailing banks, whose dire conditions are common knowledge, he said.

Abdur Razzaque, chairman of Research and Policy Integration for Development (RAPID), said the credibility and depth of the monetary policy has increased under the interim government, which is very important in the fight against any economic crisis.

Under the new governor, the central bank continued with a contractionary monetary policy to reduce inflation. Yet, inflationary pressures remain stubborn, especially after the production of several crops was hampered by flooding in several districts within weeks of the political changeover.

By credibility, he indicated that the central bank is not providing loans to the government by printing money while simultaneously claiming to implement a contractionary monetary policy to tame inflation as it had done in the past.

"So, people can believe the central bank now," Razzaque said.

"Raising interest rates is a non-populist measure, but the central bank's implementation is adequate and reflects that the policy has depth," he added.

The RAPID chairman also said that reform activities may appear a bit slow, but in reality, the interim government is cautious about policies.

"For a proper reform, policies must be informed and inclusive," Razzaque said, adding that all reform-related committees have held talks with stakeholders.

"So, it may take time but it will be proper," he added.

Razzaque informed that after getting reports from various committees and taskforces, the government will start significant reform activities in the next six months.

"So, the next budget is very important, especially in terms of allocating enough for reform activities," he said.

Stock market investors are also feeling the pinch. As a result of the political turmoil in July and August, most listed firms saw an erosion in profits in the first quarter of the current fiscal year.

Moreover, manipulators, perhaps wary about impending reforms, are making off with their stakes.

So far, the BSEC has formed an investigation committee to probe any anomalies in the stock market, including allegations concerning the issuance of Beximco Green Sukuk Bond and IFIC Granted Sreepur Township Green Zero Coupon Bond as well as irregularities involving around nine other listed companies.

The regulator also appears to have moved away from the tradition of slap-on-the-wrist fines, imposing an unprecedented penalty of Tk 428.52 crore on several investors for manipulating prices of Beximco Ltd's stocks in October.

Alongside that, it has taken steps to avoid any deficit in consolidated customer accounts, which previously created a scope for embezzlement, and has taken a tough stance against directors of several listed firms that have not been providing dividends properly.

Despite all these moves, the DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), dropped to a four-year low last month amid a confidence crisis.

In response, the interim government quickly designed some moves to boost investor confidence.

For example, it reduced the capital gains tax and gave a sovereign guarantee against Tk 3,000 crore in loans that the Investment Corporation of Bangladesh (ICB) sought from the central bank.

After that, the stock market index bounced back.

Regarding the business climate, Mostafa Kamal, chairman and managing director of Meghna Group of Industries (MGI), said the law-and-order situation needs to be improved.

Indicating extortion, he said that the regime has changed, but the same system remains. Moreover, their demands have increased, he added.

He also said there should be bureaucratic accountability, holding them responsible for spending so long in passing along files.

"The government has started a marathon and 100-meter sprint in parallel. It came following 10-12 years of a very bad rule in terms of democratic and economic governance," said M Masrur Reaz, chairman and CEO of the Policy Exchange of Bangladesh.

Restoring governance to crippled institutions is a long-term agenda, he said, adding that the interim government had started with the right approach.

He said the government inherited several problems that threatened the economy and has started working on the tasks at hand. However, Reaz added that it could have done more on two fronts: restoring normalcy in the banking sector and focusing on small and medium enterprises and exports.

"100 days is long enough to roll out plans to restore normalcy and consolidate confidence," he said, adding that there should be a plan about what reforms will be implemented in the trade and investment sectors.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments