Bad loans hit alarming record

Awami League-affiliated businesses had already put the country's banking sector in trouble with huge bad debts, but the loans disbursed through irregularities to these companies turned sour even at a more alarming pace after the party's ouster.

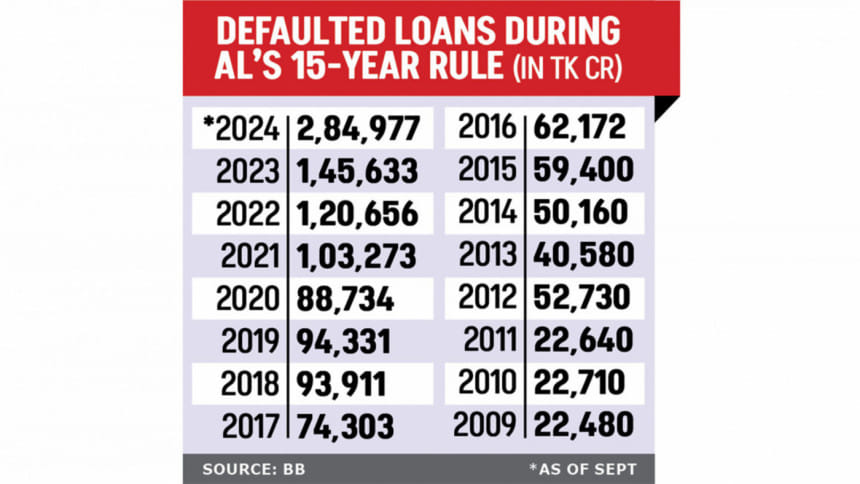

The result: bad debts in Bangladesh's banks hit a record Tk 284,977 crore at the end of September, less than two months after the fall of the Sheikh Hasina-led government on August 5.

The figure includes a staggering Tk 73,586 crore defaulted in just three months. Between July and September, bad debts soared by 34.8 percent, according to data from the Bangladesh Bank.

When compared with last year's figure, the picture is even grimmer: soured loans increased by an eyewatering 83.4 percent.

Some large borrowers, including S Alam Group, Beximco Group and Bashundhara Group, defaulted heavily after the Awami League's fall, pushing up the total to an unprecedented level.

Of Beximco's Tk 23,000 crore loans with Janata Bank, Tk 19,000 crore turned bad during the July-September quarter, The Daily Star has learnt from the state-run bank's officials, who spoke on the condition of anonymity.

Hasina's close collaborator Salman F Rahman, who advised the former prime minister on private industry and investment, is the vice-chairman of Beximco Group.

Around Tk 8,000 crore of loans of another of Hasina's close allies, S Alam Group, with Janata Bank has gone bad during the quarter.

As a result, Janata's bad loans rose to Tk 60,000 crore at the end of September, which is the highest in the banking sector.

Two concerns of Bashundhara Group have defaulted on their loans amounting to Tk 416 crore with IFIC and Rupali.

Defaulted loans have increased in the majority of the banks, including some Shariah-based lenders who saw their boards reconstituted after Ahsan H Mansur took charge as Bangladesh Bank governor in mid-August.

One of the reasons behind the increase in defaulted loans is the central bank's adoption of a new method to calculate bad loans following global best practices, said BB spokesperson Husne Ara Shikha.

As per the new method, the grace period for term loans has been reduced to three months from the previous six months.

"We are assuming that this is one of the reasons behind the increase in bad loans in the July-September quarter."

Besides, some entities had filed writ petitions with the High Court about their bad loans. Some of the writ petitions were vacated recently and those disputed loans were marked as bad.

"This could be another reason," Husne Ara added.

Subsequently, at the end of September, bad loans accounted for 16.9 percent of the total disbursed loans of Tk 1,682,821 crore.

A rise in defaulted loans was expected for several reasons, said Syed Mahbubur Rahman, managing director and chief executive officer of Mutual Trust Bank.

Borrowers were already struggling before July-August due to challenges such as insufficient electricity and gas supplies, which reduced production and exports.

This was further compounded by the foreign exchange crisis, high inflation and an unfavourable local investment climate.

Additionally, the central bank's directive for greater transparency has led banks to disclose more accurate figures, including previously concealed bad loans, Mahbubur added.

The actual amount of the defaulted loans would have been higher if the other stressed assets, including written-off loans, had been taken into consideration, said Fahmida Khatun, executive director of the private think tank Centre for Policy Dialogue.

"Unfortunately, there is no shortcut to reducing the high amount of bad loans -- most of the big defaulters are on the run."

Fahmida, who was recently appointed a director of the central bank, suggested strengthening the money loan court both quantitatively and qualitatively.

Cases should be filed over the bad loans, she said, adding that the attorney general may form a special bench to settle the large default cases.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments