Janata moves to recover Tk 1,260cr from AnonTex

Janata Bank is set to auction the mortgaged assets of Simran Composite Ltd -- a concern of apparel-maker AnonTex Group -- to recover the company's Tk 1,260 crore in bad loans.

AnonTex has been regularly making headlines for years as one of the top defaulters of Bangladesh.

However, this is the first time the group is facing an auction of its mortgaged assets by a commercial lender.

To recover the defaulted loans along with interest, the Janata Bhaban corporate branch of the state-run bank has scheduled an auction on December 29 under the Money Loans Court Act.

According to the notice, AnonTex Group properties located in various areas of Gazipur and Ashulia are mortgaged with Janata Bank.

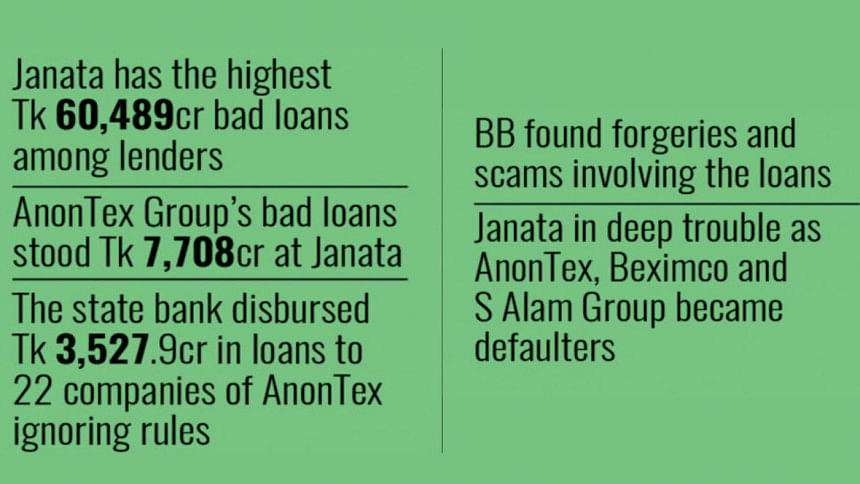

The state-run bank currently holds the highest amount of defaulted loans in the banking sector, totalling Tk 60,489 crore till September this year.

This amount represents 61 percent of the bank's total disbursed loans and 21.22 percent of the sector's total non-performing loans (NPLs) of Tk 284,977 crore till September this year, according to central bank data.

Of Janata Bank's total bad loans, a large chunk is owed by large borrowers.

Beximco Group owes the bank Tk 19,507 crore, S Alam Group Tk 10,500 crore and AnonTex Group Tk 7,708 crore.

Requesting anonymity, a senior Janata Bank official said the commercial lender's current management and board of directors are trying to recover defaulted loans from large borrowers as the bank is in deep trouble due to its high level of bad loans.

The official said the decision to sell the mortgaged properties of defaulters is part of this recovery effort.

Last month, the state-run bank announced an auction of mortgaged assets belonging to Global Trading Corporation Ltd -- a concern of S Alam Group -- to recover Tk 1,850 crore in bad loans.

The Daily Star tried to reach Md Mazibur Rahman, managing director of Janata Bank and Md Younus Badal, managing director of AnonTex Group, via phone and text messages, but neither responded by Thursday evening.

Between 2010 and 2015, Janata Bank disbursed around Tk 3,528 crore in loans to 22 companies of AnonTex Group.

Including interest, the total amount owed to the bank reached Tk 6,528 crore in December 2022.

This exceeds 25 percent of the lender's capital base, violating the single borrower exposure limit set by the Bank Company Act.

As of now, the outstanding debt of AnonTex Group stands at Tk 7,708 crore, according to Janata Bank data.

After a central bank investigation uncovered massive irregularities in loan approvals by Janata Bank, the banking regulator ordered the commercial lender in 2018 to conduct a functional audit and take legal action against those involved in the scams.

However, the bank has yet to take any legal action.

In March this year, the Janata Bank board approved a decision to waive Tk 3,359 crore in interest owed by AnonTex Group, contingent upon a one-time loan payment.

The lender also decided to collect Tk 4,960 crore of the principal loan amount by selling the group's mortgaged properties in Ashulia and Tongi.

However, in April this year, the central bank ordered Janata Bank to revoke the Tk 3,359 crore interest waiver as an audit found forgeries and scams linked to the loans.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments