Inflation high as oligarchic grip still haunts economy

Even after the political changeover in early August, the domestic market has been reeling under the influence of oligarchs, according to economist Hossain Zillur Rahman.

He labelled this as a major economic challenge the interim government will have to overcome, linking it to the brutal price pressures that have been rampaging for around two years.

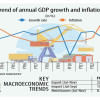

At a programme at the CIRDAP International Conference Center yesterday, the economist identified bringing discipline to the financial sector and achieving macroeconomic stability as two other key economic challenges, and said the interim government has made some progress in these areas.

However, oligarchic market powers still prevail despite several visible initiatives, he said at the launching ceremony of the 6th edition of the Banking Almanac.

After the previous Awami League government was ousted by a mass uprising in August, leading to the formation of the interim government, there have been massive reform initiatives to mend the economic fault lines that have developed over the years.

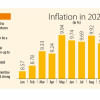

However, stubbornly high double-digit inflation continues to hinder these reform efforts.

"If we want to deal with the current inflationary pressure, then we will have to address the oligarchic market powers, which reached new levels in the last 15-year Awami League regime," said Rahman.

Simply defined, oligarchs are wealthy individuals who exert influence over the government. In the past 15 years, civil society members have been warning of the rapid rise of this super-rich class, whose influence extends from politics to local poultry supply.

"Despite the economic meltdown, Sri Lanka was able to control its inflation. But it has become difficult to address in Bangladesh despite numerous efforts," said Rahman, the acting chairman of the board of editors of the Banking Almanac.

While the macroeconomic outlook is satisfactory, the economy at the household level is also very important, he said.

On an optimistic note, he praised the interim government's focus on the uninterrupted flow of information and its professional approach to economic management.

"Along with financial discipline and macroeconomic stability, the wheels of the economy will have to be turned," he said. "Turning the wheel is not just the responsibility of the finance ministry, rather it is a responsibility for all."

The economist further said that the private sector will have to accelerate capacity building, but the private sector does not solely mean the large industrial sector.

He advocated focusing on small ventures and other micro-level businesses across the country.

As the chief guest of the event, Finance Adviser Salehuddin Ahmed said the interim government is working to create an information hub for the financial and social sectors, so investors can get all information from a single place with just a single click.

"Regular and timely publication of the book 'Banking Almanac' is important and it will help investors, bankers and depositors to get accurate information," he pointed out.

The finance adviser said the lack of accurate data hampered social and financial policymaking in Bangladesh in the past. Therefore, the government is prioritising the provision of accurate information in a single place, which is also the right of citizens to access current information.

While discussing misinformation and the lack of information, Salehuddin said that stock market investors sometimes invest in weak companies due to a lack of knowledge or are misled by misinformation, ultimately resulting in losses.

This occurs due to the lack of accurate information in a single source, he added.

Senior Secretary of Finance Md Khairuzzaman Mozumder, Deputy Governor of Bangladesh Bank Nurun Nahar and Chairman of the Bangladesh Association of Banks Abdul Hai Sarker also spoke at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments