S Alam-linked firms account for 56% of loans from First Security

Companies linked to the controversial S Alam Group took out 56 percent of the total disbursed loans of First Security Islami Bank (FSIB), one of six Shariah-based lenders controlled by the Chattogram-based business giant.

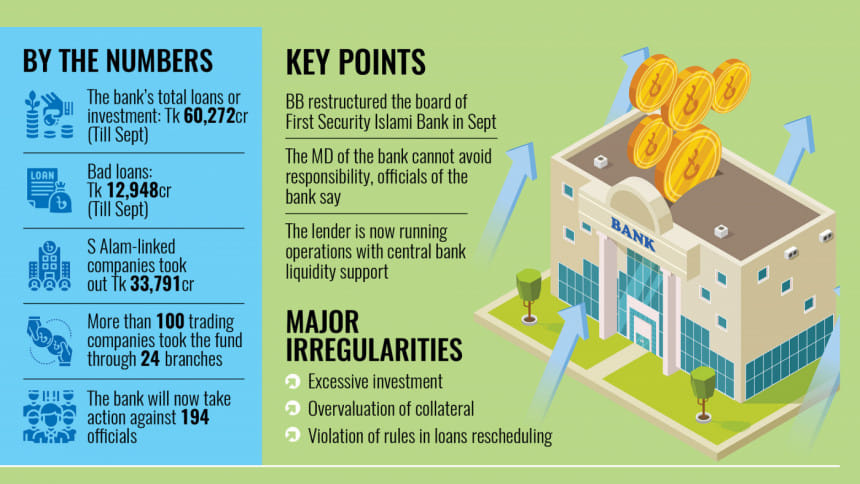

As of this September, the total loans of First Security Islami Bank stood at Tk 60,272 crore, of which Tk 33,791 crore, or 56 percent, was taken by companies linked to S Alam Group, according to an internal inspection of the bank.

These loans were disbursed through 24 of FSIB's branches in Chattogram to over 100 trading companies linked to S Alam, according to bank officials involved in assessing the commercial lender's exposure to the business conglomerate.

Mohammed Saiful Alam, chairman of S Alam Group, who was close to deposed prime minister Sheikh Hasina, was also chairman of the bank.

After the fall of Hasina's government on August 5, the Bangladesh Bank reconstituted the boards of eleven banks, including FSIB.

Under the new board, the internal control and compliance division of the bank conducted the inspection from September 10 to 22.

The inspection team found huge irregularities in loan disbursement, including excessive investment violating rules, overvalued collateral, irregularities in loan rescheduling and classifying non-performing loans as regular.

The inspection report remarked that the bank's Tk 33,791 crore in loans from 24 Chattogram branches were disbursed through scams and irregularities, plunging the bank into deep financial trouble.

According to the report, these irregularities have led to massive financial losses and tarnished the reputation of the bank. It also eroded customer confidence.

The report added that all officials and stakeholders have been negatively impacted by these irregularities.

The 24 Chattogram branches are -- Jubilee Road, Anderkilla, Kadamtali, Pahartali, Fatehabad, Khatungonj, Hathazari, Khulshi, Rahattarpul, Halishahar, Bandartila, Dobashi, Kumira, Sadarghat, Chawkbazar, Prabartak More, Boalkhali, Mohra, Agrabad, Chandanaish, Patiya, Patiya Women's, Panchlaish and Bahaddarhat.

Requesting not to be named, a member of the inspection team told The Daily Star that these branches disbursed loans to over 100 trading companies, though most of them were not eligible for credit.

The inspection report showed that companies such as M/s Banijya Bitan, M/s Deluxe Trading Corporation, Eco Trade Corner, Globe Traders, Image Trade International, Abdul Awal & Sons, Murad Enterprise, Supreme Business Center, Momentum Business Center, Orchid International, Precious Trade Center, Royal Enterprise, Safran Trade International, Shah Amanat Traders, K Enterprise, Sagar Corporation and Minhaj Corporation received large volumes of loans from the bank.

The Chattogram-based S Alam Group and its affiliates obtained these loans through these trading companies and the loans remain unrecovered, the inspection team member added.

Most of the loans disbursed to these trading companies have now defaulted, contributing to the bank's overall default loan portfolio.

As of this September, First Security Islami Bank's defaulted loans stood at Tk 12,948 crore, up from Tk 2,015 crore a year earlier, according to central bank data.

In November, the bank's management identified 194 officials, including managers of the 24 Chattogram branches, with alleged involvement in loan irregularities linked to the S Alam Group. Subsequently, they were attached to the head office of the bank in the capital.

The commercial lender is likely to dismiss these individuals soon, said a number of officials of the bank.

They said that Syed Waseque Md Ali, managing director of First Security Islami Bank, cannot escape responsibility for these loan irregularities.

The Daily Star attempted to contact Ali, but he did not respond to phone calls.

Mohammad Abdul Mannan, who succeeded Mohammed Saiful Alam as FSIB chairman in September, declined to comment on the matter.

Founded in 1985 by Mohammed Saiful Alam, a relative of late Awami League politician Akhtaruzzanan Chowdhury Babu and his son former land minister Saifuzzaman Chowdhury Javed, S Alam Group has grown into one of the country's largest conglomerates.

Not only FSIB, but the business group also cleaned out Islami Bank Bangladesh, Union Bank, and Global Islami Bank between 2017 and July 2024 under the guise of loans, according to documents.

For comment, The Daily Star tried to reach Mohammed Saiful Alam over phone, but to no avail.

Earlier, Subrata Kumar Bhowmik, executive director of the business group, told this newspaper that he is not in a position to make a comment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments