Small businesses to face tougher times as VAT threshold lowered

Small traders and businesses have decried the abrupt cuts in value-added tax (VAT) and turnover tax thresholds by the revenue board, saying this will put more pressure on consumers and eventually reduce sales.

The National Board of Revenue (NBR) on Thursday night lowered the thresholds for VAT registration to Tk 50 lakh and turnover tax to Tk 30 lakh, from previous levels of Tk 3 crore and Tk 50 lakh, respectively.

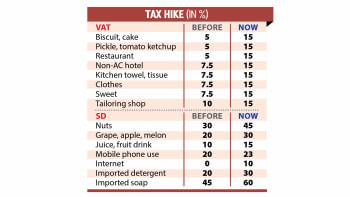

Besides, the revenue authority also raised VAT and supplementary duty on more than 100 products and services, including biscuits, mobile phone usage, internet bills, readymade clothes, tailoring and restaurants.

This mid-fiscal year move by the government is widely interpreted as an attempt to increase falling revenue collection and meet the conditions set by the International Monetary Fund (IMF) for its ongoing $4.7 billion loan programme for Bangladesh.

Economists and businesses criticised the timing of the NBR's decision, as people have been struggling with above-9-percent inflation for nearly two years.

Snehasish Barua, managing director of SMAC Advisory Services Ltd, said that a large number of small businesses have come under the VAT net following the downward revision of turnover tax enlistment and VAT registration criteria.

Under the new rules, he explained that if a business records Tk 2.5 lakh in monthly turnover, it will fall under turnover tax enlistment criteria and be subject to a 4 percent tax on sales.

Similarly, a firm that records Tk 4.17 lakh in monthly turnover will need to pay 15 percent VAT on sales, according to him.

"The impact will be huge and will increase the scope of informal dealing," he said. "As a result, tax-compliant businesses will suffer the most."

The tax expert believes this could have been ideal had the country managed to bring all transactions into traceability and fix the VAT Act 2012. "We could have easily extracted the due amount of income tax too."

"Until and unless the country develops its own unified payments interface system, raises business awareness of it, ensures effective monitoring and amends certain provisions of the VAT Act 2012, lowering this threshold will not yield expected benefits for the exchequer," he argued.

Zahirul Haque Bhuiyan, general secretary of the Bangladesh Shop Owners Association, said they have been struggling with sales since the Covid-19 pandemic, and consumers, who ultimately bear the VAT burden, are also facing price pressures for a long time.

"Over the past few years, real incomes have stagnated while inflation has remained stubbornly high," he added. "Against the backdrop, the government's decision will impose an even greater strain on everyone, from day labourers to middle-income people."

For many people, bearing this heavy burden will be extremely difficult, he said.

In December 2024, inflation eased slightly to 10.89 percent from 11.38 percent the previous month. The price pressures remained above 10 percent throughout October and November, according to the Bangladesh Bureau of Statistics (BBS).

Bhuiyan said they plan to meet with the finance adviser to lodge their concerns.

Like tax expert Barua, a senior NBR official said that automation of the tax system is the ultimate solution.

However, he said the latest threshold lowering would not impact small businesses.

"We issued an order in 2019 under which we have brought most services, including restaurants, sweetmeats and other stores, under the VAT net regardless of turnover," he said.

"Therefore, there is no practical impact of the reduction in the turnover tax enlistment threshold."

However, those firms with a turnover of more than Tk 50 lakh but below Tk 3 crore, which are currently paying 4 percent turnover tax, will have to pay 15 percent VAT after VAT registration, he said.

"We may get additional VAT in this area after revising the VAT registration limit," said the official, adding, "but the amount is going to be small."

He added that Tk 17 lakh in turnover tax would accrue to the government's coffers when these firms were under the turnover tax net.

However, Dewan Aminul Islam Shaheen, recent former president of the Dhaka New Market Business Owners' Association, said such a government decision will create extra pressure on shop owners and traders.

"Real incomes of buyers have not increased in the last two to three years," he said. "In the overall situation, profit margins have also decreased."

"We will have to face more difficult situations in the coming days," said Shaheen, also the owner of Siraj Jewellers at New Market.

"It would have been better if the government had taken a decision to increase the VAT net by keeping the VAT threshold at the previous level," he added.

"In the past, we have never seen the government make such a decision in the middle of the year," he continued. "So, it's quite irksome on the one hand and extremely frustrating on the other."

Abul Hashem, general secretary of the Bangladesh Edible Oil Wholesalers Association, said that any increase in VAT will inevitably push up commodity prices, further escalating costs for consumers.

"With people's purchasing power already on the decline, this decision will only worsen their suffering," he said.

"If these non-compliant traders are held accountable, it would help distribute the tax burden more evenly and reduce pressure on consumers," he added.

Rizwan Rahman, former president of the Dhaka Chamber of Commerce and Industry (DCCI), said traders already face massive challenges.

He argued that the budget for the current fiscal year should be reviewed and adjusted downward to align with economic realities.

Rahman said that while the government continues to expand facilities for bureaucrats, the situation for ordinary people is deteriorating.

"Reducing public expenditure is essential, and the government must prioritise protecting consumers' interests above all."

Rahman said that the government should engage in negotiations with the IMF to find out more balanced policy solutions.

Speaking on condition of anonymity, another business leader said that businesses were already in a tight spot, and increased VAT and supplementary duty will only complicate the problem.

"Business owners will either evade taxes or increase the prices of goods and services. If prices are raised, it will further reduce consumer demand," the leader said.

"On the other hand, a sudden and sharp increase in VAT rates is disappointing," the leader added. "A gradual increase would have been more acceptable."

"The government has added to the burden on the public by imposing taxes in the middle of a fiscal year, following IMF recommendations," the leader mentioned. "It has failed to consider the current state of the economy," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments