Is this the right time for tax hikes?

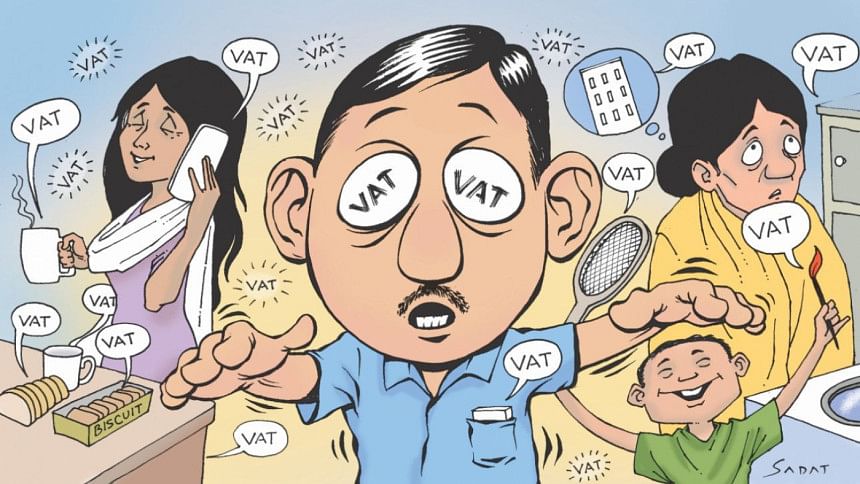

It is not the best of times—it is the worst of times! Recently, the value-added tax (VAT) and supplementary duty (SD) have been increased on nearly one hundred products and services. The list of such products and services ranges from sweets to clothes, from restaurants to motorcycle imports, from mobile phones to internet, and the tax and duty hikes range from 15 percent to 100 percent. And this has been done by a presidential ordinance, in the middle of the current financial year, ahead of the next national budget in June. Most importantly, the tax hikes have taken place at a time when the country has been experiencing persistent double-digit inflation, with its economic growth being less than two percent. All these beg three fundamental questions. First, what prompted the decision to increase VAT and SD on more than 90 products and services? Second, would such tax increases not make the persistently high inflation even worse and the current low economic growth of the country more depressed? And finally, were there no other options and alternatives to reduce the budget deficits of the country?

First, it is well-known that the International Monetary Fund (IMF) has put pressure on Bangladesh to increase taxes, in order to meet conditionalities set by the organisation. Under the existing credit programme of $4.7 billion, Bangladesh is supposed to increase its tax/GDP ratio by another 0.2 percent in FY2025-26. It means that in absolute terms, the country has to mobilise Tk12000 crore in additional taxes. Such conditionalities by the IMF are not anything new. In the decade of 1980s, under its Structural Adjustment Facility (SAF) and the Enhanced Structural Adjustment Facility (ESAF), the international lender has imposed various conditionalities upon the developing countries of Africa, Asia and Latin America. As a result, budgets were balanced by unbalancing the lives of the people. In 1980s, in the process of financial sector reforms, the IMF imposed a set of conditionalities on Bangladesh as well.

Second, concerns are being raised in many quarters as to whether the tax increases on nearly 100 commodities and services would exacerbate the current level of high inflation, resulting in further increases in prices. Government officials confidently maintain that this would not happen. They have put forward two arguments. First, the goods and services that are subject to tax hikes are not part of the Consumer Price Index (CPI) basket. So, the increased taxes on those products and services will not impact the CPI and consequently, inflation will not be raised. This is, in fact, a mechanical argument, devoid of realities. For instance, people from all walks of life buy clothes—the richer section may buy clothes worth Tk 50,000 and the common people may buy clothes worth Tk 5,000—but the increase in VAT on clothes from 7.5 to 15 percent will increase the economic burden of common people, whether it is reflected in the CPI or not. Similarly, people buy sweets for various social functions and events. With a VAT increase again from 7.5 to 15 percent, it will pinch the pockets of people on the streets. Irrespective of whether such increases are captured in the mathematical equation of inflation, they will reduce the purchasing power of the consumers and increase the economic woes of the people.

Along with the effects on the consumers, the tax hikes are expected to have negative impacts on the businesses. Already various businesses, particularly small businesses, have expressed their dissatisfaction regarding the proposed tax increases. Small businesses and informal sector enterprises use mobile phones a lot for their business activities. The tax increases on mobile phones and the internet will not only impact individual consumers but also affect business adversely. In the past, the VAT was set at 15 percent, which later on was reduced to 7.5 percent. As a result, the VAT revenue was enhanced. This leads to the question: since the demand for goods and services, such as mobile phones and the internet, is elastic, will the doubling of VAT result in the desired goal of increased revenue? If the tax hikes do not lead to revenue increases, would such hikes be consistent with the objective of accelerated economic growth in the country?

In reply to the reactions by businesses, it has been maintained that with tax hikes, the duties on essential products, including rice, onion, and potatoes were slashed, some even to zero. So, it is argued that as the prices of those products with zero duties are reduced, the impacts of tax hikes will be negated. As a result, there will not be any further inflation. But the point is that even with zero duties, the prices of those commodities have not come down. Furthermore, the sale of food items from the trucks have been discontinued and about 43 lakh family cards have been made void. This will increase economic pressure on low-income families. We should be mindful that Ramadan is coming up and historically, in Bangladesh, people experience price hikes for many products during Ramadan. It is expected that the prices of a series of products and services will go up further, the purchasing power of common people will be reduced and the business community will be adversely affected.

We all want the revenue income of the government to increase. But are the indirect taxes the most effective means to achieve that objective? Everyone is of the opinion that the direct tax base of Bangladesh must be expanded. The tax/GDP ratio in Bangladesh is only about eight percent, while in neighbouring countries like India, it is 12 percent and in Nepal, it is 17 percent. Our tax/GDP ratio is way below the average tax-to-GDP ratio in the Asia and the Pacific region, which is 19 percent and that of the developing world, which is 25 percent. So, Bangladesh must increase its tax/GDP ratio and that must be done through increasing the coverage and the amount of direct taxes. About 68 percent of people in the country do not pay income tax. These people must be brought under the income tax net.

There is another important dimension to direct tax. In the past, revenues were mobilised through indirect taxes and duties on poor people, rather than income taxes on the rich. It goes without saying that through this process, the economic disparities in the society have been enhanced. Today, when Bangladesh is set to achieve an equitable society, it is essential to change this structure, which is unfriendly to common people. It should be kept in mind that while in a country like India, nearly 60 percent of tax revenue comes from direct taxes, in Bangladesh, nearly 65 percent of taxes come from taxes and duties on essential commodities, which are paid mainly by poorer people. Revenue income can also be increased through tackling tax evasion and improvements in the tax administration. Because of tax evasion in different sectors of the economy, the Bangladesh government loses tax revenues ranging from Tk 56,000 crore to Tk 300,000 crore. Such evasion can be stopped through the use of different information and communication technologies.

The tax increases on nearly 100 products and services will increase economic pressure on common people and reduce their purchasing power. There will be adverse impacts on the business community. In order to overcome these woes, it is essential to reform the tax structure and the tax collection systems. There are no alternative options to enhance economic growth and reduce disparities in our society.

Selim Jahan is director of the Human Development Report Office and lead author of the Human Development Report.

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments