Outstanding debt up 3% in first half of FY25

The government's total outstanding debt has increased by 2.93 percent in the first six months of the current fiscal year till December 2024 and reached Tk 1,944,171 crore, which is increasing the pressure of debt servicing in the budget.

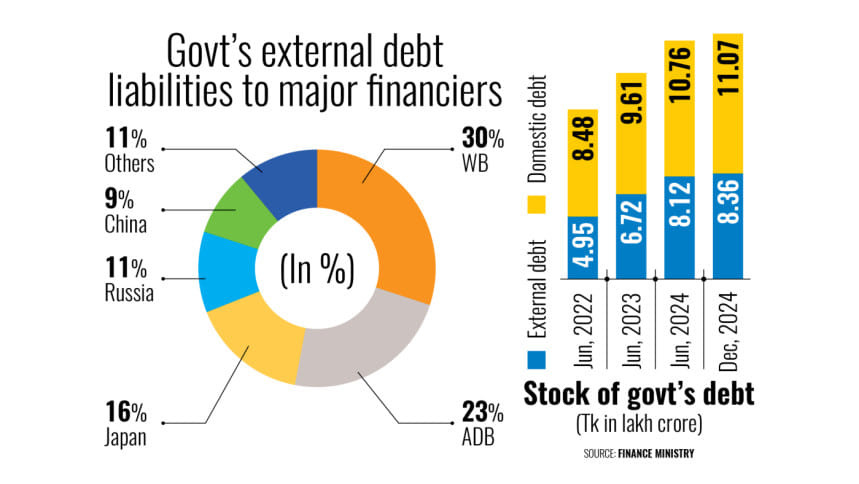

The outstanding debt, both local and external, is increasing gradually. It was Tk 1,344,443 crore till June 2022 and reached Tk 1,888,787 crore till June 2024.

Of the total outstanding debt, foreign loans accounted for about 43 percent or Tk 836,658 crore till December last year. It was Tk 495,793 crore in June 2022.

According to the Quarterly Debt Bulletin released yesterday, the government planned to focus on increasing reliance on the domestic debt market to reduce foreign currency exposure risks in the medium term.

"But, as the liquidity position in the financial market remains tight, there will be some challenges to implement the strategy," it said.

Bangladesh still has access to concessional external financing and prefers this mode of financing, inclusive of concessional and non-concessional terms, said the bulletin.

It said the country has been gradually facing exposure to non-concessional loans by official creditors due to persistent economic development and higher per capita income in recent times.

Moreover, it said, the cost of borrowing from commercial lenders has been increasing due to global monetary tightening, high domestic inflation and depreciation of the local currency.

It is expected that inflation would decrease substantially in the next fiscal year, and the currency exchange rate would be stabilised due to the current initiative by the central bank.

According to the bulletin, the majority of the external debt is denominated in US dollars, which accounts for around 53 percent of the total external debt, followed by Japanese yen, euro and Chinese yuan.

"This composition underscores the strategic choices in currency allocation, aiming to reach a balance among major world currencies to manage exchange rate risks effectively," it added.

The bulletin said external interest payment has increased by 26 percent during the July-December period of FY25, compared to the same period of FY24.

"So now effective management of external debt interest payments is not just a matter of sound financial management for Bangladesh," it said.

"…it is fundamental to ensuring macroeconomic stability, protecting its foreign exchange reserves, fostering sustainable economic growth, maintaining international creditworthiness, and securing its future development prospects," it added.

The domestic debt in the first six months of the current fiscal year also rose by 2.86 percent till December 2024 and stood at Tk 1,107,513 crore. In June 2022, domestic debt was Tk 848,650 crore.

The interest payment against the domestic borrowing has increased by 8 percent during the July-December period of FY25, compared to the same period of FY24.

The government borrows from local sources in two ways -- treasury bills and bonds through the banking system and savings instruments.

The interest payments for treasury bills and bonds have increased by 24 percent while savings instruments have reduced by 10 percent during the six months of FY25.

The bulletin said national savings certificates (NSCs) remain attractive as the government balanced fiscal discipline and aligned NSC interest rates with market rates in December 2024.

Now, NSC interest rates are linked to the yields of government bonds (such as the five-year Treasury bond), allowing for adjustments in response to market movements.

"This will prevent a large divergence between NSC and market-based rates. This reform will ensure that NSC rates reflect prevailing market conditions, thereby reducing distortions in the domestic debt market," it said.

Dr Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development, said the debt increased due to the lack of low revenue collection.

"Revenue collection remains lower during the interim government's period. Bangladesh is the lowest revenue collector among the low-income countries in the world. As a result, the government needs to depend on borrowings more," he said.

He said the debt-to-GDP ratio was still at a moderate level, but if this continues, a critical situation may arise soon.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments