Most listed firms saw profits fall in Jan-Mar

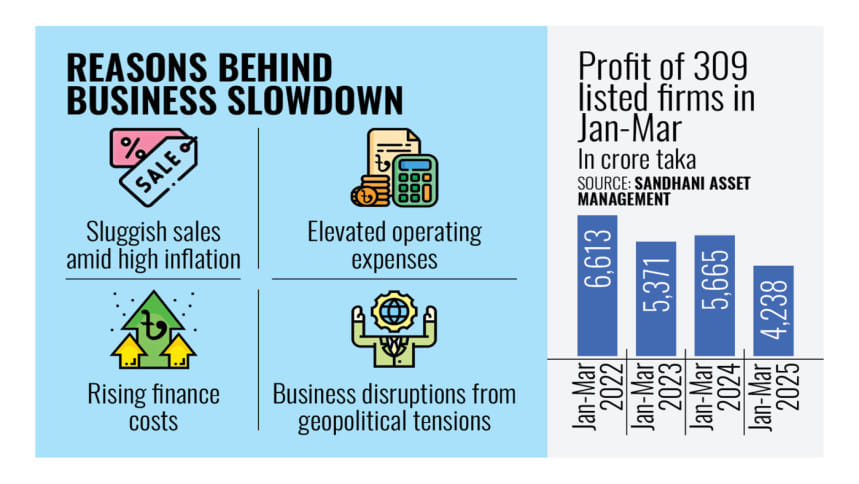

Most listed companies saw their profits shrink in the January-March period of the current year as stubbornly high inflation pushed up business costs while weak consumer demand held back sales growth.

So far, 309 listed firms, including banks, have published their financial reports for the quarter. Of them, 177 reported lower profits compared to the same period last year.

Together, their earnings fell by 25 percent, showing a turbulent business climate during the time.

Among the 177 companies, 27 posted losses despite having been in profit during the same period a year ago.

"High inflation has squeezed people's purchasing power. As a result, consumer spending fell, which hit company sales and, in turn, profits," said Humayun Rashid, former president of the International Business Forum of Bangladesh (IBFB), a research and advocacy organisation for local and foreign entrepreneurs.

Inflation has stayed above 9 percent for 37 consecutive months, marking the longest period of high consumer prices in four decades, according to the state-owned statistical agency BBS.

Throughout 2024, the central bank raised its policy rate several times in an effort to contain rising prices. This pushed the repo rate, the interest rate at which the central bank lends to commercial banks, to 10 percent.

"The high interest rates in the banking sector have added to the costs of the firms," said Rashid, who is also the managing director of Energypac Power Generation.

He added that the overall cost of doing business has risen due to inflationary pressures.

At the same time, Rashid said business sentiment has weakened.

"Entrepreneurs feel shaky, so they are reluctant to invest. Public investment has also slowed. When both private and public investment are tight, it affects business," said the Energypac Power MD.

Geopolitical tensions, including the prolonged Russia-Ukraine war and conflict in the Middle East, have compounded the difficulties.

Rashid said these conflicts have had a knock-on effect on business.

A market data analysis shows that the combined profits of listed firms fell more than 25 percent to Tk 4,238 crore in the January-March period, down from Tk 5,665 crore a year earlier.

Although there was some improvement in combined profits in 2024 compared with the previous year, earnings remained well below the Tk 6,613 crore recorded in the first quarter of 2022.

This marks a 36 percent decline in January-March combined profits of the same listed firms over three years, according to Sandhani Asset Management.

"This year, overall business was weak due to slower sales growth and higher costs," said Md Kyser Hamid, an executive member of the Bangladesh Association of Publicly Listed Companies (BAPLC).

Manufacturers who deferred letters of credit (LC) payments were hit hard by the sharp depreciation of the local currency, while finance costs rose as bank interest rates climbed, he added.

Among individual firms, Grameenphone recorded the highest profit in the quarter at Tk 633 crore, followed by Square Pharmaceuticals at Tk 605 crore and United Power at Tk 417 crore.

However, Grameenphone's profit fell by more than half as lower data prices, weaker consumer spending, and ongoing macroeconomic pressures took their toll.

Top profit-makers such as British American Tobacco and Walton Hi-Tech Industries also saw earnings decline.

British American Tobacco was hit by lower sales, while Walton's profits fell due to higher costs, including rising finance charges.

During the January–March period, some banks performed better, benefiting from higher yields on government bonds.

Brac Bank, Jamuna Bank, Pubali Bank, and Eastern Bank all reported solid profit growth during the quarter.

Many banks, however, fared poorly. First Security Islami Bank reported the largest loss, at Tk 575 crore, followed by IFIC Bank at Tk 499 crore and AB Bank at Tk 255 crore.

The banking sector underwent a major shake-up since the political changeover on August 5 last year.

Politically influenced bank boards were dissolved and restructured, and tighter central bank oversight exposed the poor state of many commercial lenders. Large volumes of bad loans, previously hidden, came to light.

"Many banks had to reclassify regular loans as non-performing," said Hamid, who is also managing director and chief executive of Bangladesh Finance.

"This hurt profits in two ways. These loans stopped generating interest income, and the banks had to set aside provisions for the bad loans," he said.

Hamid added that high deposit costs also put pressure on the bottom line of banks.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments