Govt to scale back foreign loan reliance

The government plans to scale back its dependence on foreign loans as it seeks to mitigate threats to external debt sustainability.

At present, the external debt to export is 140 percent, according to the latest Debt Sustainability Analysis (DSA).

"The rising external debt stock, principal and interest payment of Bangladesh against export may create vulnerability in the external debt position and may affect external debt sustainability in the coming years," said the report titled Medium-Term Macroeconomic Policy Statement FY26-FY28.

By the end of the fiscal year, the government's outstanding foreign debt would stand at Tk 914,200 crore, which is equivalent to $76.18 billion at the current exchange rate.

It would reach Tk 1,207,700 crore, or approximately $100 billion at the current exchange rate, in fiscal 2027-28, it said.

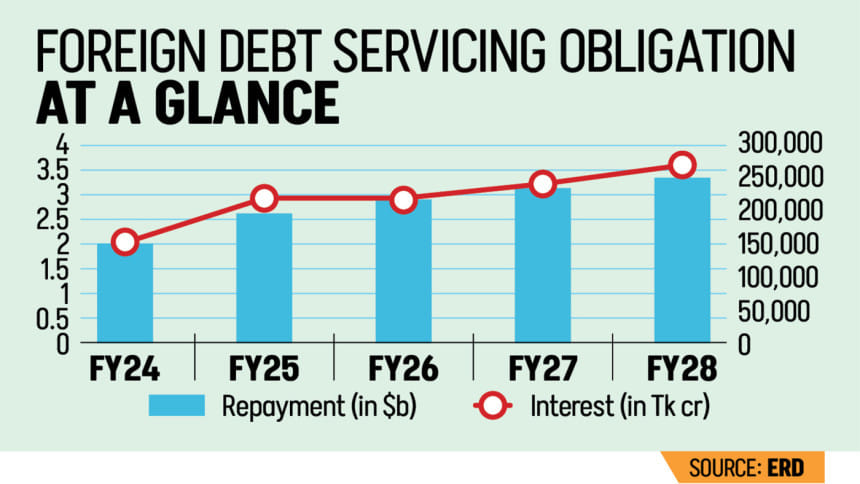

The government will have to repay about $2.6 billion of the principal amount of foreign loans this fiscal year, up 30 percent year-on-year. In fiscal 2027-28, the repayment would reach $3.34 billion.

Repayment volume is on the rise due to loan maturity, currency depreciation and the end of grace periods for certain loans, it said, adding the depreciation of taka against the dollar significantly increases the cost of servicing external debt as more taka is needed to repay the same amount of foreign currency.

The taka weakened from around Tk 84 per dollar in early 2021 to over Tk 123 now.

The interest payment on external loans is now Tk 22,000 crore, which is equivalent to $1.83 billion -- up about 45 percent from a year earlier. It will hit Tk 27,100 crore in fiscal 2027-28, equivalent to $2.25 billion.

The government plans to conduct another DSA this month using the latest data to examine the vulnerability and ensure the transparency of debt management.

The finance ministry also plans to reduce the external borrowing gradually: it aims to bring it down to 16.7 percent of gross financing needs by fiscal 2026-27, down from 22.9 percent this fiscal year, as per the latest Medium-Term Debt Management Strategy.

External debt has shot up for the sheer number of mega projects during the ousted government's tenure, said Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development.

"The next three to four years are very critical. If we don't want to be a defaulter, whose consequences would be bad, we need to manage more foreign currencies."

The government should be very careful in initiating any project by calculating the financial benefits and priorities.

"If we can complete the development projects timely and transparently without extending time, those projects will give us results," he said, adding that the government should have a strategy for this.

Besides, when Bangladesh graduates from the least-developed country bracket in 2026, the window to get low-interest rate loans will shut. "We need to be more careful about this," he said

Upon graduation, Bangladesh will lose access to grants and concessional loans (low interest rates, long repayment periods) from multilateral and bilateral development partners.

The country would then have to rely more on commercial loans with higher interest rates and shorter repayment periods, increasing its debt servicing costs.

The medium-term outlook for Bangladesh's debt after LDC graduation hinges on the government's ability to implement effective strategies to counter the challenges, said the finance ministry report.

"Without robust reforms in revenue mobilisation, export diversification and debt management, the debt burden and associated risks could increase. However, successful implementation of these strategies could help Bangladesh navigate the transition and maintain a sustainable debt trajectory while leveraging its improved economic standing."

Effective management of external debt interest payments is not just a matter of sound financial management for Bangladesh; it is fundamental to ensuring macroeconomic stability, protecting its foreign exchange reserves, fostering sustainable economic growth, maintaining international creditworthiness, and securing its future development prospects, it added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments