Reserves to edge up as IMF expands support to $5.5b

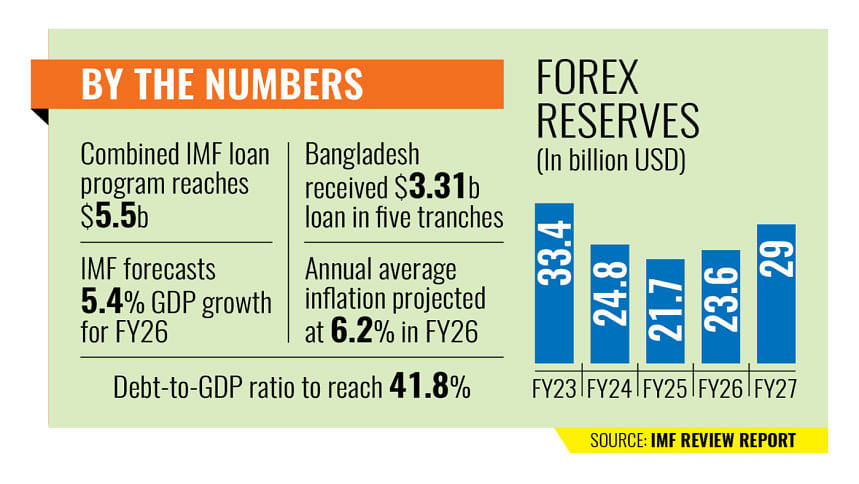

Bangladesh's foreign exchange reserves are projected to rise modestly to $23.6 billion in the next fiscal year from $21.7 billion in the current year, as the International Monetary Fund (IMF) expanded its total support package amid ongoing efforts to stabilise the country's macroeconomy.

The reserve uptick comes after the IMF Executive Board approved the completion of the third and fourth reviews of Bangladesh's reform programme. The decision unlocked immediate access to a combined amount of $1.34 billion.

Gross reserves stood at $27.30 billion as of June 24, while reserves measured under the IMF's BPM6 manual were $22.24 billion, according to data published by Bangladesh Bank. The latest numbers underscore the limited room available to manage external shocks.

With foreign reserves still fragile, a narrow fiscal margin, and banking risks rising, the IMF's backing provides both funding and credibility. But, as the IMF made clear, the next phase of Bangladesh's recovery will depend on consistent execution across all fronts -- from exchange rate management and tax reform to governance and green investment.

"Bangladesh's economy continues to navigate multiple macroeconomic challenges," said Nigel Clarke, IMF deputy managing director and acting chair. "Despite a difficult environment, programme performance has remained broadly on track, and the authorities are committed to implementing necessary policy actions and reforms."

The original IMF loan package for Bangladesh, approved in 2023, totalled $4.7 billion. Following the augmentation approved on Monday, the total size of the programme has increased by $800 million to $5.5 billion. Of this, $3.31 billion has been disbursed so far.

The IMF cited "broadly satisfactory" performance despite political instability, rising trade barriers, and financial sector stress in the wake of the 2024 popular uprising that unseated the previous government. "Advancing the reform agenda is critical to restoring economic stability, protecting the vulnerable, and supporting inclusive and environmentally sustainable growth," the IMF said.

Trade figures highlight ongoing volatility. Exports are expected to grow by 5.2 percent in FY2025, recovering from a 17.1 percent decline the previous year. Momentum is projected to accelerate in the next fiscal year, with exports rising 19.8 percent. Imports are also set to increase by 5.8 percent in FY2025 and 11.6 percent the following year, reflecting a gradual pickup in domestic demand and higher energy-related costs.

Economic growth is now projected at 5.4 percent in the next fiscal year, a downward revision from the IMF's earlier 6.5 percent forecast, and broadly in line with the government's own estimate of 5.5 percent. Annual average inflation is expected to fall to 6.2 percent in FY2026, down from 9.9 percent in the current year. In April, the IMF had forecast a lower 5.18 percent inflation rate.

"Near-term policies should prioritise rebuilding external resilience and reducing inflation," Clarke said. "The authorities' recent steps to implement a new exchange rate regime and include revenue-enhancing measures in the FY2026 budget are welcome."

Clarke warned that "efforts to raise tax revenues and rationalise expenditures, including through subsidy reduction, are critical for creating the fiscal space needed to strengthen social, development, and climate initiatives."

"Sustained progress in reducing government subsidies to a fiscally sustainable level, along with enhanced public financial management, is essential to improving spending efficiency and mitigating fiscal risks," he added.

The IMF also flagged continued stress in the financial sector and urged authorities to accelerate banking reform. "Financial sector policy should prioritise safeguarding stability and addressing rising vulnerabilities," Clarke said. "Developing a comprehensive, sequenced strategy to guide reforms is an immediate priority, followed by the swift implementation of the new legal frameworks to enable orderly bank restructuring while protecting small depositors."

On climate finance, the IMF reiterated that reforms must be anchored in institutional efficiency. "Building resilience to natural disasters is essential for achieving high and inclusive growth," Clarke said.

While the IMF granted a waiver for the temporary breach of a performance criterion related to exchange restrictions, citing corrective measures, the IMF made clear that the path ahead will require sustained reform. "Sustained structural reforms are essential for Bangladesh to achieve its goal of attaining upper-middle-income status," Clarke said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments