Increased remittance inflow encouraging

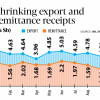

We are encouraged by the recent increase in remittance inflows into the country at a time when our economy is under significant pressure due to dwindling foreign exchange reserves and various external payment obligations. According to Bangladesh Bank data, in October, remittances sent home by our migrant workers rose 21.31 percent year-on-year to $2.39 billion, following a 40 percent increase in August and 80 percent increase in September. Reportedly, from October 1 to October 26, Islami Bank Bangladesh received the highest amount of remittance at $371 million, followed by Agrani Bank at $185 million, Sonali Bank at $143 million, and BRAC Bank at $122 million. We now hope that this upward trend in remittance inflows will continue in the coming months, which will eventually help ease pressure on our forex reserves.

This achievement, of course, would not have been possible without the hard work of our migrant workers, who toil in foreign lands, often under unfavourable conditions and with low pay. Since our economy is heavily dependent on the remittances they send, it is our responsibility to ensure their rights are protected, both at home and abroad. The high cost of migration has long been a barrier for aspiring migrant workers, which the government should address urgently. Moreover, it is concerning that the number of workers who went abroad between January and September this year was significantly lower than during the same period last year—while 989,685 workers migrated in 2023, the figure dropped to 698,558 this year. The Ministry of Expatriates' Welfare and Overseas Employment must investigate the reasons behind this decline and take proactive measures to address them.

Currently, Bangladesh faces substantial challenges in paying its external debts and importing essentials such as gas, fertiliser, and raw materials for the garment sector due to the dollar shortage. Adani Power, for instance, has recently warned Bangladesh of a potential suspension of supply if overdue payments of around $850 million are not cleared. Therefore, it is crucial that the government take all necessary steps to increase our forex reserves. To this end, the government should find new markets and focus on sending more skilled workers abroad to secure better jobs and enhance remittance flows. Additionally, it should promote the use of formal channels for remittance transfers. Previously, the gap between official and unofficial exchange rates led many migrants to favour informal channels, but this practice needs to change.

However, the government should not rely solely on remittances to alleviate the ongoing pressure on forex reserves. Simultaneously, it must also work to boost export earnings.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments