Potential of Small and Medium Enterprises

SMALL and medium enterprises (SMEs) are treated as the engines of growth and drivers of innovation worldwide. They play a significant role in driving economic growth and generating jobs.

In Bangladesh, the sector is actually changing the face of the economy. SMEs are playing a vital role for the country's accelerated industrialisation and economic growth, employment generation and reducing poverty.

SMEs now occupy an important position in the national economy. They account for about 45 percent of manufacturing value addition, about 80 percent of industrial employment, about 90 percent of total industrial units and about 25 percent of the labour force. Their total contribution to export earnings varies from 75 percent to 80 percent.The industrial sector makes up 31 percent of the country's gross domestic product (GDP), most of which is coming from SMEs.

The total number of SMEs in Bangladesh is estimated to be 79,754 establishments. Of them, 93.6 percent are small and 6.4 percent are medium. The 2003 Private Sector Survey estimated that there are about 6 million micro, small and medium enterprises, with fewer than 100 employees. About 60 to 65 percent of all SMEs are located outside the metropolitan areas of Dhaka and Chittagong.

The country's SME sector has created 15 lakh jobs between 2009 and June 2014. Now, private and foreign banks disburse half of all farm loans and a third of these are going to SMEs.

Potential of SMEs

Every year about 2 million young people join the country's workforce. Half of them find jobs at home or abroad. So, it has become a challenge to create more jobs so that the rest can be employed. SMEs can be an answer to the problem.

The target of achieving double-digit growth hinges largely on the performance of the small and medium enterprises. In a labour surplus country like Bangladesh, SMEs can play a substantial role in providing the impetus to the development of the modern manufacturing sector and the job creation outside the agriculture and informal sectors.

In Bangladesh, people exhibit lesser ability in processing capital and machinery. SMEs are labour intensive but relatively low capital intensive. For a developing country like Bangladesh, SMEs are a cost effective way towards the reduction of unemployment. Since Bangladesh has not yet displayedadequate performance in large-scale industries that are predominantly owned and operated by public bodies, the country can solve its unemployment situation by encouraging SMEs. Seasonal and disguised unemployment can also be solved to a substantial extent by SMEs.

SME can reduce the urban migration in the capital and other major cities, increase cash flow in rural areas, and thereby enhance the standard of living of the rural people. SMEs are widely distributed all over the country which means developing SMEs will play a major role in bridging the urban-rural income gap and contribute towards inclusive growth. In a way, inclusive growth can only be achieved through a vibrant SME sector in a country like Bangladesh.

Constraints facing SMEs

Lack of capital support, modern technology, inability to market products and maintain product quality, lack of skilled technicians and workers, high bank interest

rates, inadequate supply of gas and electricity, unavailability of appropriate infrastructure facility, inadequate policy reforms, law and order situation and frequent strikes are some of the key barriers the country's SMEs are facing.

It is important to understand the operational strengths and weaknesses of the SME sector for pragmatic policy making and effective implementation of these policies.

Central Bank's role

The central bank has been at the forefront of SME development in Bangladesh.

The government has rightly identified SMEs as the priority sector for transforming Bangladesh into a middle-income country. In line with government's thrust, BB has been instrumental in designing and implementing SME sector development initiatives as part of its development financing agenda.

BB has shown the world that a central bank can successfully manage its traditional role of monetary authority while playing the complementary role of development driver. BB has already become the role model in SME financing in the international arena within a span of only five years. Its initiatives are being studied by other central banks of the world. The central bank is regularly receiving delegates from other central banks who are looking at the country's success stories.

In the past, a very insignificant amount of loans went to the SME sector although promises were aplenty. Ever since assuming office as the 10th central bank governor in 2009, Atiur Rahman has been spearheading SMEs financing in the country.

Rahman's passion for SMEs earned him the nickname 'SME Governor'. Due to banks' serious involvement in agriculture and SMEs, domestic demand has gone up significantly, helping the country avoid the onslaught of global financial crisis.

Bangladesh Bank has not only opened a new department for promoting SME financing, but has made it mandatory for all banks to open a separate department for SME clients. The banks have responded positively. Some even opened SME branches.

The central bank has launched target-based credit activities for banks. Between 2010 and 2013, about 18.35 lakh SMEs got loans to the tune of BDT 262,340 crore. Loans of nearly BDT 100,000 crore are going to SMEs every year. BB has launched a number of refinancing schemes involving BDT 2,100 crore from its own fund as well as funds from development partners.

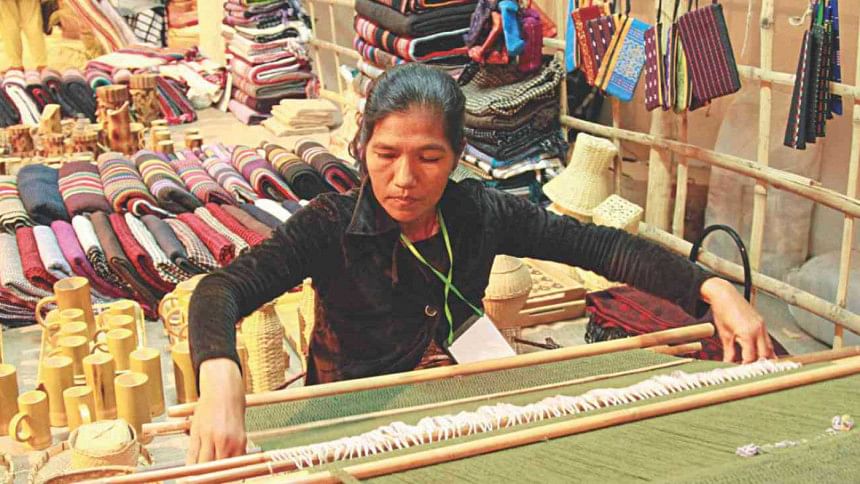

The central bank is also promoting cluster-based SME credit programmes to tap the regional economic potential. Among the clusters, there is sewing and handicraft in Jamalpur; handicraft, flower farming and processing industries in Jessore; handloom in Moulvibazar; handloom, cane and bamboo craft in Sylhet; handloom in Tangail; light engineering in Bogra; garments in Syedpur; khadi in Comilla and Chandpur; and jamdani in Narayanganj.

Uniquely, SMEs are also geographically widely distributed. So they offer a good prospect for geographic diversification of the economy. In this sense, SMEs are an important driver of inclusive growth as well.

Conclusion

The country needs to encourage the adoption of modern technology in SMEs so that their products can compete with those of the competitors.

Banks and non-banking financial institutions need to have a tailored and explicit strategy for SME banking in order to build a solid banking policy to facilitate sound growth and profitability in SME banking, as well as to have better credit evaluation mechanisms, product design, marketing skills, and knowledge of customer and product profitability.

For smooth and sustainable development of SMEs all over the country, more emphasis should be given to develop SMEs at district and upazila levels to arrest the rising flow of population to cities.

Regionalism in Asia led by global value chains (GVCs) and free trade agreements has increasingly put the spotlight on SMEs. Now more than ever, SMEs in Asia have the opportunity to engage in international trade given the falling barriers to trade and fragmentation of production whereby the manufacturing of final goods is spread over firms located in several countries, each one undertaking an individual task of the overall process.

Firms no longer need to have the expertise to export to a modern market; instead, they can simply support the value chain as suppliers of intermediate inputs in the form of parts and components, and act as subcontractors several levels below the ultimate buyer. Increased internationalisation through trade and participation in GVCs provides SMEs in Asia the opportunity to achieve economies of scale, expand market share, and increase productivity.

SMEs in Bangladesh should see whether they could be part of this new phenomenon. It is worth noting that SMEs that invest in technology and those with high labor productivity are more likely to be part of the GVC. Bangladesh needs to maximise the benefits derived from the SME sector, as this sector plays a pivotal role in promoting and sustaining the industrial as well as overall economic growth.

.......................................................................

The writer is a senior business reporter, The Daily Star.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments