Another albatross around the neck of the energy sector?

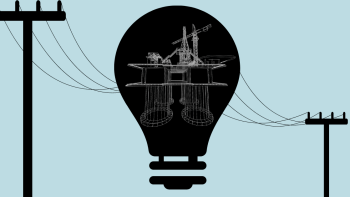

It is worrying to learn of the widening gap between our LNG imports and regasification capacity, with a UK-based research firm predicting that Bangladesh will end up with surplus regasification capacity by the end of this decade. This, among other things, means incurring hefty capacity charges similar to what we are already having to pay for the idle or underutilised power plants. The burden of these charges, it goes without saying, will inevitably fall on consumers. The question is, why are we allowing another potential albatross around the neck of the energy sector?

The looming surplus comes on the back of Bangladesh's increasing reliance on costly LNG imports as well as a continued decline in natural gas production, which is unlikely to see a substantial reversal despite recent efforts by Petrobangla. Currently, Bangladesh has two Floating Storage and Regasification Units (FSRUs)—which convert LNG, or liquefied natural gas, back to gas before supplying it to the national grid—with a combined annual capacity of 7.6 million tonnes (mtpa). An additional 21 mtpa of regasification capacity will be added if the planned four LNG terminal projects, including additional FSRUs and an onshore terminal, come into existence. However, the government has consistently failed to utilise the existing capacity so far, and even if the expected boost in LNG imports is factored in, Bangladesh will still have "significant" surplus capacity, researchers say.

Like the capacity charges for power plants, the regasification units also have a fixed cost based on their installed capacity, meaning that there will be no getting around the payment regardless of whether we can utilise it or not. So, why are we heading down a path that is certain to incur the same wasteful expenditure? This represents a glaring lack of foresight on the part of policymakers. The priority, instead, should have been addressing concerns surrounding supply and price fluctuations as well as proper utilisation of existing capacity. Moreover, there is a crying need to boost production of natural gas, which experts say should have been prioritised long time ago.

We urge the government to learn from past mistakes and undertake comprehensive feasibility studies and risk assessments before expanding LNG regasification capacity. Given the damage it has already done to the energy sector through various questionable policies, it should urgently engage experts to chart the sector's future trajectory, and boosting gas exploration and production must be a vital part of it. Furthermore, we must enhance energy efficiency and promote renewable energy sources to reduce reliance on fossil fuels and mitigate environmental impact.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments