Fix our current account deficit

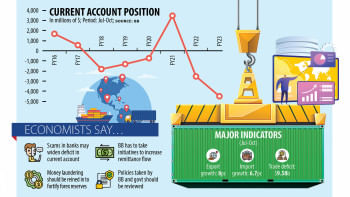

It is disheartening to know that Bangladesh's current account deficit has been increasing at an alarming rate amid ongoing economic uncertainties. As a report by The Daily Star reveals, quoting data from Bangladesh Bank, the current account deficit for 2022 stood at USD 4.5 billion by the end of October. While 2021 recorded a lower deficit of USD 3.83 billion during the same period, it was still concerning given that, in 2020, our current account recorded a surplus of USD 4.05 billion. As predicted by the IMF Global Economic Outlook Report in early October, the present dipping trend may continue until at least 2027. Worse still, the deficit is also having a negative effect on our dwindling foreign exchange reserve.

The fact that our imports have continued to rise in recent months – despite banks limiting the opening of letters of credit (LC), restrictions placed on import of non-essential goods, and an overall shaky business atmosphere (which makes imports of capital machinery unlikely) – indicates that money continues to be laundered out of the country. As per a report by the Global Financial Integrity (GFI), Bangladesh lost approximately USD 8.27 billion on average annually between 2009 and 2018 because of over- and under-invoicing of import-export goods by traders. Though such trends have persisted for long, allowing businesses to evade taxes and launder money abroad, the central bank has apparently become aware of them only recently. It points to the dire lack of monitoring, causing enormous damage to the economy.

It is because of such regulatory failures that huge amounts of money have also been disappearing from our banks, as highlighted by some recent cases of financial scams and wilfully defaulted loans. It is disappointing that the authorities are yet to take effective action to address this issue, despite some of the biggest loan defaulters being well-known, as media reports suggest. Instead, the central bank and the finance ministry have time and again relaxed rules and regulations, encouraging potential scammers to exploit the banking sector.

Reportedly, one important contributor to the current account deficit is remittance inflow not being proportionate with worker outflow. Remittance inflow rose by only 2.03 percent between July and October despite 7.84 lakh job-seekers having left the country between January and August. To encourage remittance inflow through official channels, it is important that the authorities allow taka's value to be determined by the market, as the current fixed exchange rate system makes it so that unofficial channels such as hundi are more profitable for those sending money home.

We urge the authorities to take effective action against all possible contributors to our current account deficit. They should identify goods and services that could bolster our export basket, increase monitoring to prevent money laundering through incorrect invoicing, and review existing policies to identify loopholes preventing our current account balance from rising.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments