Why is Bangladesh seeking IMF support in the first place?

As Bangladesh, facing an unprecedented economic crisis, entered a negotiation with the International Monetary Fund (IMF) for a USD 4.5 billion loan package – akin to a bailout – three kinds of discussions have ensued in the country. First, why the country had to ask for such a large amount of loan from the multilateral institution after more than two decades, especially when the government has been offering a glowing picture of the economy for years. Second, whether this request is only a proactive measure as suggested by the government or a precursor of a more difficult time. The third strand of the discussion has resurrected the long-standing debate of whether the IMF helps or hinders countries – especially the poorer segments of the society.

The reason for Bangladesh's decision to ask for the bailout – or loan package, if you prefer a softer version of it – was predicated by the ongoing economic crisis. There is no denying that the inflation has reached an unprecedented level at 7.6 percent, according to official statistics, although the market situation suggests double-digit inflation. Besides, the finance ministry's projection suggests that, even in the most optimistic scenario, prices of daily necessities will continue to rise until the end of the year. The trade deficit has reached a historic high: Around USD 33.25 billion. Despite some increase in remittances in recent days, overall, the remittance is down by 15 percent. Most importantly, the foreign exchange reserves are down below USD 40 billion, which can foot the bill for about five months of import. It is now well-known, thanks to the media's sudden awakening, that the figure presented by the Bangladesh Bank about the forex reserves has too many holes in it. Even the simplest accounting puts a difference of about USD 10 billion between the official statistics and the real numbers. As such, the economic crisis is not as small as the official rhetoric suggests. Had the crisis been so minor, the government would not have asked for budget support to almost all the development partners in recent months. The money asked of several donors and multilateral agencies is close to USD 3 billion, at a time when the total loan is already on the rise for the past decade.

The official narrative regarding the economy in the past month has been a mixture of denial and desperation. Finance Minister AHM Mustafa Kamal said the country's economy was doing fine and would not require any support, while it has been in search of support from various sources. Some are suggesting that the government is acting out of an abundance of caution, after watching the situation in Sri Lanka where a plunging economy took down the government, and Pakistan's political turmoil that led to the fall of the Imran Khan government. There is some truth to it in the sense that the government has not waited until it started defaulting on its loans. But it ignored the signs of a potential crisis for quite some time and dismissed any criticism as "antidevelopment" politics.

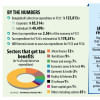

There were ample warnings by analysts that Bangladesh's economic situation should not only be judged by its present debt-GDP ratio, but a medium-term perspective should be the guide and people's well-being should be at the centre of planning. As for the external debt to GDP ratio, the number was 21.8 percent at the end of 2021, but trending upwards from the previous years. The government's domestic borrowing to finance its development budget has increased significantly. In the calendar year 2021, the government's borrowing from domestic sources increased by more than Tk 113,000 crore. As such, currently the ratio of GDP-domestic debt is about 41 percent. According to the estimate of the Centre for Policy Dialogue (CPD), "Bangladesh's current debt is 46 percent of its total gross domestic product (2005-2006 as a base year), which was 44.10 percent in FY21." This places Bangladesh in a comfortable zone, and perhaps breeds complacency, too. But the ratio is bound to get higher as new loans are being sought from outside and the government is borrowing more from the domestic sources at a time when revenue generation has remained very low and remittance growth is slow. According to the Bangladesh Bank projection well before the crisis, the interest payment against foreign loans would cross USD 1 billion (around Tk 8,730 crore) in FY2023-24 from USD 630 million in 2020-21. The debt burden is just one aspect of the future situation, while uncertain externalities will influence events and trends. Add to this the penchant of the incumbent for large infrastructure projects and the inability to rein in the runaway loan default and money laundering. These are the political aspects; there is no sign of shifting the direction.

These statistics and projections are important to understand the likely scenarios, but the central question is: Who will bear the burden of the impending situation – from the price hike to the lack of jobs and other related impacts? In the past years, the middle class and the poorer segments of society have become the primary victims. Income equality has risen, and the new poor has joined the millions. As such, the impact of the current crisis is a precursor of what may become the new reality, unless the structural causes and the economic policies which engendered the situation are identified and addressed.

In some measures, the question as to who will bear the burden has brought the IMF's history to the conversation. IMF, since the 1980s, has faced enormous criticisms for policies prescribed under its Structural Adjustment Programmes (SAPs) and its adherence to the so-called Washington Consensus. Its insistence on privatisation and deregulation has resulted in hardship of the middle class and poor people in various countries. Faced with these criticisms, the IMF has made some changes in its policies and tried to defend its position. While some consider it the "firefighter of financial crises," others have described it as the "arsonist." Despite such controversies, countries have reached out to this multilateral agency at times of crisis, and negotiations led to discussions on conditionalities.

While the debate on the impacts of the IMF continues, we should also ask what prompts the economic crisis that leads the countries to the doorstep of the IMF seeking a bailout. Simon Johnson, who worked as the chief economist of the IMF between 2007 and 2008, and governments in Eastern Europe after 1989, and in the private sector in Asia and Latin America in the late 1990s and early 2000s, has provided an answer to this in an essay published in The Atlantic in May 2009. Johnson writes, "Typically, these countries are in a desperate economic situation for one simple reason – the powerful elites within them overreached in good times and took too many risks. Emerging-market governments and their private-sector allies commonly form a tight-knit – and, most of the time, genteel – oligarchy, running the country rather like a profit-seeking company in which they are the controlling shareholders."

The oligarchic nature of politics and the economy, in some form or other, engenders the crisis. Johnson further notes that the members of this oligarchy "reckon – correctly, in most cases – that their political connections will allow them to push onto the government any substantial problems that arise." This is where the problem lies. The economic crisis is a result of a political system that delivers the benefit to the smaller group, undermines the basics of the economy, and ignores the majority of the population. As Bangladeshis discuss whether the country should subject itself to the IMF conditionalities, and some critics put their nationalist sentiment on display as a spectacle, it is necessary to understand why the country has come to the situation requiring the loans or bailout.

Johnson also mentions what happens when the crisis continues. These words should provide some clue as to what the citizens should be vigilant about in the coming days, "[At] the outset of the crisis, the oligarchs are usually among the first to get extra help from the government, such as preferential access to foreign currency, or maybe a nice tax break, or […] the assumption of private debt obligations by the government. Under duress, generosity toward old friends takes many innovative forms. Meanwhile, needing to squeeze someone, most emerging-market governments look first to ordinary working folk – at least until the riots grow too large."

The debate about the current crisis and Bangladesh's negotiations with the IMF should include this perspective – no less than others.

Ali Riaz is a distinguished professor of political science at Illinois State University in the US, and a non-resident senior fellow of the Atlantic Council.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments