Stabilising prices is the immediate priority

As the new interim government is trying to settle down, expectations are soaring. People are eagerly waiting to see how the government will address their immediate needs, especially providing respite to the poor, low-income, and fixed-income middle-class people who have been suffering from the devastating effects of high inflation for over two years. Continuous high inflation but no increase in wages and salaries have eroded their purchasing power. Many have also used up their savings to survive due to the high cost of living.

According to Bangladesh Bureau of Statistics (BBS) the point-to-point inflation rate in Bangladesh was 11.66 percent in July 2024 compared to 9.69 percent in July 2023. The non-food inflation has gone up as high as 14.10 percent in July 2024 from 10.42 percent in July 2023, according to BBS. The increase in electricity prices several times also pushed the non-food inflation rate to 9.68 percent in July from 9.15 percent in July 2023.

Inflationary pressure is being felt severely in the face of wage growth declines. The above-mentioned BBS report indicates that wage growth of low-paid and unskilled workers declined to 7.93 percent in July 2024 compared to 7.95 percent in June 2024, though inflation increased from 9.72 percent in June 2024 to 11.66 percent in July 2024.

The former government failed to take effective measures to contain high inflation. Bangladesh Bank (BB) was reluctant to use monetary policy tools to control inflation and continued to impose a cap on both lending and deposit rates from April 2020 to June 2023, even though the inflation rate was much higher than the fixed lending rate. Later, BB introduced a reference lending rate—the six-month moving average rate of treasury bills (SMART), which failed as it did not follow the reality of the market and was not supported by appropriate fiscal policies.

BB's decision to withdraw the interest rate cap and make it a market-led rate in May 2024, taken at the suggestion of the International Monetary Fund (IMF), could not bring any positive results till now due to late adoption. The new governor of the BB has indicated that the policy rate will be increased further to tame inflation. In May 2024, the BB hiked the policy rate to 8.5 percent from 8 percent in January 2024. The policy rate, which is the rate at which commercial banks can borrow money from a country's central bank, was kept the same in the Monetary Policy Statement for July-December 2024. With the intention to increase the policy rate, the governor of BB has signalled the upcoming interest rate hike in commercial banks to the market, thereby slowing down the increase in the money supply to fight inflation.

However, the monetary policy alone cannot contain inflationary pressure and must be implemented with a coherent fiscal policy. The government followed an expansionary policy without any effort to reduce administrative and operational costs and wastage during difficult times. The budget deficit for the FY2025 was kept at 4.6 percent despite high inflation and suggestions from economists. To meet its expenditures, the previous government continued to borrow from commercial banks alongside BB as overdraft. In FY2023, the government borrowed about Tk 98,000 crore from the BB. Before the outgoing governor of BB was appointed in early July 2022, the limit for overdraft for the government from the bank was Tk 6,000 crore. However, upon his appointment, the previous governor increased the overdraft limit for the government to first Tk 8,000 crore and then to Tk 12,000 crore. However, the previous governor continued to cross this limit. The government borrowing high-powered money from BB has contributed to high inflation.

The other reason for high inflation is the imperfect market mechanism and the dominance of a limited number of importers, sellers, and producers. High import prices are frequently blamed for high domestic prices, as Bangladesh relies on fuel and other essential commodity imports. High fuel prices, transportation, and logistical costs impact locally produced items. Besides, the taka has depreciated by about 27 percent from July 2022 to June 2024, which has also increased prices.

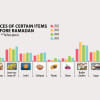

International prices have been declining for many months. However, consumers do not see much reduction in the prices of both imported and domestic commodities. There is a large difference in prices at production, wholesale, and retail levels, even if there is no dearth of essential commodity supply in the market. The prevalence of middlemen in the supply chains who take a margin of the price, as well as a weak logistics network, contributes to higher prices.

However, the existence of various malpractices contributes the most to high prices. Rent-seeking by organised groups, including local goons, often belonging to the political party in power, and members of law enforcement agencies collecting money from vehicles carrying products from various districts to the marketplace are common. The creation of artificial shortage of certain commodities by syndicates has been widely discussed. Such unethical practices increase the market prices of commodities which the consumers ultimately bear. Unfortunately, the previous government turned a blind eye to these malpractices as the government existed with support from corrupt individuals and groups.

The recent severe floods in several districts of Bangladesh have taken many lives while affecting thousands of people. The floods have affected agricultural production in the flood-affected districts, and, due to supply shortages, prices of goods have increased exponentially.

While the government has announced that it would focus its efforts in helping the flood-affected people, their food security has to be at the forefront. Unfortunately, the budget for fiscal year 2025, as announced by the previous government, cut the distribution plans for food grains, despite high food inflation. Therefore, food distribution programmes must be enhanced through open market sales (OMS) and food-friendly programmes. The government must also increase cash support to the vulnerable.

As the interim government is committed to undertaking reforms, increasing transparency in the pricing system of goods should be a major concern. Bangladesh Competition Commission (BCC), which plays a crucial role in supervising the price of commodities, should augment its efforts and develop an all-encompassing database on the prices of all commodities across the nation, spanning from the farm to the market. Close surveillance and oversight are needed for effective market regulation in order to maintain control over commodity pricing. BCC should regularly monitor the behaviour of dominant market players, examine instances of market manipulation, and take appropriate action. The Competition Act, 2012 should explicitly tackle the problem of monopolies in the market and provide clear antitrust laws. Individuals who breach the norm should be subjected to legal consequences. Therefore, measures towards inflation control have to be a multi-dimensional and collaborative process.

Dr Fahmida Khatun is the executive director at the Centre for Policy Dialogue (CPD) and non-resident senior fellow of the Atlantic Council.

Views expressed in the article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments