Banking sector reform can no longer be delayed

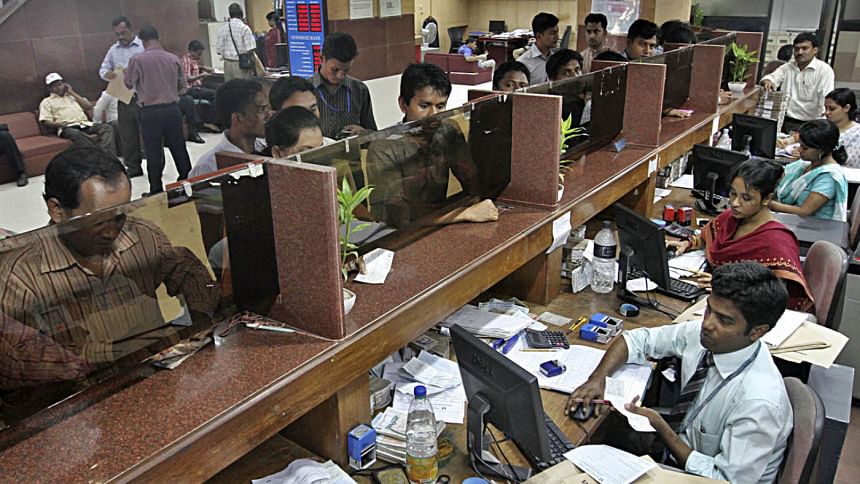

Global credit rating agency Moody's recently downgraded its outlook of Bangladesh's banking sector from "stable" to "negative." Anyone following the endless crisis in this sector would say this was inevitable. Reported estimates suggested that the amount of bad loans was as high as Tk 120,649 crore at the end of 2022. The cost incurred by the default culture in Bangladesh can hardly be overstated: excessive non-performing loans (NPLs) reduce GDP growth, stunts economic development, and exacerbates income inequality.

How can we eradicate this culture of loan-defaulting? First, policymakers must substantially strengthen the enforceability of regulations and make the bankruptcy system efficient. Second, banks must tighten up their loan monitoring methods once a loan is disbursed. And third, Bangladesh Bank should consider further development of bank stress tests.

In Bangladesh, the primary reason behind excessive bad loans is a general lack of governance and, in particular, the inability to enforce banking regulations, which breeds corruption and moral hazard. Consequently, decisions on credit intermediation tend to be driven by political connections or outright bribing of bank executives, without any serious consideration of a borrower's debt repayment capacity. More generally, when the legal system in an economy is not strong, and policymakers routinely amend regulations to serve the purposes of powerful groups with vested interests, it is only inevitable that unethical borrowers will default without fear of adverse consequences. Demonstrating strict punishment is the only way to change the deeply entrenched mindset that a large borrower can get away without repayment.

Unfortunately, the government has long shied away from any serious overhaul of financial regulations. Such an overhaul would entail increasing the accountability of bank management and strengthening the bankruptcy system so that lenders have sufficient ability and incentive to identify and penalise wilful defaulters. Policymakers need to consider setting up new bankruptcy courts that administer the elements of the bankruptcy process, including disputes related to legal settlements, and appoint insolvency professionals who can help banks recover as much of defaulted loans as possible.

If first-order problems such as enforceability and bankruptcy resolution can be strengthened, the second step is to tighten up the banks' risk management practices. Before disbursing a loan, a bank must carefully screen creditworthy borrowers based on their financial statements, collateral quality, and projected ability to repay debt. After a loan is disbursed, banks must continue to monitor borrowers.

One of the most common mechanisms to monitor a borrower is to use loan covenants, which are restrictions on the actions a borrower can take after a loan is disbursed; they are typically written into the initial loan agreement. For example, one of the most common loan covenants used by banks globally is the minimum earnings-to-interest-expense ratio (or the "interest coverage ratio") that a firm must maintain. In the US, many banks require borrowers to have an ICR of at least 1.5 or more. This means that the borrower's cash flow or earning must always be greater than its required interest payment by at least a factor of 1.5. Every quarter, a borrower must report their financial statements to the lender in order for the lender to verify compliance with loan covenants. If a borrower violates this requirement, the bank gets the contractual right to demand immediate repayment of the loan, raise interest rates on the loan, lower loan maturity, or demand additional collateral. The expectation of this type of punishment ensures that the borrower has sufficient incentive to generate adequate cash flow to always avoid defaulting on a loan. At the same time, a covenant violation gives the lender an early signal that a borrower might be in financial distress. But the effectiveness of loan covenants is highly dependent on the enforceability of loan agreements.

My conversations with experienced bankers in Bangladesh suggest that, while some foreign commercial banks use covenants regularly, most of the domestic commercial banks do not, thus leaving themselves open to a higher likelihood of borrowers defaulting on their obligations.

Regulators and economists at the Bangladesh Bank must consider using more granular data when they conduct their periodic stress tests of bank loan portfolios. The idea behind stress tests is to see how resilient the banking system is to an unexpected economic or financial crisis, and how well it can support an economy during a recession. How should stress tests be designed to truly assess banking sector vulnerabilities? And are the stress tests conducted by the central bank effectively capturing emerging risks? In my professional view, corporate default probability needs greater attention in this regard.

The non-performing loan (NPL) numbers we hear of are what economists call an equilibrium outcome, meaning that it is the result of choices made by two parties: the lender who supplied credit and the borrower who demanded credit. Therefore, simply looking at bank-level data (such as the sensitivity of capital to risk-weighted assets to various recessionary scenarios) is not enough. When there is an aggregate negative shock (for example, a pandemic), it will hurt everyone in an economy simultaneously. Examining one party in a loan agreement, without considering the financial condition of the other, overlooks the full picture.

As a first step, BB's stress tests should be able to predict default probability at the borrower level to get a clearer picture of underlying credit risk. While it is commendable that BB's current stress tests take concentration risk quite seriously and estimates the effect on NPLs if the top three borrowers default, understanding the full extent of corporate default risk requires generating default probability for each borrower. When estimating the probability of default at the borrower level, researchers must directly incorporate the borrower's outstanding debt, their existing stock of cash, historical cost of borrowing, historical tendency to default, access to alternate sources of capital, and the amount of assets that can be sold in the event of serious liquidity problems.

The best way to better understand corporate default risks is to generate more data and produce greater information. Such data encompasses detailed financial statements of all companies that borrow from domestic and foreign commercial banks operating in Bangladesh. For example, the Federal Reserve System requires the largest banks in the US to report their entire portfolio of corporate and retail loan holdings every quarter (above a certain loan size threshold). These reports include details on each individual loan disbursed by a given bank, along with the detailed income statement and balance sheet information of the borrower. This allows regulators and researchers to dig deep into corporate debt capacity and default probability. Furthermore, requiring borrowers and lenders to produce more granular information will generate transparency for all stakeholders in the banking system.

At the heart of it all, policymakers must be willing to adopt change and accept the fact that playing by a business-as-usual attitude will no longer work. Reforming the banking sector is long overdue, and regulators must act now before a full-blown crisis hits the economy and ordinary people end up paying the price again.

Dr Sharjil Haque is an economist based in Washington DC, US. Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments