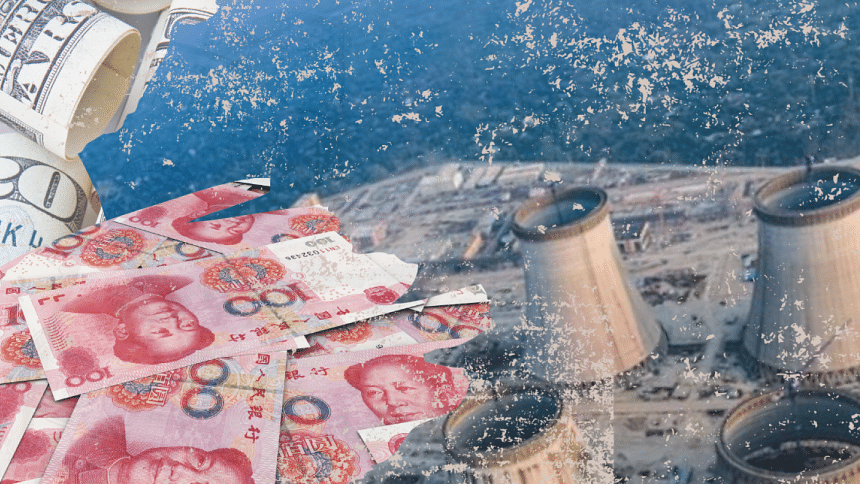

Dhaka repaying Moscow in yuan: Is dollar hegemony on shaky ground?

The decision by Bangladesh to pay Russia in yuan for the Rooppur Nuclear Power Plant project has sent ripples through the geopolitical landscape, and will have far-reaching repercussions for the West and nations neighbouring Bangladesh. This move sheds light on the shifting economic interdependence that exists on a global scale, as well as on nations' growing tendency towards employing alternate currencies and the creation of new strategic partnerships.

For a long time now, the US dollar has been the primary reserve currency for global trade. However, Bangladesh's decision to utilise the yuan over the dollar signals a significant shift away from using the dollar. The hegemony of the US dollar is being put to the test as more countries explore alternative currencies; the results of which could have implications for global trade and finance overall.

The story behind Bangladesh's choice involves the strengthening commercial and political links between China and Russia. The united front that this strategic alliance presents against the influence of the West in terms of dollar hegemony is taking form. There is a possibility that a shift in the regional and global distribution of power could result from an expansion of China and Russia's strategic relationship, which now encompasses commercial and economic activities in addition to joint military projects. It might also encourage other countries in the region to consider alternative payment methods and establish deeper ties with China and Russia. Bangladesh's action could have this effect. This turn of events could potentially result in a reorganisation of regional alliances, which would likely reduce the influence of Western countries in the region. The balance of power in the region may shift even further due to the growing dependence of smaller nations on China and Russia for political and economic assistance.

It is possible that the West – the United States, in particular – will view Bangladesh's choice as an indication of expanding Chinese influence in the region. As a direct result, the West could possibly reevaluate its economic and political engagement with Bangladesh and even take a more cautious approach. This response would have the potential to put a strain on diplomatic relations and impede collaboration in sectors such as commerce, investment, and safety.

On the other hand, in resorting to using the yuan to finance the payment for Rooppur, Bangladesh may find itself more susceptible to economic leverage from China. This influence may extend to other parts of Bangladesh's foreign policy, which may lead to a more substantial alignment with Beijing on issues pertaining to the region and the world at large. An alignment of this kind might threaten the region's stability and ratchet up tensions between Bangladesh and its neighbours and the West.

Despite such possibilities, it is crucial to understand that Bangladesh's decision to utilise the yuan as a payment method is not an isolated incident. Instead, it is a reflection of broader developments in the global economy, in which countries are increasingly seeking to diversify their economic dependence and reduce their reliance on the US dollar. As the global environment continues to develop, policymakers and analysts need to maintain a heightened awareness of these shifts and carefully evaluate the consequences they have for geopolitical relations across the board.

The global community is now faced with the challenge of coming to terms with the realities of a changing geopolitical landscape, characterised by the emergence of new alliances and economic dependencies. As we traverse these uncharted waters, we need to maintain our vigilance and adapt to the constantly changing order of the global community. In the end, the action taken by Bangladesh is a crucial case study that may be used to understand better how decisions of this nature can change a geopolitical landscape and the dynamics of regional relationships.

Nazmul Haque is currently pursuing his masters in Philanthropic Studies at the Indiana University, US.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments