How carbon markets can drive Bangladesh’s green transition

With the flow of international climate finance still slow, carbon markets, supported by results-based finance, will likely pave the way for developing and least developed countries to incentivise emission reductions. The approval of Article 6 at the 29th UN Climate Change Conference (COP29), held in Baku, Azerbaijan, has finally laid the foundation for a global carbon market.

Article 6 defines two market-based approaches under Article 6.2 and Article 6.4. The former allows direct country-to-country carbon trading, known as the Internationally Transferred Mitigation Outcomes (ITMOs). ITMOs may contribute to a country's mitigation target under its Nationally Determined Contributions (NDCs), while the other country will receive revenue against the sold ITMOs.

Article 6.4, also known as the Paris Agreement Crediting Mechanism (PACM), is a centralised and stringent carbon market framework, which a supervisory body of the United Nations Framework Convention on Climate Change (UNFCCC) will regulate. A host country may implement clean energy and environment-friendly projects, register these with the UNFCCC, and sell the verified emission reductions to another country seeking carbon credits to meet its mitigation target. Article 6.4 will allow both countries and companies to participate in trading.

This article will further assess the eligibility of the transition of the Clean Development Mechanism (CDM), which has been the UNFCCC-administered carbon trading instrument between developing and developed countries since 2006.

As CDM is the largest project-based carbon crediting programme, different countries will now build on their experience with it to utilise it in carbon markets under Article 6. While some countries largely benefited from CDM projects, Bangladesh has enjoyed limited success. The country needs to prepare, drawing lessons from the CDM era, and undertake measures for readiness to develop suitable mitigation projects for swiftly tapping the opportunities of carbon markets.

Moreover, Bangladesh's apparel sector may buy carbon credits under Article 6.4 to meet its goal for emission reductions beyond what it can achieve by implementing measures locally.

Bangladesh's lacklustre performance in the CDM

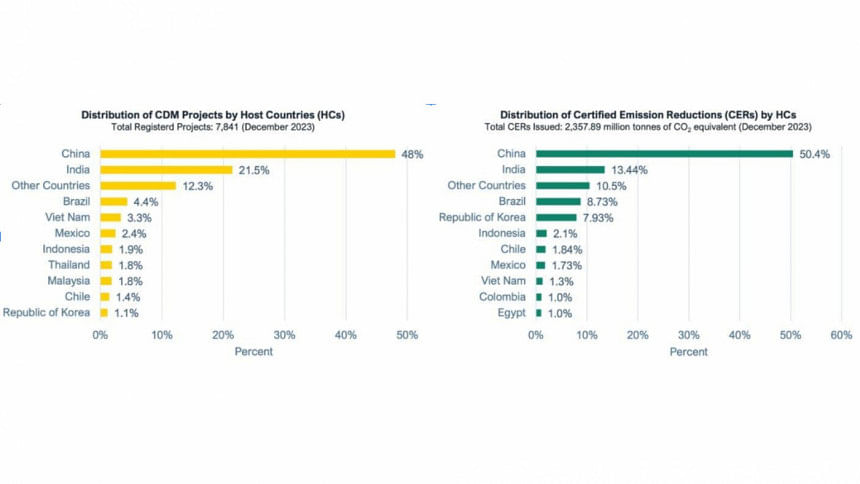

As of December 2023, 99 host countries (least developed, developing, and small island countries) registered 7,841 CDM project activities. The UNFCCC issued 2,357 million Certified Emission Reductions (CERs).

Notably, 10 of the 99 host countries registered more than 87 percent of CDM projects, while China and India combined registered 69.5 percent. However, China benefited the most as its projects generated more than 50 percent of the CERs issued by the UNFCCC. Projects in India, Brazil and the Republic of Korea, which delivered around 30 percent of the CERs, were behind China.

On the contrary, Bangladesh could register 10 CDM projects, resulting in a paltry 1.26 million tonnes of CERs, representing only 0.53 percent of the total issuance till December 2023. While Bangladesh has also registered 11 CDM Programme of Activities (POAs), to date, only around half of them have generated CERs.

Such a lacklustre performance in registering the CDM projects can, at best, be described as a lack of capacity in, among other things, establishing the baseline emissions and writing the project design document (PDD), following the suitable methodologies approved by the UNFCCC. By the time a few people developed the capacity to establish baseline emissions, write PDDs and complete the project cycle until the issuance of CERs, the CDM market collapsed. Prices crashed to $0.65/CER in 2012 against a lucrative price of more than $30/CER in 2008, owing to unsold CERs due to oversupply and lack of demand. Prices stayed low for carbon credits and were less than avoided even for most of the period between 2021 and 2024. Buyers attribute this to a lack of high-quality carbon credit projects. Therefore, many potential local project developers lost their intrinsic motivation to pursue CDM projects.

Lessons from CDM projects

Bangladesh's readiness will dictate how it will fare in the new carbon market regime. The country should decide on, among other things, the potential role of Article 6. Building on its limited experience with CDM, the country should design targeted programmes to develop the capacity of professionals and organisations to implement high-quality greenhouse gas (GHG) mitigation projects swiftly.

Furthermore, it should develop policy and regulatory processes to expedite the implementation of projects under Articles 6.2 and 6.4.

The Department of Environment (DoE), which is Bangladesh's designated national authority (DNA) to the UNFCCC, may help in designing and facilitating the country's readiness programme for carbon markets to develop the technical capacity of stakeholders in designing, implementing and monitoring projects. The DoE would also need to establish a national registry and accounting mechanism for the ITMOs to avoid double counting. Bangladesh should highlight its strong commitment to utilise carbon markets to stakeholders, including the private sector.

How Article 6 can benefit Bangladesh

Bangladesh faces challenges in expanding renewable energy, enhancing energy efficiency, and mitigating pollution from sectors like brick and household cooking. Article 6-driven carbon markets present a significant opportunity for the country by creating an additional revenue stream for projects and increasing their commercial viability.

Potential projects for carbon markets

The brick kiln sector, one of the country's largest sources of GHG emissions, will emit 23.98 million tonnes of CO2 in 2030 under the business-as-usual (BAU) scenario. Transitioning to energy-efficient and non-fired brick technologies will drastically cut the sector's CO2 emissions and improve air quality in adjacent areas, but upscaling these expensive technologies will require incentives. International carbon markets may incentivise the quick deployment of these technologies.

The National Action Plan for Clean Cooking shows the country had 29 million biomass-based inefficient cookstoves during 2019-20. Improved cookstove projects can generate considerable carbon revenues.

Bangladesh may further capitalise on carbon markets to promote renewable energy technologies, including battery storage, both in utility-scale and rooftop segments, which under the BAU scenario shows a sluggish trend. Innovative solutions, such as replacing gas boilers with electric ones or heat pumps, can also deliver additional carbon revenue.

Among other things, municipal waste to energy and leakage reduction in the gas distribution systems will likely qualify for carbon revenue.

The apparel industry, which has committed to reducing 30 percent of its GHG emissions by 2030, may consider a combination of approaches—implementing projects locally for part of the mitigation and purchasing the remainder from high-quality projects implemented elsewhere under Article 6.4.

While carbon markets under Article 6 echo the promises that CDM initially showed, Bangladesh needs a clear-sighted approach to benefit from it. This approach should include designing and implementing a readiness programme for carbon markets to develop the capacity of key stakeholders and bridge the knowledge gap. The major stakeholders will then determine which projects to prioritise. However, unclear or poorly defined priorities may limit Bangladesh's success in the new carbon market regime.

Shafiqul Alam is lead energy analyst for Bangladesh at the Institute for Energy Economics and Financial Analysis (IEEFA).

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments