How do we clear this economic mess?

We extend our sincerest congratulations to the young students and individuals in our community who demanded for a just and more equitable social order in Bangladesh. They have achieved the seemingly unachievable. Their courageous deeds have not only converted the quota reform movement into a powerful popular revolt for political transformation, but also resonated with the aspirations of every individual in the nation. Their resonant voices have deeply moved and inspired the entire nation, paving the path towards aspired progress. Credit also goes to whatever little is left in our civil society, including some important stakeholders of change in the media.

For the last 15 years, individuals as well as institutions have been denied economic advantages as a result of persistent corruption and prejudice. The government's exclusive preoccupation was with infrastructural development in the name of GDP growth, which failed to significantly impact the lives of broader segments of the populace, putting the inclusion agenda in the backyard with very little investment in social infrastructure building. Hence, it only favoured dishonest politicians, bureaucrats, and businessmen.

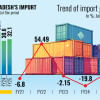

The regime has methodically destroyed institutions. The scarcity of employment prospects and the practice of preferential treatment via the quota system are indicative of the marginalisation experienced by the youth in the country. More so, the scenario in education, from the primary level to tertiary educational institutions, has become very pathetic and dismal. The lower level of the judiciary, and education and health systems have been politicised, resulting in poor service delivery. Despite loud discussions over it, the revenue expansion agenda was not acted upon due to individual officials prioritising personal gain. The overall size of the possible inward remittance is estimated to be more than $40 billion annually, but actual remittance has never exceeded $24 billion in a year because of an ever engulfing hundi business. Even our regulator lent a blind eye towards what was being done by some exchange houses owned by interest groups in the gulf, resulting in rampant rise in trade-based money laundering. The six and nine percent caps on interest rates only favoured a rogue few, not the honest and small entrepreneurs. An almost fixed exchange rate regime discouraged exporters and remitters. It neither helped foreign investors, nor the local ones. Favouritism in identifying the public interest projects as well as selection of project drivers also remained a big question for the development partners.

There is no doubt that the state and its dysfunctional systems must be rebuilt. The economy must be salvaged from the turmoil caused by the despotic administration and its supporters. Rectifying the chaos caused by the political regime over the last 15 years would need extensive effort and resolute decision-making. Over the last 15 years, we have seen the growth of many monsters, trying to swallow everything around, occupying large banks. High amount of cash transactions in banks during odd hours and the significant rise of impaired loans favoured only a few cronies, and depriving the honest entrepreneurs.

Individuals are experiencing the adverse effects of significant inflationary pressure and insufficient money in the ecosystem. The economic foundations have been severely compromised. Consequently, all economic indices are under strain. Every institution has been methodically dismantled to enable corruption and maintain an undemocratic grip on power as well as simple decision making.

The heads of regulatory agencies responsible for governing the economy exhibited complete susceptibility to a single "decision maker" and made erroneous and detrimental choices in order to appease political seniors and those with connections to those in power. Some examples are Bangladesh Bank, National Board of Revenue, and the capital market watchdog. Consequently, these entities have implemented various discriminatory and erroneous policies. Some of these actions involve amending the Banking Company Act to benefit the few board directors, refraining from taking any measures against willful bank loan defaulters, altering the definition of classified loans, maintaining fixed interest rate caps and exchange rate for an extended period, and neglecting to make autonomous decisions to manage inflation.

Hence the desired laundry list to reboot the economy is quite extensive. Significant exertion and unwavering commitment will be required to effectively guide the trajectory. Decision makers need to be very cautious regarding who they put up to dispassionately clear the mess. Relevant credentials and the ability to remain above any controversy should be the minimum threshold. Along with these, implementation with precision can never be underestimated.

Mamun Rashid is the founding managing partner of PwC Bangladesh and chairman at the Financial Excellence Ltd.

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments