How far can the IMF loan promote clean energy?

The International Monetary Fund's (IMF) $4.7 billion loan is mainly to ease the pressure on Bangladesh's current account balance through various reform measures. One of the important areas of reform is to address the challenges concerning clean energy and climate change. The IMF loan will be provided under three different facilities: Extended Credit Facility (ECF), Extended Fund Facility (EFF), and Resilience and Sustainability Facility (RSF). Of the total loan, $1.4 billion (29.8 percent) will be disbursed under the RSF, which is the main component targeting clean energy and climate change-related concerns (i.e. adaptation and mitigation measures). These loans will be provided during FY2023-26 in seven instalments upon six successful periodic reviews of the implementation of different conditions.

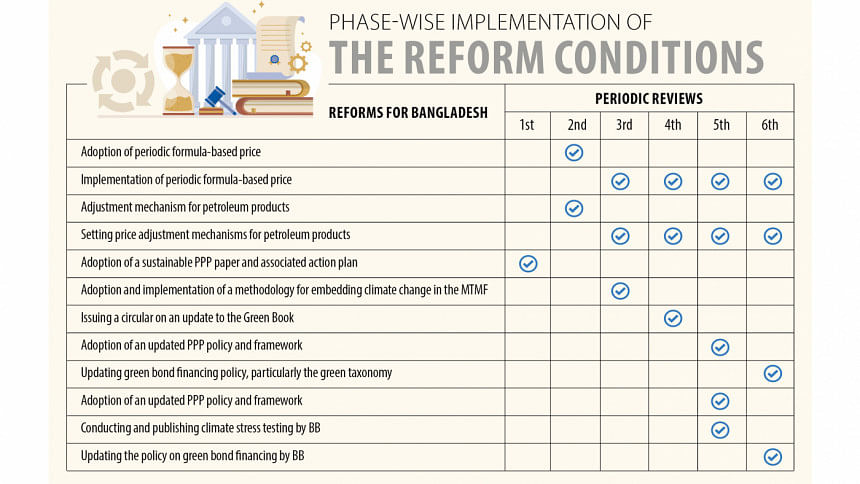

As self-defined, most conditions – 10 out of 12 identified conditions – that will help ensure the green transition fall under the RSF criteria. The core policy objectives of the RSF programme are: rationalising subsidies; strengthening Public Financial Management (PFM)/Public Investment Management (PIM) to increase spending efficiency and facilitate climate adaptation; greening the financial system to meet climate needs; making infrastructure investment green and resilient; strengthening climate fiscal management; and mobilising private climate finance and enhancing financial sector resilience. These reforms complement reforms under the ECF/EFF by improving climate investment potential, strengthening institutions, and enhancing climate-spending efficiency to build resilience and catalyse additional official and private finance.

The sum of 12 conditions needs to be fulfilled in different phases within six reviews starting from FY23. The review phase includes only one reform status: adoption of a sustainable public procurement policy paper and an associated action plan integrating climate and green dimensions, to be completed by September 2023. It is important to note that implementing the first-phase conditions will ensure the flow of funds from the second phase onwards.

Among the medium-term conditions, five or six can be very important in promoting clean and renewable energy, including the implementation of periodic formula-based prices, setting price adjustment mechanisms for petroleum products, and updating the policy on green bond financing by the Bangladesh Bank.

Subsidy rationalisation has been appearing and reappearing as a key reform agenda under both criteria. According to the conditionality, the subsidy mainly provided in the power and energy sector needs to be rationalised by adapting periodic formula-based prices under the ECF and EFF criteria, aiming to phase out subsidies on fossil fuel energy to promote renewable energy.

As part of the implementation of this reform agenda, the government has been gradually phasing out subsidies by raising energy and electricity tariffs. Fuel oil prices were hiked by 42.5-51.6 percent in August 2022 (amid the IMF loan discussion). Gas prices were increased up to 179 percent for industries from February 1, 2023. During January-March 2023, the electricity price was hiked by 15 percent by government executive orders.

As part of the implementation of this reform agenda, the government has been gradually phasing out subsidies by raising energy and electricity tariffs. Fuel oil prices were hiked by 42.5-51.6 percent in August 2022 (amid the IMF loan discussion). Gas prices were increased up to 179 percent for industries from February 1, 2023. During January-March 2023, the electricity price was hiked by 15 percent by government executive orders.

A large part of the subsidy burden is because of weak and disaffecting public policies and laws, including the non-competitive bidding process, creating excess power generation capacity, faulty pricing structure, excess capacity payment for IPPs, etc. Besides, LNG import has been proposed instead of promoting gas exploration in onshore and offshore gas fields. Without addressing any of the above-mentioned issues, the government has passed its fiscal burden directly on to different categories of consumers.

The existing fiscal and monetary policies are highly discriminatory in terms of promoting renewable energy in the country. Promoting clean energy in Bangladesh will not be possible unless fossil-fuel-based energy infrastructure is not discouraged and renewable-energy-based infrastructure is not established. Hence, measures need to be taken targeting those policy and operational weaknesses concerning fossil fuel and renewable energy.

Major reform measures will be adopting and implementing a methodology for embedding climate change in the Medium-Term Macroeconomic Framework (MTMF), analysing macro-fiscal risks from climate change, and publishing it in the Medium-Term Macroeconomic Policy Statement (MTMPS). Just analysing the macro-fiscal risks from climate change will not be adequate to make a big difference in the clean energy situation.

Such a policy statement is expected to put emphasis not only on adaptation, but also on mitigation measures related to climate change. Considering the policy targets set in achieving renewable energy – 30 percent by 2030, according to the Mujib Climate Prosperity Plan (MCPP), and 40 percent by 2041, according to the prime minister – the policy statement should set short- to medium-term targets for achieving renewable energy goals and the related methodology to be stipulated there.

Another important reform area is major infrastructure projects implemented under public and private investments in two important sectors. In the RMG sector, reforms have also started through the brands and buyers. Setting renewable energy portfolio standards for industries by the government and brand buyers can be the beginning of the clean energy era. Since the RMG sector has been building green factories (178 green/LEED-certified factories as of November 2022) targeting energy efficiency, resource reuse and clean energy, it is expected that renewable energy-based portfolio standards can be set and implemented in the coming years.

The Bangladesh Bank's policy on green bond financing for banks and financial institutions needs to be updated in the green taxonomy, particularly as it had to be aligned with the NAP to green the financial system. The existing policy promotes renewable energy in five specific activities: a) low carbon electricity; b) heating and cooling; c) generation of electricity using solar PV technology; d) hybrid renewable-powered electricity, heating and cooling, manufacture of renewable energy technologies, installation of renewable energy technologies (excluding solar pumps); and e) renewable-energy-led electricity transmission and distribution. All the activities in the green bond policy of the low carbon electricity, heating and cooling sector should include renewable and clean energy in some way or another.

Despite having such policies, the green bond is still not so popular as a mode of financing. Hence, financing fossil-fuel-based energy and electricity need to be discouraged and should be a part of green bond financing.

It is a fact that reform measures promoted under the IMF conditionalities addressing climate change-related hazards and clean energy development would be a kickstart. Moreover, implementation of the targeted measures is now crucial to see how far the reforms could be achieved. These reforms could ensure clean energy development, helping to eradicate the dominance of fossil fuel in Bangladesh. Hence, a set of parallel initiatives need to be undertaken targeting the structural weaknesses of the gas sector and power sector development to ensure energy transition, and thereby achieve the targeted 40 percent renewable energy use by 2041.

Dr Khondaker Golam Moazzem is research director at the Centre for Policy Dialogue (CPD) and project director of CPD Power and Energy Study.

Helen Mashiyat Preoty is research associate at CPD.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments