Tax reform imperatives for the interim government

Bangladesh is at a crossroads on several fronts. The expectations from the current interim government are enormous, particularly regarding the implementation of bold and radical reforms in key areas, including the economy. The key economic challenges facing the interim government include controlling inflation, preventing the depletion of foreign reserves, restoring discipline and public trust in the banking system, and overhauling the revenue mobilisation system. Historically, revenue efforts in Bangladesh—measured by the revenue-to-GDP ratio—have been seriously inadequate, which has constrained public expenditure.

This weak revenue effort has limited Bangladesh's ability to finance critical expenditures on physical infrastructure, human development, and pro-poor initiatives—thus restricting economic growth and employment. Additionally, it has strained the government's ability to fund social sector programmes, including social protection initiatives. Therefore, raising more revenue is essential for the government, and especially so for the interim government, given the heightened expectations from it for meaningful and positive changes.

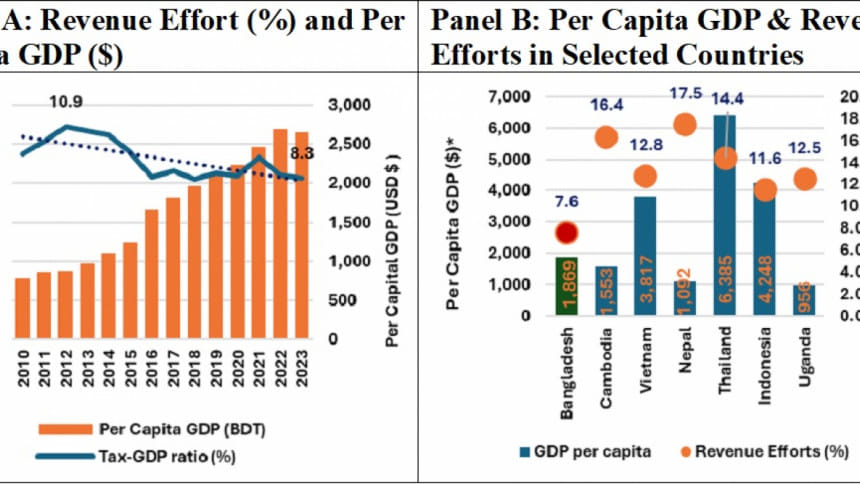

Generally, in countries, there is a positive relationship between income growth (i.e., GDP, per capita GDP) and revenue mobilisation. In Panel A of the figure provided, revenue efforts are compared against per capita GDP between 2010 and 2023. And the trend in per capita GDP is rising, indicating that incomes—and thus the tax base—are increasing, which should lead to higher revenue generation, even if tax rates remain unchanged. However, contrary to this, the declining revenue-effort trend suggests an inefficient revenue system in Bangladesh. Revenue efforts, which were around 11 percent in 2011, dropped to 8.3 percent in 2023—a decline of 2.7 percentage points over 12 years, during which per capita GDP increased by approximately 200 percent. This large negative association between per capita income growth and revenue efforts is both undesirable and unsustainable.

Furthermore, Bangladesh's performance in revenue mobilisation is dismal compared to its peers. Both Nepal and Cambodia, with lower per capita GDP than Bangladesh, have significantly higher revenue efforts—more than double Bangladesh's 7.4 percent. Even Uganda, with half of Bangladesh's per capita GDP, managed to raise 12.5 percent in revenue—5.1 percentage points higher than Bangladesh. These comparisons further highlight the inefficiencies in Bangladesh's revenue system.

The two most important taxes in Bangladesh are value added tax (VAT)—an indirect tax—and personal and corporate income taxes, which are direct taxes. In FY23, these two taxes together accounted for 72 percent of total tax revenue. VAT, which makes up about 40 percent of tax revenue, has one of the lowest productivity rates in the world. This means that Bangladesh collects less VAT revenue at existing VAT rates compared to other countries with similar or lower rates.

When considering other indirect taxes such as import duties, supplementary duties, and excise taxes, the total share of indirect taxes is around 66 percent, while the share of direct taxes is only 34 percent. The inability to raise a higher proportion of tax revenue from direct taxes is another striking weakness of our system. The income tax system is based on an outdated 1984 ordinance, leading to complex tax forms and burdensome filing requirements, which discourage voluntary compliance. As a result, there were only 2.5 million taxpayers, or 1.52 percent of the total population in FY22. Low compliance and a narrow tax net have kept income tax revenue low, increasing reliance on indirect taxes, which disproportionately burden the poor.

A paradox of our tax system is the high tax-expenditure ratio despite dismal tax efforts. Tax expenditures are special provisions in the tax code—such as exclusions, deductions, deferrals, credits, and tax rates—that benefit specific activities or groups. These provisions result in forgone revenue. According to an NBR report ("The Tax Expenditure in the Direct Tax of Bangladesh: Estimation and Review," March 2024), tax expenditures in direct taxes amounted to 3.56 percent of GDP in FY21. While some of these may be justified on merit, such high tax expenditures alongside low revenue efforts are clearly unsustainable.

The assessment above suggests that Bangladesh's revenue system is both inefficient and inequitable. The dismal state of the revenue system is largely due to the lack of meaningful reforms over the past three decades since the introduction of the VAT system in 1991. Therefore, future reforms must focus on improving both the efficiency and equity of the system. Having a clear reform roadmap with specific targets is crucial. Bangladesh should aim to increase its revenue effort to 13.5 percent within the next two years and to 16.5 percent within the next five years. Although ambitious, these targets are feasible, as evidenced by the performance of other countries. Additionally, revenue from direct taxes must increase to 40 percent within two years and 60 percent within five years.

Strategic recommendations

Implementing the 2012 VAT law is likely to improve VAT revenue collection, address inefficiencies in the system, and enhance overall revenue through: i) eliminating the complexity of having multiple tax rates on the same products at different stages of production; and ii) reducing tax evasion, boosting revenues, and discouraging vertical integration, which will support the SME sector through subcontracting by large enterprises.

Increasing revenue from the direct tax system

Bangladesh needs to mobilise more revenue from direct taxes to align with countries at similar income levels by: i) simplifying the personal income tax system by eliminating wealth and income-expenditure statements, which contribute to corruption; ii) implementing electronic filing and payment systems while eliminating direct interactions between taxpayers and tax collectors; iii) lowering corporate tax rates to a maximum of 25 percent over the medium term with minimal exceptions—all sectors, including ready-made garments (RMG), should be treated equally; iv) replacing the wealth tax with a proper property tax system, based on realistic valuations of personal and commercial properties, with revenues earmarked for local governments; and v) reducing rebates, discounts, exemptions, and reduced rates of taxation, and introducing a tax-expenditure tool to clearly show the benefits and costs of tax policies.

Improving tax administration

Bangladesh must: i) automate its tax administration; ii) establish a modern, computer-based audit system to identify audit candidates based on pre-determined red flags and focusing on revenue productivity and genuine tax evaders; iii) create a separate tax policy division within the Ministry of Finance, staffed with tax policy experts to ensure tax changes are effective, efficient, and equitable; iv) incorporate alternative dispute resolution in income tax, VAT, and customs legislation to collect unpaid revenue; v) strengthen the research and administrative capacities of the National Board of Revenue through international technical assistance and partnerships with local research institutions—all tax data should be computerised, and online tax filing should be facilitated; and vi) introduce a redistributive fiscal policy tool (in line with SDG 10) to assess the impact of tax and expenditure proposals.

Dr Bazlul Haque Khondker is chairman of South Asian Network on Economic Modeling (SANEM) and director at Policy Research Institute (PRI) of Bangladesh. He can be reached at [email protected].

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments