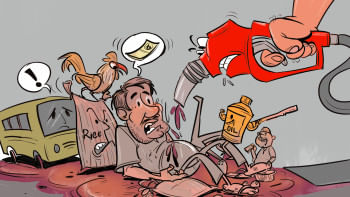

How not to fight inflation

Despite favourable indices, it is too soon to tell whether inflation has been tamed. Nonetheless, two clear lessons have emerged from the recent price surge.

First, economists' standard models – especially the dominant one that assumes the economy always to be in equilibrium – were effectively useless. And, second, those who confidently asserted that it would take five years of pain to wring inflation out of the system have already been refuted. Inflation has fallen dramatically, with the December 2022 seasonally adjusted consumer price index coming in just one percent above that for June.

There is overwhelming evidence that the main source of inflation was pandemic-related supply shocks and shifts in the pattern of demand, not excess aggregate demand, and certainly not any additional demand created by pandemic spending. Anyone with any faith in the market economy knew that the supply issues would be resolved eventually; but no one could possibly know when.

After all, we have never endured a pandemic-driven economic shutdown followed by a rapid reopening. That is why models based on past experience proved irrelevant.

Policymakers continue to balance the risk of doing too little versus too much. The risks of increasing interest rates are clear: a fragile global economy could be pushed into recession, precipitating more debt crises as many heavily indebted developing economies face the triple whammy of a strong dollar, lower export revenues, and higher interest rates. This would be a travesty.

The US has knowingly adopted a policy that will likely sink the world's most vulnerable economies. Worse, it is not even clear that there is any upside to this approach. In fact, raising interest rates could do more harm than good, by making it more expensive for firms to invest in solutions to the current supply constraints.

In retail and other markets, higher interest rates can actually induce price increases as the higher interest rates induce businesses to write down the future value of lost customers relative to the benefits today of higher prices.

To be sure, a deep recession would tame inflation. But why would we invite that? Not only is inflation falling, but wages are increasing more slowly than prices (meaning no spiral), and expectations remain in check. The five-year, five-year forward expectation rate is hovering just above two percent – hardly unanchored.

Some also fear that we will not return quickly enough to the two percent target inflation rate. But remember, that number was pulled out of thin air. It has no economic significance, nor is there any evidence to suggest that it would be costly to the economy if inflation were to vary between, say, two percent and four percent. On the contrary, given the need for structural changes in the economy and downward rigidities in prices, a slightly higher inflation target has much to recommend it.

Some will also say that inflation has remained tame precisely because central banks have signalled such resolve in fighting it. My dog Woofie might have drawn the same conclusion whenever he barked at planes flying over our house. He might have believed that he had scared them off, and that not barking would have increased the risk of the plane falling on him.

A careful look at what is going on, and at where prices have come down, supports the structuralist view that inflation was driven mainly by supply-side disruptions and shifts in the pattern of demand. As these issues are resolved, inflation is likely to continue to fall.

Yes, it is too soon to tell precisely when inflation will be fully tamed. And no one knows what new shocks await us. But I am still putting my money on "Team Temporary." Those arguing that inflation will be largely cured on its own still have a much stronger case than those advocating measures with obviously high and persistent costs but only dubious benefits.

Joseph E Stiglitz, a Nobel laureate in economics, is University Professor at Columbia University and a member of the Independent Commission for the Reform of International Corporate Taxation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments