Consequences of capital flight

Aconsensus cannot be reached on what precisely constitutes capital flight. In its simplest form, any illicit transfer of financial assets across national borders constitutes illicit capital flight (ICF),as opposed to legal capital outflows (LCO). One imprecise estimate of ICF is obtained by simply subtracting foreign currency payments for imports, debt service and additions to official reserves from total sources of foreign exchange (exports, borrowing, investment by multinationals, etc.) The unaccounted-for dollar difference is labeled as capital flight (Concise Encyclopedia of Economics.)

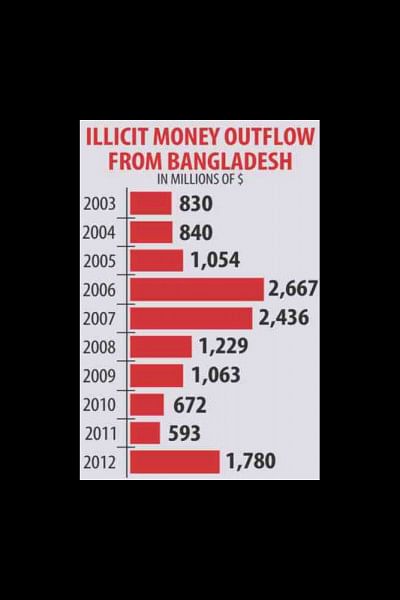

Washington-based capital flight watchdog, Global Financial Integrity (GFI, December 15, 2014)) ranked Bangladesh 51among 145 countries adversely affected by ICF. According to GFI, capital flight from Bangladesh tripled to USD 1.78 billion from its 2011 estimates of D 5,931 million – a 200 percent jump. Over the 2001-2010 period the country lost around USD14 billion in ICF, of which 75 percent (or USD 10.5bilion) was stolen through the manipulation of export and import invoicing. In the Swiss National Bank's (SNC) 2013 annual report, deposits from Bangladeshis showed an increase of 62 percent as opposed to India's 45 percent. What is most alarming for Bangladesh is a recent newspaper report claiming that nearly 30 percent of the USD14 billion comprising annual expatriates' remittances are siphoned off to India through remittances and capital flight.

Unlike legal outflows, ICF is a one-way traffic from LDCs to developed economies, obviously benefiting the latter disproportionately. Combating this national adversity requires identifying the perpetrators and understanding why and how they do it. Perpetrators of ICF can be loosely identified into four somewhat overlapping groups:

People in powerful positions (politicians and high political officeholders, senior civil servants, and so on);

Business people dealing with export-import activities;

Foreign investors in developing countries' capital markets;

Multinational Corporations (MNCs) operating in different countries and continents.

According to a 2011 study by the Ministry of Finance, the underground economy makes up about 62.75 percent of Bangladesh's GDP. Most of this wealth is amassed through various forms of corruption and illicit deals by a few. Some of this money – widely known as “black money” – finds its way into bank deposits under various names of family members. A part of this is legalised through successive governments' “black money whitening” scheme, while another significant amount tiptoes out of the country as capital flight.

Both ICF and LCOs are influenced by the following:

Political instability threatening freedom of movement and all other aspects of life and living;

Endemic corruption of politicians and public servants, and tax evasion by businesses and property owners;

Erosion of the value of wealth due to persistent high inflation;

Weak enforcement of the rule of law – threatening security of life and property rights (ill governance);

Strict capital and currency controls;

Domestic currency devaluation and speculations;

Frequent policy changes with change of government creating uncertainty in business investment and expansion

Easy access to credit markets followed by fake loan default;

Weak capital market and potential for higher asset return from investment abroad;

Persistent low real interest rates;

Offshore secrecy jurisdiction and tax havens;

High taxes on wealth;

High foreign debt;

These thirteen factors hereinafter will be referred to as capital flight triggering (CFT) factors. How and why many of the CFT factors may trigger ICF is widely known and hence their explanation here are deemed redundant. For example, people in Bangladesh are experiencing the first eight factors day in and day out, and to a lesser degree the other factors. The GFI considers political instability as one of the leading causes of ICF from LDCs. Bangladesh saw large scale money laundering during the political unrest in 2012 following the contentious parliamentary elections. Currency devaluation or even rumors of one can set off an episode of capital exit. Higher foreign debt (1980s Third World debt crisis) can make domestic investors suspicious that their government would give preference to its foreign debt obligations rather than to its domestic ones.

Portfolio choice theory explains ICF as being driven by risk and return of honestly acquired wealth. However, in many instances, supported by empirical studies, this theory is defied since the holders of illicit assets would be willing to accept even negative returns for having their assets protected abroad by bank secrecy and tax heavens.

There are many innovative ways ICF is consummated in Bangladesh. The most widely known ones include:

Under-invoicing of exports and over-invoicing of imports;

Withholding of indenting commission in the country of trade;

Electronic funds transfer through unregulated offshore financial centers and bank remittances sent for fake payments overseas;

Outright money smuggling;

Transfer of foreign remittances through banking channels under anonymous or fake accounts to make payments for imports. Such transactions in the BOP's

Current account shows payments for imports far exceeding their actual sum. The difference disappears in capital flight and in BOP's balance sheet the missing payments are accounted for as errors and omissions.

Hundi system;

It may be underscored that unless there are specific legal prohibitions, some hundi type transactions may not constitute capital transfer. For example:

Case 1: Consider two Bangladeshis in America (dual citizens) X and Y or expatriate workers in UAE. X buys property from Y located in Bangladesh and pays Y in dollars in the USA or UAE.

Case 2: Suppose X paid educational expenses of Y in dollars in the USA and in exchange Y deposited the equivalent amount in taka in X's bank account in Dhaka.

Case 3: Suppose X and Y bought their second home in Malaysia.

All transactions took place at the official exchange rate and no foreign currencies escaped Bangladesh in any of these cases. Unless there are specific legal prohibitions, these transactions may be deemed as potential capital deprived – not capital flight. In all three scenarios the country may have implicitly benefitted from having avoided capital flight though illicit channels.

Consequences of capital flight

Capital flight is an opportunity lost for foreign currencies to work for domestic economic expansion through imports of capital goods. In contrast, LCOs among countries of similar fundamentals can be mutually constructive and they often find their way back to the home country once the unfavourable investment climate receeds.

Other adverse outcomes of ICF include the erosion of a country's tax base creating an income redistribution dilemma, and the dissuasion of foreign direct investment (FDI). Obviously, LDCs have overwhelming preference for FDI over foreign portfolio investment in capital market assets. Unlike investments in financial assets, which can be liquidated and the proceeds repatriated in a matter of minutes, FDI encompasses long-term commitments in physical capital such as factories and enterprises that cannot be liquidated easily at short notice.

Two forms of capital flights are quite pernicious: (a) Government borrowing money from foreign banks for infrastructure and other productive developments (World Bank and Padma Bridge scandal.) Unfortunately, a big chunk of this money finds its way back to where it came from through capital flight. The citizens are left dry with the burden of interest and loan repayment. (b) Foreign aid (foreign taxpayer's money) is intended to help poverty stricken people or to build infrastructure. Corrupt government officials, NGOs, and companies find ways to ferry a portion of the aid money out of the country.

Capital flight can dry up a country's ability to finance both public and private investments. Over the period 2000–2007, African countries saw a hefty growth rate of 4.8 percent. Unfortunately, the growth had failed to trickle down to the poor majority of the populace. Amongst other factors, Leonce Ndikumanaat attributed this in part to low level of both public and private investments constrained by a lack of domestic financing – especially long-term investment capital (University of Massachusetts, December 22, 2013). He argues that on one hand Africa showed a worsening investment-saving gap while the continent became a source of large-scale capital flight (estimated at USD 1.7 trillion in 35 sub-Saharan countries).

Empirical studies show that in developing countries, ICF occurs through the transfer of a part of domestic private savings. For example, over the 1970–2005 period, the eight West African Economic and Monetary Union (WAEMU) countries experienced a low savings rate of 6.3 percent and a low private sector credit to GDP ratio of 17.7 percent (Ameth Ndiya 2012, University of Dakar, Senegal.) During the same period, the region suffered a capital flight between 27.7 percent and 34.7 percent of real GDP. Ndiya attributed the low savings and low investment capital, to ICF, indicating significant capital flight. Ndikumana's 2013 study covering 39 African countries also partly blamed ICF for shortages of investment capital in the continent. For students of macroeconomics, the adverse consequences of ICF can be succinctly depicted using the AD-AS framework.

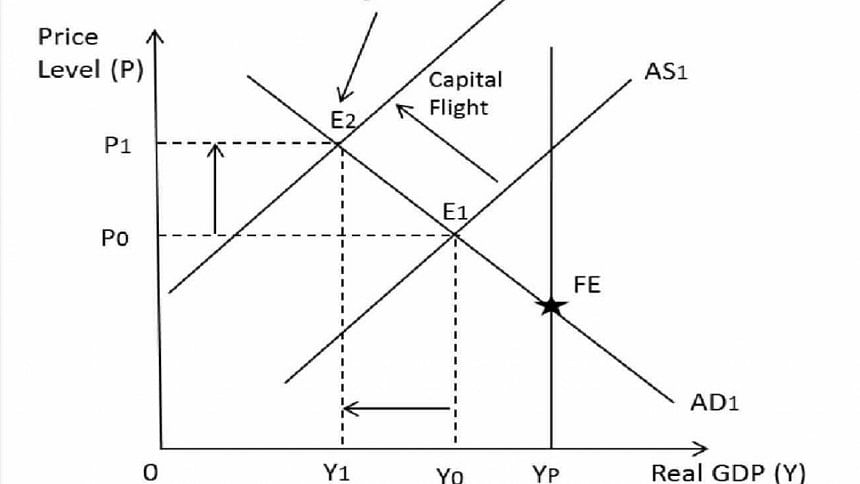

The macroeconomic equilibrium is determined by the interactions of aggregate demand (AD) and aggregate supply (AS), where the equilibrium is dependent on the determinants of both AS and AD. While AD is a function of monetary and fiscal policies net exports (exports minus imports), trade policies, and consumer preferences, AS is a function of the factors of production such as prices of inputs (labour, capital, energy etc.), availability of labour and capital and their corresponding productivities, the level of technology, and so on. Any large change in any of the supply factors, referred to as supply shock, shifts the AS function leftward or rightward, depending on the shock being negative (unfavourable) or positive (favourable).

For faster economic growth and poverty reduction, LDCs must attract MNCs to invest in building factories and enterprises, i.e. FDI. Unfortunately though, the CFT factors that encourage capital flight are some of the same factors that often deter FDI. Under such a manifestation of double jeopardy, the country's production capacity is likely to be impacted negatively for the lack of equipment and parts and the replacement of depreciated capital goods because of potential foreign currency constraints. This will take a toll on the productivity of labour (through a lower capital-labour ratio). If the double jeopardy persists, and assuming AD remains virtually unchanged, one would expect a leftward shift of the AS function, derailing the economy into a new equilibrium with stagflation, which is a phenomenon of the simultaneous occurrence of declining output (higher unemployment) and high inflation, as shown in the figure. (1)

YP = Potential real GDP when all available resources are fully and efficiently employed. For example, with the December 2014 unemployment rate of 5.6 percent and the 2014 average annual inflation rate 1.3 percent, the US economy is approaching the full employment equilibrium.

Y0 = equilibrium real GDP below full employment equilibrium);

For the Bangladesh economy, the output at Y0 (corresponding to equilibrium at E1) implies that the economy is producing at less than its full potential (YP) because of political instability (strikes and lockouts), endemic corruption, weak enforcement of rule of law (ill governance), and so on. With unabated capital flight added to these factors, the AS function shifts to AS2 with a new equilibrium at E2 (stagflation).By striving hard to ameliorate the first six factors of capital flight alone, Bangladesh can achieve output growth at or close to the potential level YP, with the AS function shifting rightward to equilibrium FE (full employment). This will allow output growth well beyond the 6 percent average growth of yesteryears, and inflation well below the average annual rate of 7 percent.

An episode of stagflation is a policy makers' worst nightmare since attempts to ameliorate one (inflation) by using monetary and fiscal policies will worsen the other (unemployment), and vice versa. An ongoing spectacle of stagflation is what Russia is experiencing now because of massive capital flight driven by western economic sanctions and plummeting oil prices.

Deterring capital flight

Once capital flight sets off, there is no easy fix to immediately stop the inertia and most preventive measures often produce undesirable outcomes. Prior to 1973, whenever the fixed exchange rate regime failed, the US and other developed countries resorted to frequent capital controls. This further worsened investor confidence in domestic financial markets while deterring the return of runaway capital. Additionally, capital controls bring into play black markets for foreign currency.

A better strategy to limit ICF is to make holding domestic currency more attractive by keeping it undervalued relative to other currencies or by raising and keeping domestic interest rates high. The recent western sanctions (after Russia's annexation of Ukraine's Crimean peninsula in 2014) and plummeting oil prices caused the Russian ruble to lose 50 percent of its value against the US dollar. To protect the ruble and also to deter ICF (with over USD 220 billion already fled) the Russian central bank in mid-December 2014 raised its key interest rate from 10.5 percent to 17 percent. One obvious downside of this measure is making imported equipment and parts more expensive which can reduce domestic capital investment (AS function shifting leftward).

Other measures to combat capital flight include frequent intervention in the foreign exchange market. The French government tried this in 1924 by bidding the franc down from 124 to 61 francs per dollar in only a few weeks. By selling Francs “short”, currency speculators were hit with big losses. Other countries such as Italy, the US and Sweden have also resorted to this surprise intervention tactic from time to time.

Reduction of tax benefits by having rich and poor countries adopt new tax treaties and exchange data on income paid to foreigners may somewhat lessen capita flight. Based on US' experience, Nobel economist Joseph Stiglitz recently advanced the idea of taxing the global profits of MNCs and then redistributing a portion to capital flight victim countries. This is akin to a source-based taxing system – one that is fervently being lobbied against by MNCs.

To thwart capital flight by MNCs, many natural resource-rich LDCs have put in place the so-called “thin capitalisation rule”– one that was introduced in Canada in 1972 and now in place in about 60 countries. The rule specifies a “safer haven” debt-to-equity ratio that limits the amount of deductible interest for tax purposes. It is designed to counter cross-border transferring of profits through excessive debt and thus aims to protect a country's tax base. (Capital Flight Risk, IMF, September 2013).

The most feasible measures against most capital outflows are the ones at the discretion of the domestic government itself. For example,

Pursuing domestic fiscal and monetary policy strategies to avoid large exchange rate changes and minimise exchange rate volatilities;

Tax evasion driven capital flight can be lessened by slashing taxes on interest and capital gains on financial assets;

Following Brazil's example in the early eighties, governments in developing countries may improve and promote domestic financial markets by offering relatively safe alternatives that may dampen the exodus of capital.

The 13 CFT factors do not necessarily apply to all developing countries at the same time. The governments of the countries being inflicted by capital flight (such as Bangladesh) already know the country-specific factors and must adopt appropriate measures accordingly. However, success in combating capital flight must have strong cooperation from developed countries – especially the trading partners. Unfortunately, such a co-operation will be difficult to achieve given that it is counter to the interest of the capital recipient country. For example, the open door policy of the government of Malaysia, which allows foreigners to invest in that country is a very worthwhile “go for deal” for wealthy people from countries that are experiencing depreciation due to political instability, ill governance, corruption, lack of protection of life and property, etc.

The government of all developing countries by and large know who the perpetrators of capital flight are. In fact, these people perpetrate ICF because of the weak enforcement of law. There is no dearth of laws and regulations against capital flight on the books – only the will to enforce the laws is lacking. The presumed interconnected perpetrators, to a large extent, are unofficially immune from capital flight crimes. Until this revolving door is slowed down, capital flight will continue undiminished.

Tracking capital flight in foreign destinations and having capital repatriated has rarely been a successful venture. The recent announcement by Bangladesh Bank (BB) to investigate Swiss Bank deposits of Bangladeshi citizens is a bold but expensive undertaking. As explicated earlier, expatriate workers using foreign currency from their country of employment to buy homes and businesses anywhere outside Bangladesh does not constitute capital flight. That may, at most, be considered potential inflow being deprived.

In Balance of Payment (BOP) accounting, Bangladesh does not have capital account convertibility, i.e. allowing convertibility of domestic financial assets into foreign financial assets and vice versa at market exchange rates. All foreign transitions are carried through the current account in the BOP. Recently, the government has relaxed some currency controls in terms of the size and ease of getting foreign currencies for education, medical treatment, business travel, tourism and so on. Capital convertibility would facilitate transfer of foreign currencies abroad within the allowable limits, but would that guarantee any lessening of illicit capital outflows through unofficial channels?

There are some suggestions in various forums for an independent foreign exchange operations department to develop policies and capital flight surveillance strategies. Creating another bureaucracy has the potential of instituting corruption in foreign currency transactions; instead, BB's existing department should be empowered appropriately as needed.

Capital flight – whatever form it may take – deprives ordinary citizens from economic justice. We can blame those involved in this illicit act to no avail. Without significant improvement of the capital triggering factors, no new regulations and surveillance strategies can produce any measurable positive outcomes. Economics 101 tells us that resources (both human and financial capital) are always allocated to their most safe, productive and rewarding activities and destinations, wherever they may exist.

..............................................................

The writer, formerly a physicist and nuclear engineer, is a Professor of Economics at Eastern Michigan University, USA. Thanks are due to BB economist Abdul Awwal Sarker for helpful discussions, and Dr. Christopher Elias and Dr. James Saunoris for their insights and comments.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments