Pragati Insurance – Driving forth change

Pragati Insurance Limited is maintaining its constant growth from the very beginning and hopefully it will remain in future. At present, the insurance market is in great demand which is expanding day by day. Though contribution to GDP in insurance sector is below 1%, we are hoping that the situation will change soon and it will show its effect in GDP. Currently, the government is paying more attention on this sector and has suggested expanding this insurance market by introducing new products. Few non-traditional products have already been launched, such as Bangabandhu Shurakkha Bima, Weather Index Based Crop Insurance etc. We are trying to reach the masses by creating need-based insurance products. This target will not only develop the market, but also help general consumers. However, the Government's constant focus is imperative for the betterment of this sector.

PRAGATI INSURANCE LIMITED (PIL) is a leading private non-life insurance company in Bangladesh. It was established in 1986 by a group of young Bangladeshi entrepreneurs who had earlier launched a Commercial Bank in the private sector. The Sponsors include Shipping Magnates, Engineers, Road Builders and Top Garment Industrialists.

The company offers a complete range of general insurance products and services in motor, marine, energy, property and casualty, health, accident and liability areas.

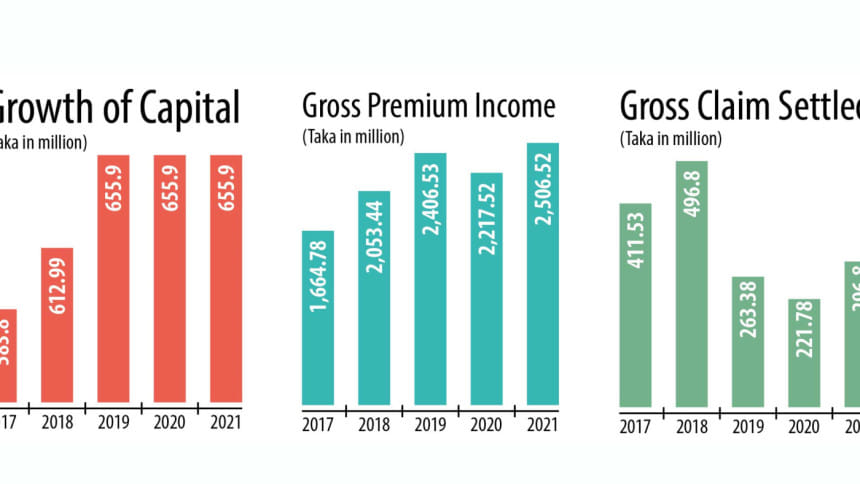

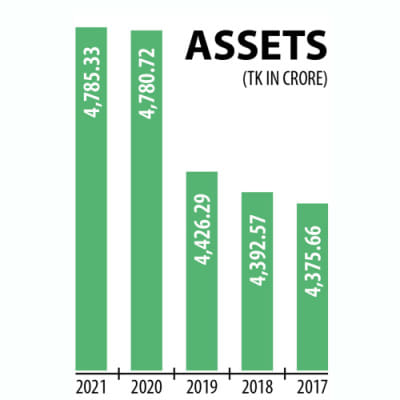

PIL, with its strong capital base and reinsurance partnerships with highly rated national and global Re-insurers, enjoys a competitive edge in the insurance industry. This is possible because of its strong assets, huge reserves, a balanced portfolio mix, steady growth in gross premium and continuous increase in share price at the stock market.

Pragati is listed on both stock exchanges in Bangladesh and enjoys 'A' class reputation. Pragati Insurance Limited is rated 'AAA' for the Long Term rating by renowned rating company. 'AAA' signifies 'VERY STRONG' financial security characteristics and with which an entity is adjudged to have very good financials, claim paying ability and first rate operating environment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments