Islamic Banking in Bangladesh

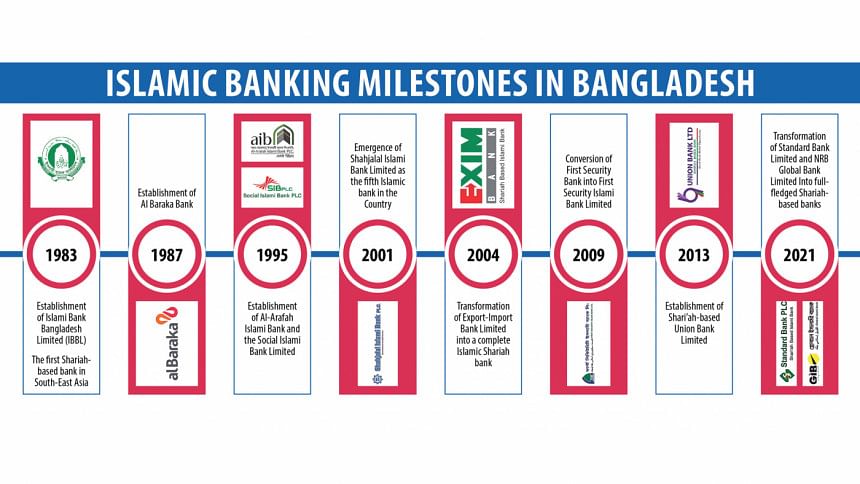

Over the past four decades, Islamic banking has firmly established itself as a significant financial sector in Bangladesh, operating in accordance with Islamic principles and providing a secure platform for transactions. However, like the broader banking sector, Islamic banking currently faces a range of challenges. Despite these obstacles, there exists a strong sense of optimism for recovery and growth, contingent upon effective leadership and strategic oversight.

"Just as Islam has been established as a universally acceptable way of life that embraces all the beauty and perfection of the world, in the same way, Islami Bank is moving forward by facing all contemporary challenges," shares Sohail R K Hussain, Managing Director and CEO at Bank Asia.

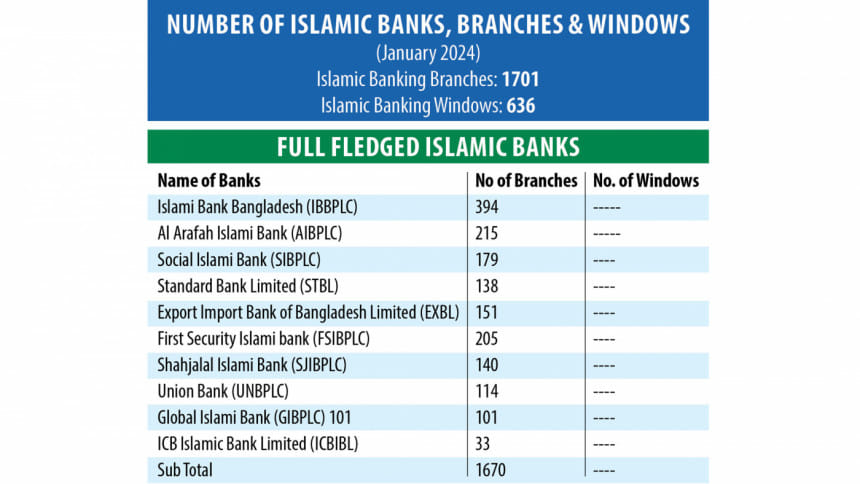

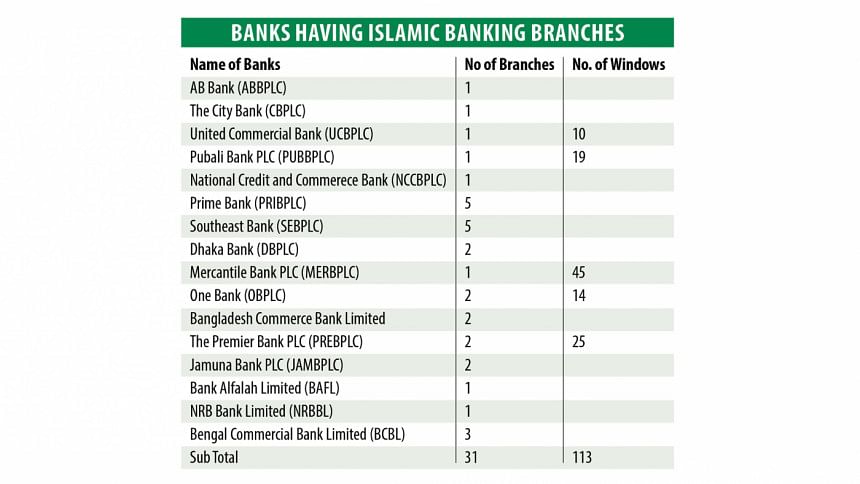

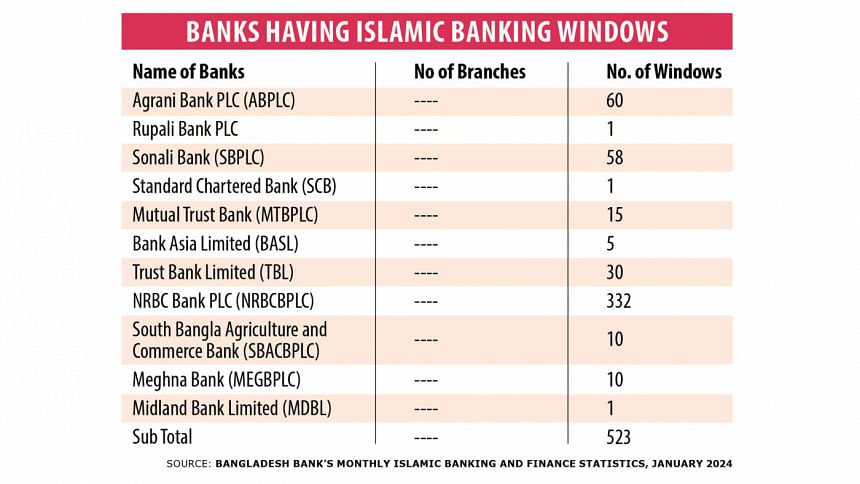

At present, ten full-fledged Islamic banks operate across 1,672 branches nationwide. In addition, 15 conventional commercial banks have set up 31 dedicated Islamic banking branches, and 16 conventional banks maintain 646 Islamic banking windows to offer Shariah-compliant financial services throughout the country.

"The Islamic banking system is well-positioned to thrive in our country due to its considerable appeal. Consequently, traditional banks are also establishing Islamic branches and windows, thereby allowing conventional and Islamic banking to coexist equally. Nevertheless, the S Alam Group has caused substantial damage to Islamic banks, particularly Islami Bank, which has suffered the most. In response, Bangladesh Bank is providing liquidity support to help these banks endure, and there are emerging signs of recovery. Islami Bank has already navigated much of the crisis, and other Islamic banks are also on the path to recovery," stated Prof. Dr. Mainul Islam, former professor of economics at Chittagong University.

According to the latest Bangladesh Bank Quarterly Report on Islamic Banking, total deposits in the Islamic banking system reached BDT 4,394.65 billion at the end of March 2024, reflecting a decrease of BDT 39.38 billion, or 0.89 percent, compared to December 2023. However, this figure represents an increase of BDT 278.34 billion, or 6.76 percent, compared to the same quarter of the previous year. During the reporting period, Islamic banks accounted for 26.23 percent of total deposits in the entire banking sector.

The total investments (loans and advances) in the Islamic banking system rose by BDT 120.20 billion, or 2.70 percent, reaching BDT 4,569.94 billion at the end of March 2024 compared to December 2023. This increase also represented a rise of BDT 445.97 billion, or 10.81 percent, compared to the same quarter of the previous year. At the end of March 2024, Islamic banks constituted 28.24 percent of total loans and advances in the entire banking sector.

Additionally, the Investment-Deposit Ratio (IDR) of Islamic banks stood at 0.97 at the end of March 2024 (excluding EDF and refinance), up from 0.93 in December 2023 and 0.92 in March 2023.

Notably, the excess liquidity of Islamic banks declined by BDT 51.25 billion, or 77.14 percent, bringing it down to BDT 15.18 billion at the end of March 2024, compared to BDT 66.43 billion at the end of December 2023. This figure was also BDT 5.85 billion, or 27.82 percent, lower than the same period last year.

Meanwhile, the number of Islamic bank branches, including the Islamic windows of conventional commercial banks, increased to 1,703 at the end of March 2024, compared to 1,700 in December 2023 and 1,684 in March 2023. Similarly, the number of Islamic banking windows rose to 646 by March 2024, up from 624 in December 2023 and 550 in March 2023.

As of March 2024, total employment in Islamic banks reached 51,272, a rise from 50,306 in December 2023 and 50,143 in March 2023.

Although indicators such as total deposits and excess liquidity in Islamic banks are experiencing a decline, the number of Islamic bank branches and windows is gradually increasing. Notably, Islamic banking now accounts for over a quarter of the total banking sector regarding deposits, loans, and advances, which suggests a promising outlook.

Banks are currently optimistic about the revival of Islamic banking in the prevailing political context, provided there is appropriate guidance from Bangladesh Bank and strategic measures are refined to address the ongoing crisis.

According to industry insiders, the Islamic banking and finance sector in Bangladesh encounters several structural challenges despite its significant opportunities. These include the lack of an Islamic Banking Act, insufficient Sukuk and Shari'ah-compliant investment options, inconsistent Shari'ah rulings, and no apex training bodies for professionals. Additionally, the absence of a secondary securitization market, insufficient syndication efforts for Shari'ah-compliant public project financing, the lack of an Islamic money market, and the need for updates to the Shari'ah governance framework present significant challenges.

"At the governmental level, there is an absence of clear policy, strategy, and a roadmap for the development of Islamic banking over the next five years. A cohesive plan is essential for guiding the industry forward," opines Syed Ibne Shariar, Head of Islamic Banking Division at Prime Bank.

He also highlighted that a prevalent misconception exists regarding the similarity between Islamic and conventional banking, and it is essential to address this mindset.

There is also a notable shortage of banking professionals who possess both technical finance expertise and a profound understanding of Islamic jurisprudence. Besides, there is general lack of understanding of Islamic banking principles and products limits potential customer engagement, consumer uptake, confidence, and market growth. The research and development budgets are also inadequate.

The major players in the country's Islamic banking industry are facing a challenging liquidity position.

"Conventional banks can access interbank markets and central bank liquidity windows, while Islamic banks face difficulties in liquidity management due to their inability to utilise interest-based instruments," shares Farman R Chowdhury, Managing Director and CEO at Al-Arafah Islami Bank, a dedicated Shariah-based Islamic bank in the country.

"However, several conventional banks offering Islamic banking services possess adequate liquidity. For instance, City Islamic, the Islamic banking wing of City Bank, has even provided liquidity support of BDT 500 Crore to two full-fledged Islamic banks," states Md Afzalul Islam, Executive Vice President and Head of Islamic Banking at City Bank Plc.

Farman R Chowdhury further points out that Islamic banks in Bangladesh mainly provide basic financing options like Murabaha and Ijarah, which restricts their competitive edge due to a limited range of available financial products.

Bank insiders believe that before investing in projects through Islamic banking, banks should conduct thorough assessments of each project's feasibility, expertise, and potential, ensuring they have a clear understanding of relevant forward and backward linkages. The Central Shariah Board could support this process by carrying out regular inspections and verifications.

"The Central Shariah Board for Islamic Banks of Bangladesh (CSBIB) must operate with a certain degree of influence from Bangladesh Bank. It is essential that regulatory processes align with those of the Bangladesh Institute of Bank Management (BIBM). Consequently, coordination should occur in a hierarchical manner to avoid any disruptions. Given its expertise in Shariah law, the CSBIB should possess the authority to conduct inspections as needed. In cases of non-compliance, the CSBIB should provide guidelines and suggestions for future improvements," states Mohammad Ali, Managing Director and CEO of Pubali Bank.

Shariah-based transactions are increasingly gaining popularity among the general public due to their alignment with ethical principles, profitability, and faith-based values. As a result, more conventional banks are venturing into the Islamic banking sector by establishing new windows and branches.

Eastern Bank, a prominent conventional bank, launched its Islamic banking operations on August 22, 2024. "In our Islamic Banking division, we will uphold our commitment to performance, maintain a strong compliance culture rooted in Shariah principles, and ensure that we provide the same level of care to our customers as we do in Conventional Banking. By choosing our Islamic Banking services, customers not only protect their financial interests but also support a financial system that promotes justice, equity, and social responsibility. We have introduced Musharakah to address the working capital needs for financing overhead costs, which is a rare offering in Bangladesh," says Ali Reza Iftekhar, Managing Director of Eastern Bank PLC.

In summary, Islamic banking holds significant potential, although it has yet to gain full momentum. Achieving this growth necessitates robust macro-level management from both the banks and the central regulatory body, ensuring that this ethical banking system meets the needs and expectations of its clients.

"The outlook for the growth of Islamic banking in Bangladesh appears positive, driven by increasing demand, government support, innovation, and economic stability. As the industry continues to evolve and adapt to changing market dynamics, ample opportunities exist for Islamic banks to further solidify their presence and contribute to the overall financial inclusion and diversity within the banking sector in Bangladesh," shares Md. Ahsan-uz Zaman, Managing Director and CEO of Midland Bank.

The introduction of diverse and innovative Shariah-compliant financial products and services is attracting a broader range of customers, including retail, corporate, and investment sectors, shares Mohammad Feroz Hossain, Managing Director and CEO at Exim Bank .

He also adds that the rise of fintech is enabling Islamic banks to enhance their services, improve efficiency, and expand customer experiences, reaching a wider audience through digital platforms.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments