Good, but can be better

THE year 2015 was very significant for Bangladesh for at least two reasons. Firstly, the government finalised its development plan through the Seventh Five-Year Plan that aims to transform Bangladesh into a middle income nation by 2021. The second reason is that Bangladesh, along with all the countries in the world, has now a new set of Sustainable Development Goals after ending the year successfully implementing most of the Millennium Development Goals.

That is not all. Last July, Bangladesh graduated from a low income status to a lower middle income nation, comfortably meeting the World Bank's requirements.

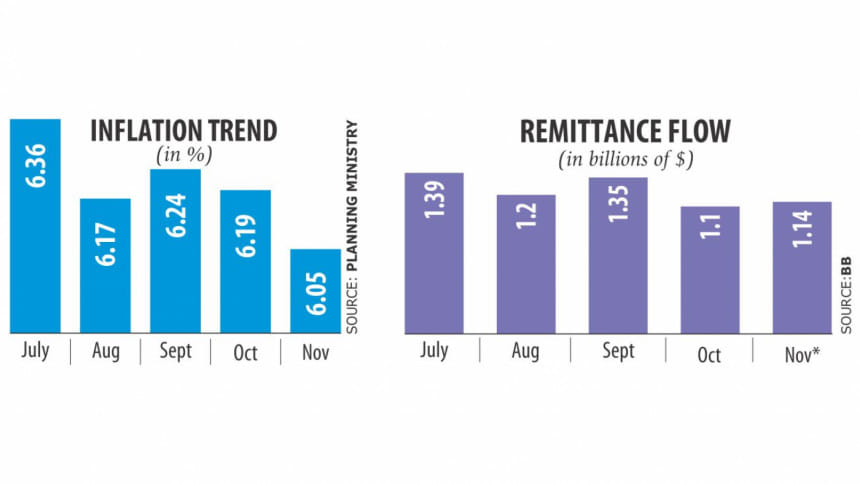

The economy, moreover, is on a strong footing with the gross domestic product growing above 6 percent. Inflation has fallen to its lowest level in 10 months in November. It averaged at a stable 6.21 percent throughout the year.

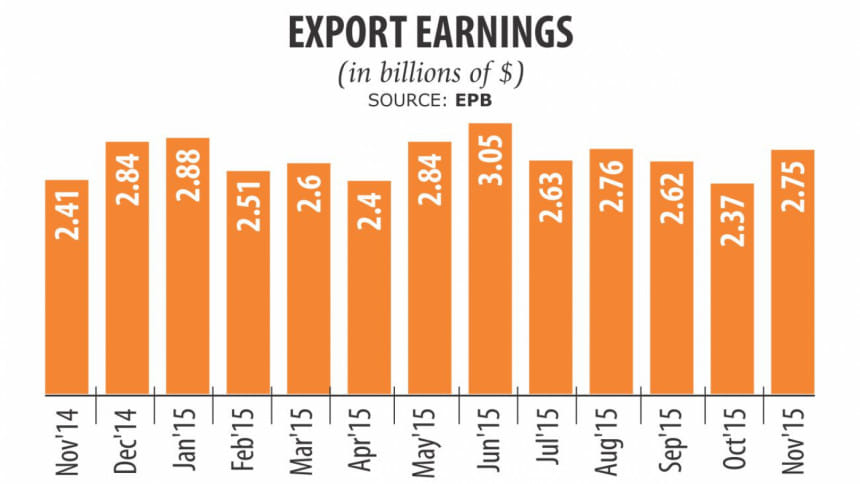

Foreign currency reserves crossed a $ 27-billion mark in October 2015, which was $22 billion in 2014. Export incomes stood at $29.41 billion as of November 2015. Remittance income brought home $14 billion in the first 11 months.

The country has also topped an HSBC survey of 6,300 global businesses that have a positive outlook on Bangladesh's trade prospects for the second half of 2015, thanks to lower logistics costs and higher profit margins.

On the downside, Bangladesh is a difficult country to do business in, according to the World Bank's Doing Business Report. The report highlights the bottlenecks which a local entrepreneur must face when trying to open and run a small to medium-size business while complying with relevant regulations. The country dropped two positions to 174th in the ranking due to stalled regulatory reforms. The picture becomes bleaker if the latest ranking is compared with that of 2014: Bangladesh was ranked 130th.

The highest number of reforms came for starting business, paying taxes and getting electricity. The World Bank report found that no reforms were recorded in areas of trading across borders, protecting minority investors, enforcing contracts and resolving insolvency. This is a wake-up call to revitalise regulatory reforms in order to increase the attractiveness of Bangladesh as a profitable investment destination compared to the country's international competitors.

With nearly 16 crore inhabitants on a landmass of 147,570 square kilometres, Bangladesh is among the most densely populated countries in the world. Sustained growth in recent years has generated higher demand for electricity, transport, and telecommunication services, and contributed to widening infrastructure deficits.

Although the government has been trying to do a lot of positive things in recent years, they are slow in execution. Businesses and industries are facing serious problems in getting gas and electricity supplies. While factories do manage to get the connection, the quality of supply of electricity and gas tends to be poorer.

The pace and scale of reforms over the past two years in the garment's sector have been unprecedented since the 1980s. Yet this was not enough for the Obama administration to readmit Bangladesh in its list of poor countries that enjoy duty-free trade benefit. At the beginning of 2015, particularly during the first quarter of the year, the business community faced severe problems to run their day to day operations because of frequent shutdowns and strikes. The inland transportation of goods and services almost reached a point of crisis because of these disturbances. The business community was just beginning to remain afloat after the severe disruptions in 2014. Finally, good sense prevailed and from the beginning of the second quarter businesses began to get some breathing space.

One key element that was noticeable throughout the second and the third quarter was the excessive amount of liquidity in the banking sector. But local investors have had limited scope for either expansion or fresh investment due to the higher cost of doing business.

One key factor that affected the export turnover is the devaluation of euro, as pointed out by Asif Ibrahim, former president of the Dhaka Chamber of Commerce and Industry. The euro is down more than 8 percent against the dollar year-to-date, and has fallen by 12 percent over the past year. A significant percentage of exports go to the European Union and the devaluation of the euro to a 12-year low was a key negative factor.

One positive step that was appreciated particularly by the exporters was the availability of foreign funds at a comparatively cheaper rate of interest than BDT borrowing for importing capital machinery. The central bank should continue to make available such funds for entrepreneurs. Availability of land for industry still remained a strong impediment for both domestic and foreign investors.

There is a need to expedite the setting up of the special economic zones and the country specific zones offered by the government. In terms of infrastructure, operations of the domestic inland river terminal was a welcome initiative, however more volume of trade should be facilitated using this facility.

Energy prices increased affecting the competitiveness of businesses. The government may rethink its energy pricing strategy for industries.

Some start-up projects were taken up using the public private partnership (PPP) model. More infrastructure projects need to materialise for the PPP to really become successful.

A very significant event for the country was the visit of the Prime Minister of India Narendra Modi. There were deals signed with the Indian government and the Indian private sector, particularly on energy cooperation. The bilateral trade agreement was renewed and a new $2 billion line of credit was offered by our next door neighbour. The Bangladesh government offered a special economic zone for Indian investors and Prime Minister Modi offered a readymade garment warehousing and retailing facility in Gujarat to Bangladeshi garment entrepreneurs.

On a scale of one to ten, Asif Ibrahim gives a 6.5 ranking for the year 2015 which almost echoes our stable though stagnant growth rate.

The writer is Business Reporter at The Daily Star.

[email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments