Retail banking: making luxuries affordable

Everyone has dreams of a better life, and given the pace of urbanisation and the rising purchasing power this aspiration has become more palpable.

And helping people meet their aspirations is retail banking with its concept of consume first and pay later.

Retail banking, also known as consumer banking, is the provision of services by a bank to the general public, rather than to companies, corporations or other banks.

In retail banking, the focus is on the individual consumer, and services offered include savings and checking accounts, mortgages, personal loans, debit/credit cards and savings certificates.

Western countries have embraced this form of banking back in the 1980s, but in Bangladesh people are still warming to the idea.

In Bangladesh, Standard Chartered was the pioneer in this type of banking because of its global presence and know-how.

But some local banks and non-bank financial institutions are coming up fast to have their pegs in this segment of business.

Banks with exciting consumer banking divisions are: City, BRAC, Eastern, Bank Asia, Dutch-Bangla, Prime, Dhaka, United Commercial and IFIC.

Of the non-banks, IDLC Finance, Delta-Brac Housing and LankaBangla Finance are doing well, particularly in home and auto loans.

“Retail banking has a huge prospect in Bangladesh as per capita income has been growing steadily for the past several years,” said Abul Kashem Md. Shirin, managing director of Dutch-Bangla Bank that has a customer base of 2.5 crore.

Nowadays, people want to buy more, be it a flat, car, television or air-conditioner, thanks to their rise in income.

“Solvency also breeds savings,” he added.

Banks in Bangladesh are still in the traditional mode, with little to no interest in bringing millennial and lower middle-class population to the banking system, said Mashrur Arefin, managing director of City Bank.

But City is aiming to go big with retail banking so that it can reach a wide variety of customers across the country.

“Retail banking is under-covered compared to Bangladesh's population and economic growth,” Arefin added.

Experts tip retail banking to be the main driver of growth for the country's banking sector in the near future as lenders' dependency on corporate banking is waning due to rising non-performing loans.

Retail banking, in contrast, have much lower NPLs than corporate banking, according to bankers.

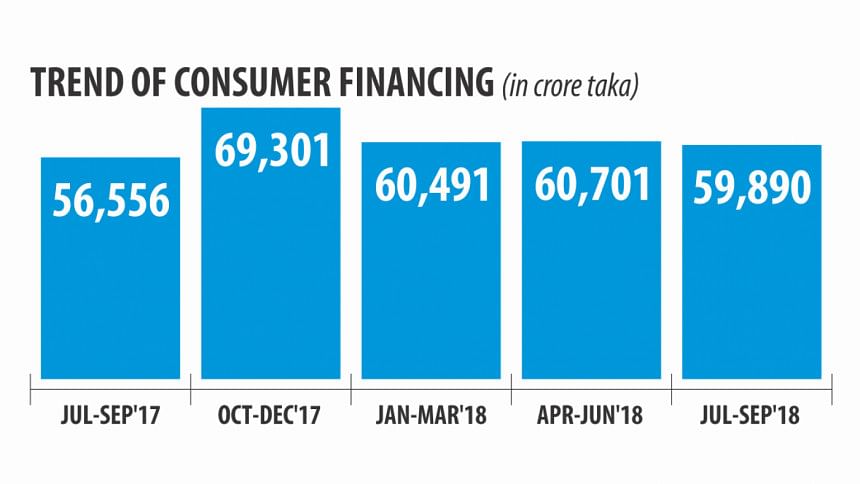

Bangladesh Bank's data also showed that retail banking is slowly but surely growing.

Consumer loans stood for nearly Tk 60,000 crore, or about 8 percent, of total outstanding loans of the banking industry.

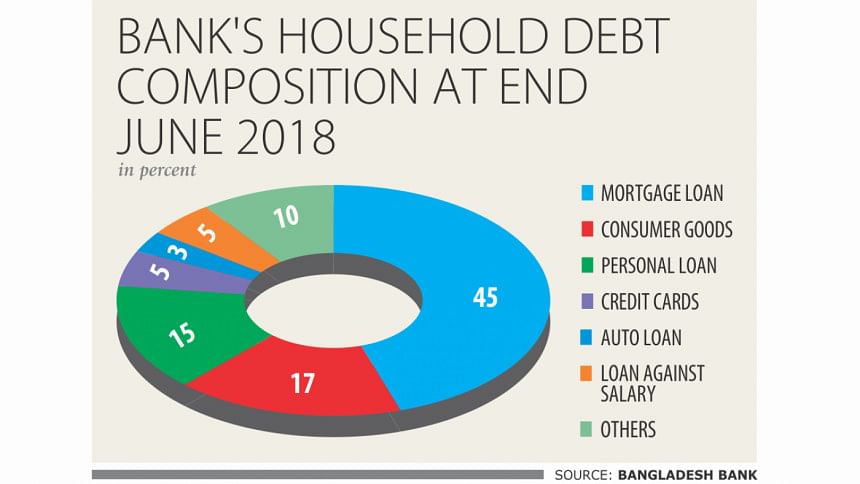

And about half of the amount has gone as housing construction (individuals), flat and land purchase, which is securitised with mortgages, according to bankers.

Digital transformation, steady economic growth, rising purchasing power and huge young population, especially salaried persons, will lead to a vibrant retail banking sector, banking sector experts opined.

Bankers are banking on a booming retail business as household debt in Bangladesh as a percentage of (nominal) GDP stood at 7.6 percent in 2017, which was the lowest in South Asoa as well as in some other Southeast Asian economies.

The ratio was 11 percent in India and nearly 8 percent in Sri Lanka.

Retail banking will also boost the government's revenue income and spearhead the BB's cashless society drive, said Masodul Bari, head of IT of Al-Arafah Islami Bank.

“Since it is a technology-driven service, transactions are recorded and people hardly get the chance to evade taxes,” he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments