Fueling growth: The evolving landscape of SME financing in Bangladesh

Financing to small and medium enterprises (SMEs) is increasing, enabling many firms to access the much-needed capital to expand their businesses and accelerate the growth of the country's economy.

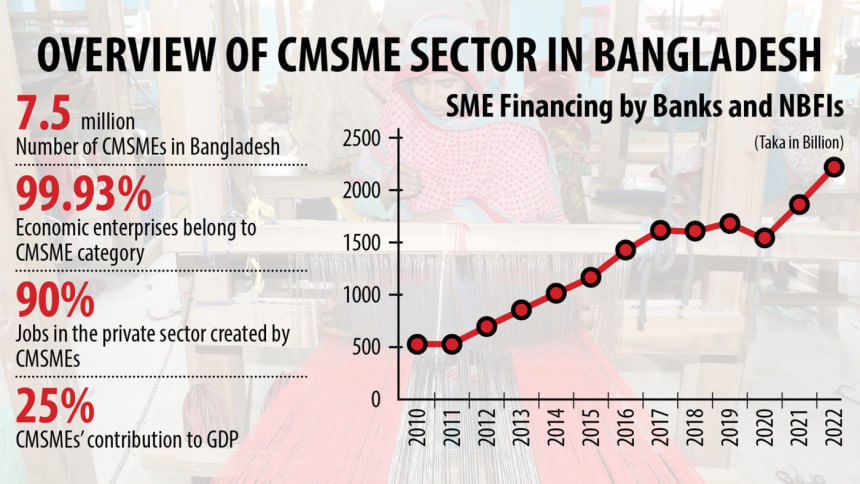

Today, the total financing to SMEs stands at around Tk 220,500 crore, which was Tk 85,323 crore a decade ago, thanks to the central bank's role in ensuring finances for cottage, micro, and SMEs. SMEs roughly contribute one-fourth to the economy and provide 90 percent of the jobs in the private sector.

Currently, all banks and non-bank financial institutions provide loans to SMEs, and several banks have dedicated windows for financing small and medium borrowers, which was not a common practice before.

"There was a time when banks and non-bank financial institutions were unwilling to provide loans to SMEs. The situation has changed significantly now. However, it is still below the expected level," said Suman Chandra Saha, a deputy general manager at the SME Foundation.

In 2013, no one even considered giving collateral-free loans. Now, some banks are offering collateral-free loans to SMEs, he said.

The landscape of SME financing began to change after the Bangladesh Bank (BB), the central bank, intervened and directed lenders to increase their SME financing portfolios by 1 percent every year. Furthermore, there is some relaxation in financing for the SME sector from banks. As a result, there has been positive growth in loan disbursement over the past 10 years, according to a senior official from BB.

The official stated that banks and non-bank financial institutions now show more interest in lending to CMSMEs to diversify their credit portfolios.

"Because when a big businessman defaults on a loan, the financial institution suddenly faces significant trouble. Therefore, many banks are now focusing on the SME sector to diversify their loans," the official added.

Sanjib Kumar Dey, the head of the SME and Agri-banking division at Mutual Trust Bank (MTB), stated that the MTB management has been highly focused on serving CMSME customers.The number of their distribution channels, such as branches, sub-branches, and agent outlets, has been increased. Most of the new channels have been established in rural areas, which are the powerhouse of CMSME business, he said.

"Furthermore, we have introduced a dedicated staff position called 'SME RM' to exclusively serve CMSMEs from all angles. We have developed an SME Hub that works solely to identify and serve quality CMSME clients in various CMSME-dominant areas of our country," he said.

Dey added that MTB has incorporated supply chain finance and collaborated with various fintech companies to reach marginal clients and unserved CMSMEs.

Dey emphasized that digital financing program could be a game-changer in promoting financial inclusion and significantly scaling up micro-merchants in the CMSME sector.

According to Dey, Mutual Trust Bank disbursed loans amounting to Tk 514.33 crore in 2018, which increased to Tk 2,865.30 crores in 2022.

He further mentioned that the recent policy on interest rates will provide the banking sector with more opportunities to focus on the CMSME sector and achieve better interest rate spreads.

The overall situation of SME financing in Bangladesh is improving. However, the contribution of SMEs to GDP remains stagnant at 25 percent, while our neighboring countries have much higher contributions (Sri Lanka: 52 percent, Pakistan: 40 percent, India: 30 percent), said Syed Abdul Momen, the head of SME at BRAC Bank Limited.

The government has taken several steps to improve access to finance for SMEs. These include pushing banks to increase their SME Loan Portfolio to a minimum of 25 percent of their entire loan portfolio, providing refinance facilities to banks and financial institutions at concessional rates, and offering policy support to banks to make SME financing more lucrative, he said.

While the situation for financing SMEs in Bangladesh is improving, there are still a number of challenges that need to be addressed, he added.

He further mentioned that banks should introduce collateral-free lending options, ensure easy access to credit, and establish close interactions with SMEs to overcome the barriers they currently face. Momen informed that in 2018, BRAC Bank disbursed loans worth Tk 81,720 crore, which increased to Tk 122,292 crores in 2022.

Md Shaminoor Rahman, the head of MSME at Bank Asia, stated that Bank Asia has been focusing on financing women entrepreneurs and different CMSE clusters. They have been offering a range of loan products to extend credit facilities and meet the requirements of business entrepreneurs in the cottage, micro, and small segments.

Rahman informed that Bank Asia has implemented a "Cluster Financing Policy" and a fully digitized CMSE cluster-based approach for financing cottage, micro, and small enterprises.

Many CMSMEs face challenges with proper documentation during loan applications. Without the required documents, loan proposals cannot undergo due diligence, making it difficult to approve loans, Rahman explained. He suggests that there could be some relaxation in regulatory prerequisites to support the development of micro and small-level entrepreneurs in Bangladesh.

"Prime Bank focuses on serving small and micro enterprises, with 87 percent of our CMSME portfolio belonging to these segments. We have achieved a strong compound annual growth rate of the CMSME portfolio within a span of the last 6 years," said Ebnul Alam Palash, Head of Small Business in the MSME Banking Division of Prime Bank.

"There are opportunities for us to collaborate closely with relevant bodies to provide seamless financial assistance for the overall sector growth," Palash added.

"Looking at the scenario of loan disbursement in the last ten years, we cannot fully understand the demand for credit in this sector," said Selim Raihan, Professor of Economics at the University of Dhaka.

This is because many entrepreneurs did not receive loans during the government's announced stimulus package during Covid-19, as they lack the required documents, he said.

Therefore, access to finance should be made easier to ensure they do not face problems in obtaining loans when needed, added Raihan.

Khondaker Golam Moazzem, Research Director of the Centre for Policy Dialogue, considered the growth of lending to SMEs a positive development.

"However, if we examine the overall loan structure, it is evident that loans in the SME sector are decreasing. Financing for SMEs is not happening as it should, and much more is required," he said, emphasizing the need for further action.

Moazzem added that 40 percent of SME businesses remain outside the reach of the banking sector's financing.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments