China economic growth slowest in 25 years

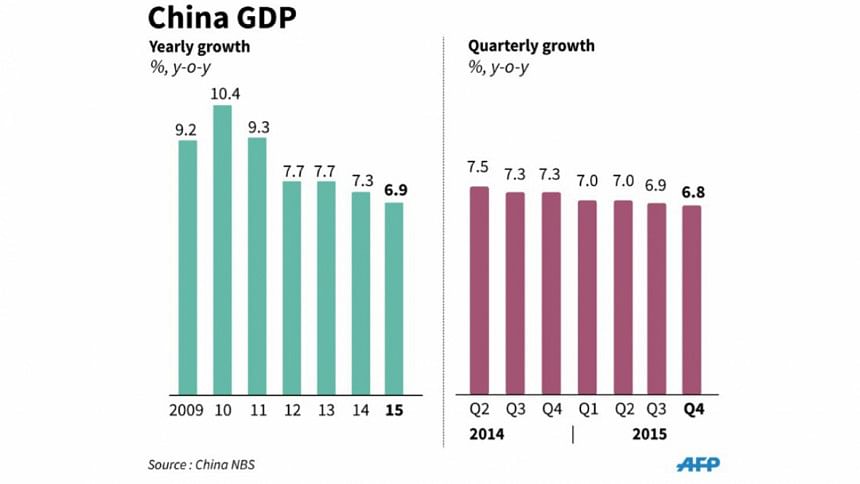

China's economy grew by 6.9% in 2015, compared with 7.3% a year earlier, marking its slowest growth in a quarter of a century.

Beijing had set an official growth target of "about 7%" for the world's second-largest economy.

Premier Li Keqiang has said a slower growth rate would be acceptable as long as enough new jobs were created.

China's growth, seen as a driver of the global economy, is a major concern for investors around the world.

Some observers say its growth is actually much weaker than official data suggests, though Beijing denies numbers are being inflated.

Analysts say any growth below 6.8% would likely fuel calls for further economic stimulus. Economic growth in the final quarter of 2015 edged down to 6.8%, according to the country's national bureau of statistics.

After experiencing rapid growth for more than a decade, China's economy has experienced a painful slowdown in the last two years.

That has prompted the central government to move towards an economy led by consumption and services, rather than one driven by exports and investment.

But managing that transition has been challenging.

"The economy is in the process of stabilisation, but it hasn't stabilised yet," Liao Qun, chief economist at Citic Bank International in Hong Kong, told AFP.

Recent falls on Chinese equity markets have also created panic on global markets about the mainland's economic strength.

Analysis: Karishma Vaswani, Asia Business correspondent

It's said so often that it has become a financial markets cliché - when China sneezes, the rest of the world catches a cold.

The drama of China's stock market crash over the last year has affected investor sentiment and data out today is unlikely to improve matters. But frankly, news that China is slowing down shouldn't come as a surprise.

The government has been broadcasting this for some time now as it attempts to transition from a state-led investment and manufacturing economy to one more dependent on services and consumption. Those two aspects now make up 50.5% of the economy, up from 48.5% in 2014.

But the real concern is just how badly China's economy is likely to do in the future, and whether these figures can be trusted at all.

Critics say China's data is unreliable and that real growth figures may be much weaker. Recent provincial economic data has indicated that growth could be much lower than what the government says it is.

Monthly industrial production (IP) and retail sales numbers for China were also released on Tuesday, and came in worse than expected.

IP numbers - or factory output - expanded 5.9% in December, down from 6% in November. Retail sales grew 11.1%, down from 11.3% in November.

In some brighter news, however, figures released on Monday showed property prices rose 1.6% in December from a year earlier.

The country's housing market accounts for about 15% of the economy and the December numbers mark the third consecutive month of year-on-year gains.

Last week, official numbers showed exports beating expectations in December to rise 2.3% from a year ago in yuan-denominated terms.

Forecasts were predicting a 4.1% fall in exports, but a weakening currency may have boosted the lagging sector.

Imports also beat expectations in yuan-denominated terms to only fall 4%, compared with forecasts of a 7.9% slump.

The jump in exports was the first rise since June last year as the sector has been battered by slowing demand and slumping commodity prices.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments