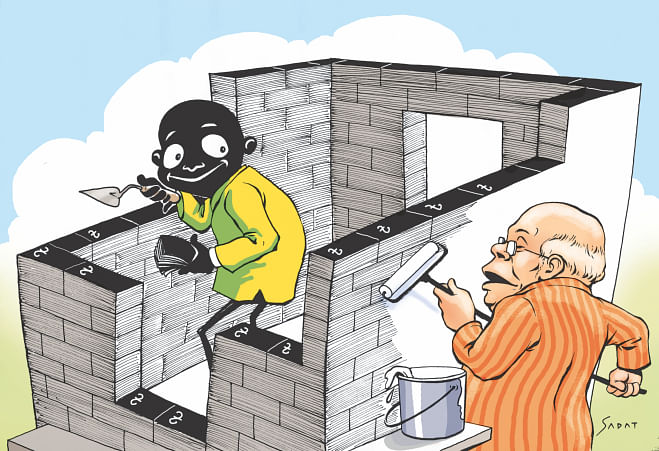

Amnesty to breed more black money

The proposed budget extends the opportunity for individuals to legalise undisclosed money by investing in the real estate sector in the upcoming fiscal year. This raises concerns among economists, who feel the move will breed more black money.

Despite repeated assertions from Finance Minister AMA Muhith against extending the opportunity on different occasions before the budget was placed in parliament yesterday, the provision was kept in place presumably in the face of heightened pressure from the real estate sector.

Black money invested in real estate sector goes blacker as the price of the purchased flats or lands is declared much lower in the papers than the actual in order to evade tax. Consequently, not much revenue is deposited in the exchequer through this opportunity being made available, economists argue.

“The owners of undeclared wealth have found an avenue to safely park their ill-gotten money in the real estate sector through the opportunity, as there is scope to under-report the actual price of a real estate product,” said eminent economist Hossain Zillur Rahman.

In fact, the opportunity has been inconsequential both economically and socially, he said, adding that the finance minister himself had admitted time and again that the opportunity had not yielded the desired results.

It has neither been able to woo any significant revenue into the state exchequer nor change the attitude of black money holders, he said. Rather, it has instead paved the way for mis-governance in the real estate sector, he believes.

Zaid Bakht, research director of Bangladesh Institute of Development Studies, said, “The only difference it makes is that the owners of ill-gotten wealth buy real estate in their own names when immunity is offered. Otherwise they buy properties in the names of relatives.”

Professor Mustafizur Rahman, executive director of the Centre for

Policy Dialogue, said that such a provision, which is politically discriminatory, discourages honest taxpayers and encourages tax evasion.

Md Wahiduzzaman, general secretary of Real Estate and Housing Association of Bangladesh (Rehab), however, defended the move and said the reason for the poor response to the opportunity is that it did not guarantee that the Anti-Corruption Commission or other government agencies would not question the source of the money.

When asked whether he thought that the response would have been better if the illegal income had been welcomed, the Rehab leader said, “Maybe.”

In his defence of such an unethical provision, Wahiduzzaman said governments had historically been in favour of it and the Rehab simply wanted it to continue.

Under the provision, people can legalise their undisclosed money by building or buying homes or apartments through paying taxes between Tk 700 and Tk 7,000 per square metre of floor space, based on the location.

Between July last year and April this year, the National Board of Revenue (NBR) received only Tk 26 crore through this facility.

The history of this controversial privilege provides an even bleaker picture. Between 1972 and 2013, around Tk 13,808 crore was whitened, with the NBR receiving taxes worth Tk 1,455 crore, which is less than 1 percent of the revenue target in the proposed budget for the upcoming fiscal.

At several pre-budget discussions over the past one month, Finance Minister AMA Muhith repeatedly spoke of scrapping the provision relating to a whitening of black money in the new budget.

However, in his budget speech in parliament yesterday, the minister carefully stayed away from touching on the issue. He neither said anything in this regard nor did he propose doing away with the provision in the money bill.

A large part of the black money is believed to be laundered abroad.

Between 2002 and 2011, around $16 billion of illicit capital left the country, according to a December 2013 study by Global Financial Integrity, a US-based non-profit organisation which focuses on curtailing cross-border flow of illegal money.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments