Md Mehedi Hasan

Investigation is my foremost interest

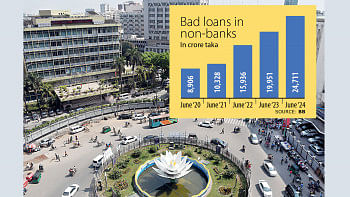

Md Mehedi Hasan, Bangladeshi investigative journalist covering financial crimes especially in banking industry. Currently, working at The Daily Star as senior staff reporter with more than eight years of experience in the field of journalism.