Implementing Budget For 2024-25: It’ll be challenging

Implementation of the new budget will be highly challenging in the current context of the Bangladesh economy, Metropolitan Chamber of Commerce and Industry (MCCI) said in a post-budget reaction yesterday.

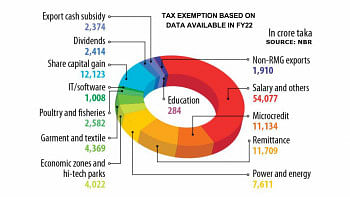

"MCCI has consistently recommended significant structural reforms in tax administration to enhance effective revenue collection. In the present framework, a considerable number of qualified entities with high income remain outside the scope of taxation.

"On the other hand, there is a growing imposition of tax burden on individuals and businesses who fulfill their tax obligations regularly. MCCI strongly emphasises the need for a proper resolution of the matter," said MCCI President Kamran T Rahman.

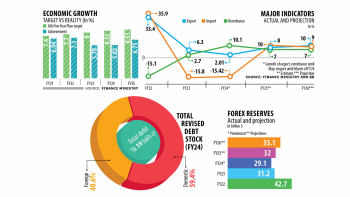

According to him, the final budget deficit is likely to widen because of ongoing tax reform prescribed by the International Monetary Fund (IMF).

Under the IMF loan conditions, the tax-GDP ratio is expected to rise by 0.5 percent to 8.8 percent, potentially increasing the tax burden on taxpayers, he added.

He also expressed concerns over the potential impact of growing inflation on future business expansion.

However, he hailed the government's decision to reduce the corporate tax rate by 2.5 percentage points for unlisted companies and one-person companies.

Meanwhile, the Foreign Investors' Chamber of Commerce and Industry (FICCI) has lauded the government's efforts in crafting a comprehensive fiscal plan in the proposed budget.

The budget will foster a conducive environment for business growth, it said in a press release yesterday.

"With a keen focus on containing inflation, reducing aggregate demand, and nurturing the supply side of the market, this budget lays a strong foundation for stabilising the economy," said FICCI President Mohammad Zaved Akhtar.

He said the budget outlines several measures to control inflation and stabilise the economy, including tightening monetary policy by raising interest rates to 8.5 percent.

The standing lending facility (SLF) and standing deposit facility (SDF) rates have been set at 10 percent and 7 percent, respectively, to curb inflation by reducing money supply and encouraging savings, he added.

Additionally, substantial investments aim to boost agricultural productivity by 20 percent and industrial output by 15 percent through technological advancements and infrastructural improvements, he said.

"This is expected to balance demand and supply, thereby stabilising the economy. The proposal to reduce the corporate tax rate for companies, which are not listed on the stock market, from 27.5 percent to 25 percent, is commendable," he said.

However, Akhtar said the budget lacks allocation or specific directions for the automation of tax, VAT, and customs administration to increase efficiency and simplify the tax collection process.

The absence of such reforms means the complexities related to VAT credit and potential financial strain on businesses will persist, the FICCI president said.

The Institute of Chartered Accountants of Bangladesh (ICAB) welcomed the introduction of prospective rate of tax, reduction of tax rate for private companies and one-person companies and reduction of source tax on daily essentials.

In a statement, the ICAB said despite the Russia-Ukraine war, high inflation, rising commodity prices, dollar crisis, slowdown in business investment and employment, and other global uncertainties, the government has taken a challenge of implementing development budget of Tk 265,000 crore, which is a very encouraging step to move forward to a developing economy.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments