No concrete steps to address inflation, low reserves: CPD

Overall, this is an ordinary budget during an extraordinary time.

The proposed national budget for fiscal 2024-25 lacks concrete measures for addressing the current economic concerns, such as runaway inflation and depleting foreign exchange reserves, the Centre for Policy Dialogue (CPD) said yesterday.

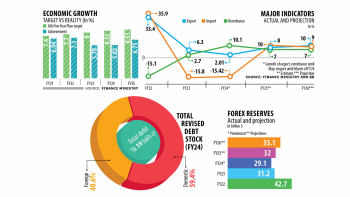

Besides, the government will not be able to reach its projections on reducing the inflation rate and increasing economic growth and investment, the think-tank said.

The CPD made these observations in its analysis of the government's proposed budgetary measures for the upcoming fiscal year at a media briefing at the Bangabandhu International Conference Centre in Dhaka.

Fahmida Khatun, executive director of the CPD, said the government's target of bringing down inflation to 6.5 percent while raising GDP growth to 6.75 percent is overambitious.

"These projections were made without taking into account the current realities. So, many of the budgetary targets will not be achieved," she added.

More importantly, due to the government's inability to acknowledge the nature of the ongoing economic challenges, the proposed budgetary measures are weak and inadequate, Fahmida said.

"Overall, this is an ordinary budget during an extraordinary time," she said.

Against this backdrop, she highlighted the skyrocketing prices of essentials, continuous devaluation of the taka, stagnant private investment, slowdown in economic growth, massive erosion of forex reserves, heavy government borrowing from the banking sector and escalating non-performing loans as the key macroeconomic challenges.

The government is aiming for a gross domestic product (GDP) growth of 6.75 percent in fiscal 2024-25, which is much higher than the provisional estimate of 5.8 percent for the current fiscal year.

In order to achieve this growth, the government has targeted to increase the private investment-to-GDP ratio to 27.3 percent in fiscal 2024-25 from 23.5 percent in fiscal 2023-24.

Raising the ratio will require additional private investment of Tk 343,544 crore, which is almost impossible to attain given the existing contractionary monetary policy.

Fahmida also said it remains unclear how the government will achieve its goals to strengthen the local currency to Tk 114 per US dollar and boost the country's forex reserve to $32 billion. With the exchange rates now almost fully market-driven, each US dollar currently costs Tk 117.9.

Prof Mustafizur Rahman, a distinguished fellow of the CPD, said the tax-free income slab should have been raised as people's purchasing power has been squeezed by higher inflation for the past two years.

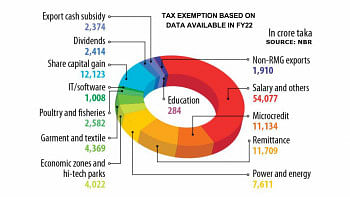

The budget plans go against the spirit of the election manifesto of the ruling Awami League, which said it would show zero tolerance against loan defaulters and tax evaders, he said.

However, the government in the proposed budget has allowed people to legalise their undisclosed income by paying a small amount of tax.

"This is something that is discouraging honest taxpayers. It's a very sad step, which is not acceptable legally or morally," Rahman said.

He added that the CPD believes the policy will have little effect as the syndicate of black money holders does not even want to pay the proposed 15 percent tax.

Khondaker Golam Moazzem, research director of the CPD, said the private sector is facing a tough situation due to a drop in credit flow amid the contractionary monetary policy, but the government has not brought down its own spending.

"When will we see the government cut its spending?" he questioned.

The government aims to raise more funds through value-added tax and hike electricity prices four times a year, which will ultimately fuel inflation further, Moazzem added.

Though the government has reduced source tax on some essential items, he expressed doubt whether consumers would be able to reap the benefits.

"The benefit will go to the businessmen who control the supply of the goods. So, it will not contribute to a decline in prices," he said.

Without correcting the supply system and market management, the price level will not come down, Moazzem added.

Towfiqul Islam Khan, senior research fellow of the CPD, also spoke at the event.

WHITENING BLACK MONEY

The scope for whitening black money is a very sad step, which is not acceptable legally and morally.

There has been a demand from the business community and the public for the legalisation of undeclared money.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments