AB Bank’s health shows no signs of improvement

Once a reputable private commercial lender, AB Bank's financial health is now deteriorating gradually due to boardroom mismanagement, loan irregularities, illegal facilities availed by its sponsors and inaccurate measures by the central bank.

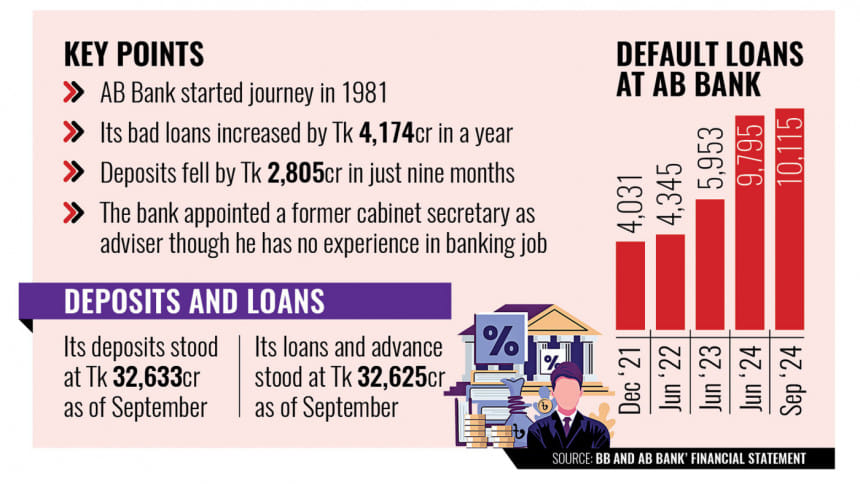

Established in 1981, the country's first commercial private bank sat on a massive Tk 10,115 crore toxic loans till September this year. This amount represents 31 percent of the bank's total Tk 32,625 crore in disbursed loans, according to official data.

The volume of bad loans at the private commercial bank doubled in the past year till September 2024. At the end of September 2023, the bank's defaulted loan portfolio stood at Tk 5,941 crore.

To keep provisions of around Tk 8,041 crore against its bad loans, AB Bank is now enjoying a deferred facility from the central bank.

If the regulatory facility is withdrawn and AB Bank makes provisions against its bad debts, the bank will face a huge loss, according to officials at the commercial lender who spoke to The Daily Star on condition of anonymity.

Apart from the burden of default loans, AB Bank, formerly known as Arab Bangladesh Bank, is now facing liquidity stress as its deposits have fallen drastically in recent months.

Till September this year, the bank's deposits totalled around Tk 32,633 crore, down from Tk 35,438 crore at the end of December last year, according to AB Bank's financial statement.

On the basis of risk analysis, the Bangladesh Bank last year placed the bank in the red category. Subsequently, it was decided to merge the bank with a sound market peer -- altogether triggering panic withdrawals.

The unexpected cash withdrawals dealt a further blow to the already troubled AB Bank, according to banking insiders.

AB Bank's troubles began to surface at least eight years ago when it faced criticism for a 2016 money laundering incident flagged by the central bank.

A Bangladesh Bank inspection found that the bank laundered nearly Tk 165 crore ($20 million) to the United Arab Emirates through two shady organisations under the guise of investment.

M Morshed Khan, a former cabinet member of the BNP government, was one of the sponsors of the bank. The bank was under the control of Khan and his family members for a long time, industry insiders said.

During the money laundering criticism, M Wahidul Haque was the chairman of the commercial lender.

In 2017, Haque, along with vice-chairman Salim Ahmed and director Faheemul Huq, resigned from the bank's board of directors.

That year, the Bangladesh Bank appointed an observer to monitor the bank's health closely. The bank still has a central bank coordinator, despite its health showing no significant improvement.

Industry insiders said that loans approved earlier through irregular means have become defaulted in recent years. Besides, lacklustre loan recovery efforts from the top borrowers and mismanagement by the current leadership are also responsible for the bank's ailing health.

The bank is struggling to recover loans from Beximco Group, Sikder Group, Asian City, Buildtrade Group and Mahin Group, they added.

AB Bank provided a guarantee to a non-bank financial institution Phoenix Finance on behalf of two companies -- Mahin Group and Buildtrade -- totaling around Tk 179 crore, but AB is now struggling to recover the amount from them.

If the recovery of large loans had been prioritised earlier under qualified leadership, the lender's financial health could have been saved, according to AB Bank officials.

But that did not happen, as inaccurate countermeasures hampered recovery efforts.

For instance, the bank appointed former cabinet secretary Kabir Bin Anwar as an adviser to the board of directors to meet parameters under the Prompt Corrective Action (PCA) framework, according to bank documents, despite the bureaucrat having no banking experience.

The Bangladesh Bank introduced the PCA framework in 2023 to help stabilise commercial banks and restore confidence in the financial system.

This was an example of the extent of mismanagement at the bank, as the bank even got the implementation of corrective measures flawed, industry sources said.

In 2019, Tarique Afzal was appointed the president and managing director of the bank. Afzal previously served the bank as deputy managing director.

Contacted, he told The Daily Star that no new loans have defaulted, but loans disbursed between 2010 and 2017 have now become defaulted. "We have not disbursed any large loans for a long time."

Defaulted loans increased because interest is added to the existing default loan amounts, he added. "Loans to Asian City and Buildtrade are all legacy issues," said the AB Bank MD.

Regarding the guarantee to Phoenix Finance, he said the guarantee was issued before his tenure and that loans to Mahin Group and Buildtrade were given in 2010.

Regarding the appointment of Kabir Bin Anwar, he said there had been a proposal for his appointment, but the bank did not appoint him as an advisor.

He said that the bank is now in a tight liquidity situation but it is able to manage the situation. "We faced a massive deposit withdrawal pressure when our bank was enlisted in the red category by the central bank. But the list itself was faulty," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments