Banks’ lending slows for liquidity crunch

The banking sector's lending growth squeezed in the April to June quarter owing to a shortage of liquidity at most banks and their unwillingness to extend credits to borrowers already struggling to pay back, official figures showed.

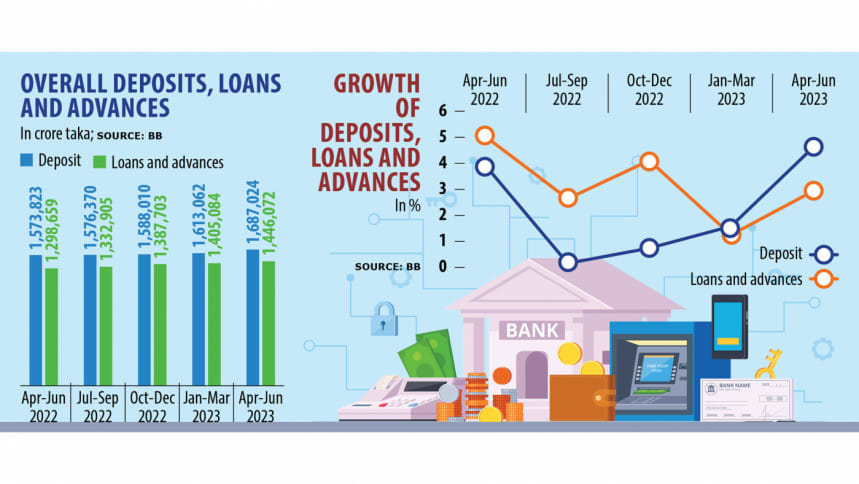

The lending of scheduled banks grew 2.92 percent to Tk 14,46,072 crore in the second quarter compared to the first quarter, according to the data of the central bank.

In April-June of 2022, the lending rose 5 percent to Tk 12,98,659 crore.

"The business in the banking sector squeezed due mainly to a higher inflation rate and a pressure on the macro-economic indicators stemming from the Russia-Ukraine war," said Syed Mahbubur Rahman, a former chairman of the Association of Bankers, Bangladesh.

"So, the loan growth declined."

He said since many entrepreneurs could not make letter of credit payments, banks have been forced to turn them into forced loans, pushing up the volume of credits in the second quarter.

The lending growth, however, almost doubled compared to the January to March quarter, when it stood at 1.25 percent.

"This is mainly because of the forced loans," Rahman said.

The noted banker said banks are not willing to lend under the current circumstances and this is evidenced from their lower-than-usual lending to SMEs and the agricultural sector.

Sector-wise, the bulk of the loans and advances went to the trading segment at the end of the second quarter, which accounted for 33.84 percent of the total credits. Working capital financing made up 19.68 percent of loans and term loans represented 20.32 percent.

The lending to the agriculture sector rose 3.37 percent, way lower than 7.41 percent in April-June of 2022, BB data showed.

A top official of a bank said banks are facing a liquidity shortage, so they are careful when it comes to lending.

"Moreover, the interest rate spread fell, so banks prefer to invest in other securities."

Deposits at scheduled banks increased 4.59 percent to Tk 16,87,024 crore in April-June riding on higher savings by urban people.

The weighted average interest rate on deposits rose to 5.03 percent in the second quarter from 4.37 percent three months earlier. The lending rate ticked up to 7.34 percent from 7.29 percent.

This means the overall spread – the gap between the interest rate charged by banks on loans and the interest rate paid by lenders for deposits – dropped to 2.31 percent from 2.92 percent, according to central bank figures.

In June, the surplus liquidity in the banking sector stood at Tk 1,66,200 crore, down from Tk 2,03,435 crore a year ago.

Of the surplus liquidity, Tk 63,600 crore were with state-run banks, Tk 68,300 crore were held by private commercial banks, and the rest of Tk 34,300 crore belonged to foreign banks.

The senior banker said political tension is mounting centring the upcoming election, so banks are cautious in disbursing loans.

A banker in Chattogram says in the past, banks even gave out loans by taking risks. "That tendency is no longer there as borrowers are now more prone to defaulting on repayments."

The loan growth was the lowest at Islamic banks at 2.18 percent. It was 2.92 percent for private banks, 2.5 percent for state-run banks, 3.22 percent for foreign banks and 5.75 percent for specialised state-run banks.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments