BB goes shopping to private banks for dollar

Bangladesh Bank is hunting for dollars to rebuild its depleting foreign exchange reserves ahead of the January 7 national election.

As part of the move, the banking regulator has approached private commercial banks, most of whom are in short supply of the greenback and have been struggling to settle letters of credit, The Daily Star has learnt from bank executives who spoke on the condition of anonymity.

Finally, the BB was able to buy $70 million on Monday and Tuesday from Islami Bank, which is facing a shortage of both taka and dollar.

BB Spokesperson Md Mezbaul Haque acknowledged the dollar purchase from Islami Bank: $50 million was bought on Monday and $20 million on Tuesday at the interbank exchange rate of Tk 110.5 per dollar.

"We will buy more dollars from commercial banks if they are sitting on excess and this type of transaction is normal. We need to raise our foreign exchange reserves," Haque added.

Islami Bank sold $70 million to the central bank at a time when it is struggling to settle LCs for its importers, according to people familiar with the events, who spoke on the condition of anonymity.

Between November 1 and 24, Islami Bank received $280 million as remittance.

The Shariah-based bank, which often fails to maintain the minimum level of liquidity with the central bank, collected remittances at about Tk 116 a dollar.

That is the maximum permissible rate by the Bangladesh Foreign Exchange Dealers Association and the Association of Bankers, Bankers -- the two associations that decide on the dollar rate on unofficial directive from the BB.

Subsequently, the bank faced a loss of Tk 38.5 crore on the sale of dollars at Tk 110.5 to the BB -- a hefty blow for a cash-strapped bank, which has the highest volume of credit disbursed among the 61 scheduled banks in Bangladesh.

Mohammed Monirul Moula, the managing director and chief executive officer of Islami Bank, could not be reached for comment.

The BB has started to buy dollars from commercial banks in an attempt to stem the tide of depleting foreign exchange reserves, said BB officials.

"People will get a negative message before the national election if the forex reserve falls so fast," said one of the officials seeking anonymity.

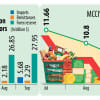

As of November, gross foreign reserves stood at $19.5 billion, down about 15.7 percent over the past three months. The dollar stockpile is sufficient to cover import bills of a little over three months, as per the latest data published by the BB.

Talking to this newspaper, Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said dollar purchase from commercial banks is part of reserve building and this is not a bad practice per se.

"But the question is why Islami Bank sold $70 million to BB at Tk 110.5 per dollar when they collect remittance at the BAFEDA-ABB permitted rate of Tk 116 per dollar. This is a problem of multiple exchange rates in existence," he added.

Although the BB is trying to buy dollars from banks, it has not slowed down on its greenback sales to the market after the record $13.6 billion sales last fiscal year.

Between July 1 and November 28, the BB sold upwards of $5 billion to banks, as per the central bank officials. On every working day, the BB sells about $60 million to banks from its reserve, they said.

The dollar sales are mostly to the state banks to settle import payments of government agencies like the Bangladesh Petroleum Corporation, the Bangladesh Agricultural Development Corporation and the Bangladesh Chemical Industries Corporation, among others.

For instance, Sonali Bank last week made a payment request of $240 million to the central bank, as per the BB officials.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments