Inflationary pains for common people to persist

Like in the outgoing financial year, the common people in Bangladesh will continue to suffer from higher consumer prices in 2023-24 as the factors behind the elevated level of inflation are unlikely to change dramatically.

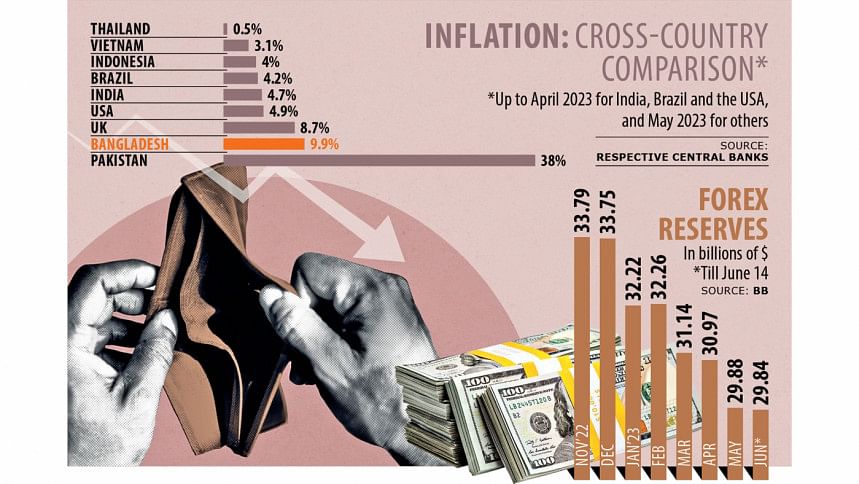

Inflation rates around the world have declined from their recent peaks in line with the fall in global commodity prices. But Bangladesh has not benefited from the development. Rather, inflation in the country shows no sign of slowing down.

Under such a bleak scenario, the central bank on Sunday unveiled its monetary policy for the first half of 2023-24 with a view to reining in inflation and giving a boost to the foreign currency reserve level.

The BB has set an inflation target of 6 per cent for FY24. But the point-to-point inflation rate surged to 9.94 per cent in May, compared to 7.42 per cent in the same month last year.

The average headline inflation stood at 8.84 per cent last month, surpassing the government's revised target ceiling of 7.50 per cent set for June 2023.

And the central bank itself thinks that achieving the 6 per cent target in FY24 may prove to be challenging.

"The rigid nature of internal price adjustment, combined with a significant depreciation of the domestic currency, could impede the downward adjustment of domestic inflation, despite the recent decline in international market prices," it said on Sunday.

"Consequently, uncertainties may persist in the inflation outlook during the first half of FY24. The inflationary pressure experienced in FY23 may also contribute to elevated inflation expectations throughout FY24."

The central bank also acknowledged the lack of a competitive environment, along with market syndication for the current level of inflation.

Other factors pushing the inflation to at least a decade high include cheap funds made available through the 9 per cent interest rate cap for the past three years.

In an encouraging move, the central bank has removed the ceiling and raised the policy rates for the sixth time in the past one year. The ceiling has rendered the multiple hikes in policy rates ineffective so far.

The BB thinks the hike in the policy rate and the withdrawal of the cap is expected to elevate the borrowing costs for financial institutions, which will subsequently influence interest rates across the economy. This adjustment will make it more expensive for businesses and individuals to access funds for investments and consumption.

This shift intends to curtail excessive monetary expansion, thereby aiding inflation control.

In another major development, the central bank has decided to adopt a unified and market-driven single exchange rate regime, allowing the exchange rate to be determined by market forces. If a uniform exchange rate could be implemented, there might be some improvement in the reserve scenario.

A multiple exchange rate regime with separate rates for exporters, remitters and importers has been blamed for the erosion of the reserve.

A wide gap in formal and informal exchange rates has been one of the factors behind the sharp fall in the foreign exchange reserves as it shifts remittances from official channels to unofficial routes and impedes repatriation of export proceeds, said the World Bank recently.

In Bangladesh, a one-per cent deviation between the formal and informal exchange rate shifts 3.6 per cent of remittances from the formal to the informal financial sector, it said.

Because of the gap between the exchange rates for imports and remittances, importers have incentives to over-invoice imports to buy more US dollars from banks and send the profits back as remittances. This rate arbitrage leads to a further decline in US dollar liquidity in banks and parallel exchange rates discouraged the inflow of foreign currencies, said the WB.

The BB projects that the reserve would rise to $31.5 billion in 2023-24 from about $30 billion currently. It was much lower than the $41.44 billion seen in June last year.

Global ratings agency Moody's has already said gross foreign exchange reserves to remain below $30 billion for the next two to three years.

A 29 per cent fall in the reserve level in the past one year, led by higher-than-usual imports and a spike in the global commodity prices, has forced the government to limit procurements from the external source, which contributed to the tightening of supplies and thus acceleration of the prices in the local market.

The government may need to maintain its import control measures until the reserve level goes up, meaning lingering struggles for businesses and industries looking to open letters of credit to import inputs, raw materials and equipment.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said: "Inflation will only come down to the targeted level if the central bank allows the interest rate to go up to the required level."

"Nobody knows how much the interest rate should increase. The contractionary monetary policy has to be implemented effectively."

He said the inflation rate has been allowed to go up. "So, a strong dose of medicine will have to be applied because the disease is serious. But the money supply will not be tightened if the interest rate is allowed to increase by a merely 1 to 2 percentage points from the current level."

The former official of the IMF pointed out that the 43 per cent growth target in government borrowing in July-December of FY24 contradicts the goal on inflation.

"A higher borrowing from the central bank as seen in recent years will stoke inflationary pressures. Then it does not remain a contractionary monetary policy. The borrowing from the central bank by the government will have to be minimal."

Under the new method, the central bank would initially set a monthly reference rate based on the weighted average rate to be calculated on the basis of the interest rates of the six-month short-term treasury bill.

The central bank controls the interest rates of T-bills and T-bonds. Since the central bank offers lower rates during the auctions of government securities, commercial banks do not get the opportunity to buy them.

"It seems that the interest rate will not be market-based," said Selim Raihan, executive director of the South Asian Network on Economic Modeling.

"If that is the case, then it will not help narrow the money supply and rein in inflation."

He urged the government to set up a coordination cell on inflation, if necessary, in order to step up monitoring and remove market imperfections.

Mansur called for ensuring a market-based exchange and interest rates as well as bringing the financial account of the balance of payments into positive territory by activating the line of credits from external financial institutions in a bid to reverse the downward trend of the forex reserve.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments