Auditors, rating agencies fail to forecast banking woes

Banks have several layers of professionals to regularly assess their financial health and raise early warnings at the first sign of trouble.

But following the political changeover in August last year, which exposed widespread corruption and the fragile state of many banks, scrutiny has turned on the very people tasked with sounding the alarm.

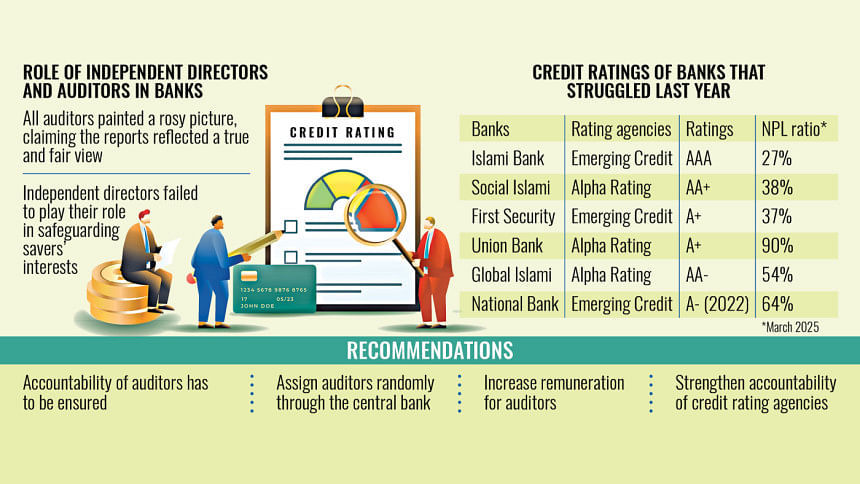

Now fingers are pointed at professionals responsible for detecting irregularities, ranging from independent directors and external auditors to credit rating agencies, for helping conceal bad loans, irregularities, and mismanagement for years.

As the cosmetic gloss begins to wear off, these so-called flag raisers are trading blame. Many now concede it was "a collective failure", rooted in a broader weakness of regulatory oversight.

At an event last week, Bangladesh Bank Governor Ahsan H Mansur said the balance sheets of most banks were "fictitious", built on "cooked-up" data. "If I judge the audit firms based on their reports, there will be no auditors left qualified for the job."

One such example of the audit blunders is First Security Islami Bank, which failed to pay depositors last year due to a severe cash crisis. Yet, over the past decade, the bank received a long-term credit rating of "A+" and a short-term rating of "ST-2".

According to the bank's own website, an "A+" rating reflects strong capacity to meet financial obligations, while the "ST-2" short-term rating means superior performance.

These ratings were issued by Emerging Credit Rating Ltd.

Despite the bank's worsening financial condition, its auditors, Shafiq Basak & Co and Rahman Mostafa Alam & Co, reported no issues in 2023. They said the consolidated balance sheet of the lender gave a "true and fair view".

But when the bank's crisis surfaced the following year, the same auditors issued a qualified, or "not clean", opinion for 2024, citing a Tk 49,000 crore provision shortfall.

Efforts to contact both audit firms were unsuccessful. Calls went unanswered, and emails sent about the bank's audit drew no response.

Jamaluddin Ahmed, chairman of Emerging Credit Rating Ltd, distanced himself from the ratings, referring inquiries to the company's management. Executive Chairman NKA Mobin also declined to comment specifically on the First Security Islami Bank case.

RATINGS INFLATED, RISKS BURIED

Auditors are required to verify a bank's financial statements, while credit rating agencies base their assessments largely on those audit reports. In theory, these two checks should paint a clear picture of a bank's health.

In practice, though, the same troubling pattern seen in the First Security case has played out across other banks, including National Bank, Social Islami Bank, Islami Bank, Union Bank, and Global Islami Bank.

For years, these lenders were given glowing audit reports and high ratings, even as they accumulated mountains of bad loans—problems only brought to light following last year's political changeover.

Islami Bank, the country's largest Shariah-based lender, made headlines for massive lending irregularities, funnelling money to shell companies tied to the controversial S Alam Group.

Yet, neither audit reports nor credit ratings reflected the scale of the problem.

In fact, Islami Bank received the highest possible rating "AAA" from its credit agency, despite evidence of severe internal weaknesses.

Emerging Credit Rating Ltd also handled the ratings for Islami Bank and National Bank. Union Bank received an "A+" rating from Alpha Rating, while Global Islami Bank was given "AA-" and Social Islami Bank "AA+".

All three of those banks struggled to return funds to depositors after the fall of the Awami League government.

Attempts to reach Alpha Rating by phone failed. An email sent on July 16 went unanswered as of yesterday.

Khan Wahab Shafique Rahman & Co, which audited Islami Bank and Social Islami Bank in 2023, issued clean reports declaring the banks' financial positions "true and fair".

When asked about their failure to raise concerns, Mohammad Shaheed, senior partner at the firm, said the loans appeared regular during the audit period and only became classified later.

"We do not audit day-to-day activities. Banks are responsible for proper reporting," he said. Admitting auditors have limitations, he said, "An auditor alone cannot raise alarms without systemic support."

NOT SO INDEPENDENT

Independent directors are supposed to represent the interests of depositors and general clients. They have access to internal information and play a key role in ensuring that boards uphold integrity. In case of wrongdoing, they are expected to report it to the Bangladesh Bank.

If they cannot fulfil that duty, resignation could serve as a form of protest. Yet many now say they were under pressure to follow board directives.

Regarding the failure of independent auditors, The Daily Star contacted Jamaluddin Ahmed, chairman of Janata Bank and also an independent director.

Janata was once one of the most reputed lenders in Bangladesh, but its financial health started to slide downhill thanks to a series of loan scams involving AnonTex and Crescent Group.

Asked about his role under the previous government, he said, "We sent many objections to the central bank, but the regulator did not take action."

When asked to name one, he replied he could not remember any.

For listed banks, the Bangladesh Securities and Exchange Commission (BSEC) is tasked with reviewing financial reports. That layer of oversight has also been found wanting.

BSEC spokesperson Abul Kalam told The Daily Star that the commission's regulatory scope exceeds its current capacity.

However, he said some matters have already been referred to the Financial Reporting Council (FRC), which regulates audit firms, and some independent directors have been replaced.

ACCOUNTABILITY MUST NOT STAY MISSING

NKA Mobin, president of the Institute of Chartered Accountants of Bangladesh (ICAB), described auditors as the "fourth line of defence" in risk management.

He said auditors follow international standards, which rely on professional judgement and sample-based assessments rather than comprehensive checks.

Issues flagged during audits are generally resolved following Bangladesh Bank regulations.

Loan loss provisions, for instance, are usually determined through tripartite meetings between banks, auditors, and the central bank, and are often based more on regulatory guidelines than on IFRS 9 standards.

Mobin said during the tenure of the previous government, asset valuations were done according to regulatory instructions, not international benchmarks. "Now, under the current government, auditors can work more independently and follow international best practices," he said.

ICAB oversees audit firms, reviewing their work and imposing penalties when necessary. Disciplinary actions may include warnings, suspensions, or removal from membership.

Toufic Ahmad Choudhury, director general of the Bangladesh Academy for Securities Markets and former DG of the Bangladesh Institute of Bank Management (BIBM), stressed the need for accountability.

"The government must ensure the accountability of flag raisers. Otherwise, people will not receive fair judgment despite paying fees for auditing and ratings."

He added that in developed countries, investors and savers rely on audit and rating reports to make financial decisions. Until proper oversight is ensured, these services will fall short of their intended purpose.

Choudhury also called for better pay for auditing and rating firms. "Right now, firms are conducting audits and ratings at very low cost just to meet regulatory requirements," he said.

Md Sajjad Hossain Bhuiyan, chairman of the FRC, said the council and Bangladesh Bank are each investigating the role of auditors in troubled banks.

He expects the probe to conclude within a month, after which action will be taken.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments