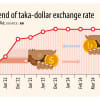

Banks devalue taka further

Bankers in Bangladesh yesterday decided to further devalue taka against the US dollar to increase the flow of foreign currencies through formal channels, according to a top official of a private bank.

As per the decision, banks will pay exporters Tk 110.50 per greenback and sell it to importers for Tk 111, up by about Tk 0.50 from the rates set by bankers at the end of September.

The decision came at a meeting of the Bangladesh Foreign Exchange Dealers' Association (Bafeda) and Association of Bankers, Bangladesh (ABB).

The development comes as the local currency remains under pressure in face of the country's falling forex reserves as exports and remittance have fallen below the requirement for import bills and other international payments.

Bangladesh's foreign exchange reserves decreased by $60 million in a week to hit $20.89 billion on October 25, according to Bangladesh Bank data.

Besides, the reserve has halved in a span of two years as it was around $40.7 billion in August 2021 and $33.4 billion by the end of June 2022, according to a document of the International Monetary Fund.

The Bafeda and ABB also decided that banks will have to sell 10 percent of their previous month's remittance earnings in the interbank market, where the rate will be Tk 114 per US dollar.

Meanwhile, the credit card settlement and student banking rates will be as per the cash selling rate.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said this is a good decision as it will boost the flow of US dollars in the banking sector.

On October 21, the Bafeda and ABB decided to provide asmuch as 2.50 percent as an additional incentive apart from the government's existing cash support for collecting remittance through formal channels.

The volatility in the global market driven by the Russia-Ukraine war has sent commodity prices higher, hitting the forex reserves of import-dependent countries such as Bangladesh, experts previously said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments