Five ways the dollar crisis impacts RMG makers in Bangladesh

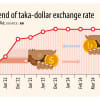

Bangladesh has a currency crisis. More pertinently, it has a US dollar crisis. In recent months, the Bangladeshi taka has plummeted to new depths against the US dollar amid a worsening foreign exchange reserve crisis. The taka has fallen 10 percent against the US dollar over the past year. In fact, it sank to a record low this month.

For context, in the beginning of 2022, the dollar-taka exchange rate stood at 84.74 (USD 1=Tk 84.74); in March, it rose to 86.00. By May, it hit 87.00, and by the end of June, it hit 93.00. At the time of writing this article, the rate stands at 95.00, and the direction is only going one way. Some economists believe the rate could touch 100.00 within 12 months.

Why is the taka weakening against the US dollar, and what impact is this having on the ready-made garment (RMG) makers in Bangladesh? That is because the economic growth in Bangladesh has lost its pace – just like the rest of the world, thanks to Covid. The economy here is threatened by the slowing global demand amid a crisis of cost of living in our main garment export markets – the US and EU. Many buyers have cancelled orders in recent months; this is a problem for a country like Bangladesh, which is so heavily dependent on garment exports.

Financial markets are also spooked that Bangladesh recently approached the International Monetary Fund (IMF) for a loan to support the economy. Negotiations are in progress, but it is well-known in financial circles that when a country approaches the IMF, it is very much a last resort. This is not a good look for Bangladesh.

In terms of how the dollar crisis will impact garment makers, I foresee five possible impacts, some of which we are already seeing.

The first is increased earnings – in theory. But how does that work? With earnings from the garment sector being denominated in dollars, an increase in the value of the dollar in theory could help our economy in the short term. Also, consider that many countries use a depreciation of their currency competitively. A lower value of taka against the US dollar makes RMG products from Bangladesh cheaper for US buyers and, all other things being equal, could increase demand (or at least negate some of the downward headwinds we have been seeing of late).

That being said, the potential benefits of competitive depreciation have to be offset against a range of other factors, which are largely negative.

This brings us to the second point, which is rising costs. With payments made by RMG makers being in dollars, the weakening of taka means the cost of purchasing raw materials and other US-dollar-denominated resources are increasing. A decrease in the taka's value against the dollar of five percent means an effective increase in the cost of sourcing dollar-denominated goods or services by five percent. This kind of cost increase is simply not sustainable over the long term.

This increase in costs is, of course, being compounded by the fact that costs for the RMG makers are already on the rise regardless of the dollar crisis. For instance, we are seeing huge increases in the cost of energy, raw materials (such as cotton earlier this year) and a range of other goods and services. The dollar crisis in many ways is fuelling an already challenging inflationary environment in Bangladesh. These things are all inter-linked. The global economy is in a state of flux right now and this chaos is more than likely one of the contributors to the dollar crisis we are seeing, the dollar seen by many investors as a 'flight to safety' in uncertain times.

Third, we could see a further shift towards larger manufacturers that are better placed to navigate a currency crisis. Currency is a complex issue, and larger players are better placed to pay expert consultants to hedge against fluctuating currencies via forward contracts and other hedging instruments.

Meanwhile, smaller companies may find themselves hit particularly hard. There are plenty of examples of profit margins on a particular order being completely wiped out by a shift in currency values. If a smaller player is dependent on a few large orders, these currency swings can leave them greatly exposed to potentially fatal risks.

The fourth way I see the dollar crisis impacting RMG makers is via inflation. In normal circumstances, a depreciation in the exchange rate would lead to inflationary pressures in a domestic economy. The growing cost of imports increases demand for domestic products, and this can potentially place upward pressure on local prices. That said, I see this as only having an indirect impact on RMG workers.

Fifth, growing volatility and uncertainty are significant as far as impacts on the country's RMG sector is concerned. Ask any garment maker about their biggest bugbear – most will say uncertainty. A highly valued dollar is one thing if it is set in stone. The challenge is that we have no idea where the dollar might lie versus the taka from one month to the next.

This issue needs addressing sooner rather than later for garment makers and, indeed, for the wider Bangladeshi economy.

Mostafiz Uddin is the managing director of Denim Expert Limited. He is also the founder and CEO of Bangladesh Denim Expo and Bangladesh Apparel Exchange (BAE).

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments