Exporters cheer weaker taka

In a historic move, the central bank of Bangladesh has depreciated the local currency against the US dollar mainly to make the country more competitive in international trade, a move that exporters and businesses welcomed.

In fact, the taka has been losing ground over the past three years, both during and after the Covid-19 pandemic, as Bangladesh's banking system struggled to supply dollars as per surging demand.

Owing to a chaotic and volatile exchange rate, local exporters were desperate for the introduction of a floating exchange rate so they could draw more money and be more competitive.

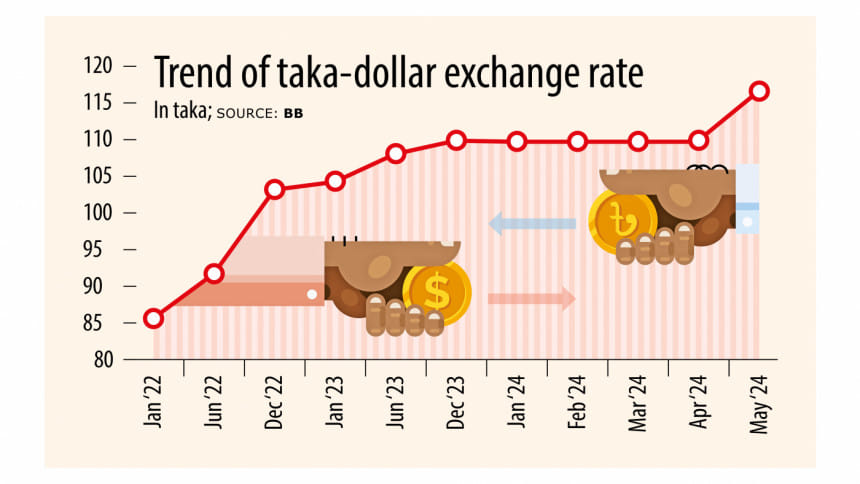

The taka stayed firm at Tk 85 per dollar for over a decade, but started weakening amid increasing pressure on the foreign exchange reserves.

The local currency depreciated 28 percent, to Tk 110 per dollar, between January 2022 and April 2024. In informal curb markets, the rate even crossed Tk 120 per dollar

Following the latest depreciation through the crawling peg, which was introduced for the first time in the history of Bangladesh, the taka lost 6.36 percent of its value, falling to Tk 117 per dollar.

Including yesterday's depreciation, the taka has lost 36 percent of its value against the greenback since January 2022.

However, exporters welcomed the decision to introduce the crawling peg, which saw the exchange rate hiked to Tk 117 per dollar from Tk 110, as it will make them more competitive.

It will provide a boost as the government has already reduced incentives on export receipts as the country is going to graduate from least developed country status in 2026.

Under the rules of the World Trade Organisation, developing and developed countries cannot directly provide subsidies on export receipts. But the government can offer benefits indirectly, such as by hiking the exchange rate, providing policy support or offering technological upgradation or skill development funds to make export-oriented sectors more competitive.

"It was necessary for us as the cost of doing business rose significantly due to increasing gas and power tariffs. The government also reduced the cash incentive on export receipts," said SM Mannan Kochi, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

A suffocating situation was created for garment exporters because of the higher cost of doing business and the latest move by the central bank will provide some relief, Kochi said.

But exporters will have to keep in mind that they must negotiate higher prices from international retailers and brands so they are not deprived of the benefits provided by such a decision, the BGMEA chief also said.

Ashraf Ahmed, president of the Dhaka Chamber of Commerce and Industry (DCCI), said it was a proper step towards a market-based exchange rate.

"We expect this move to ease the balance of payment pressure despite its impact on costs. We hope this will precipitate a single exchange rate across the board," the DCCI chief said.

Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said: "I welcome the move to introduce the crawling peg, which will eventually make us strong in exchange rate of dollar and taka."

However, if the exchange rate for remittances is higher than for exports, there will a problem, he said. Hatem added that if the new exchange rate could be standardised in the banking system, it would be better.

But if the rate varies between Tk 120 and Tk 122 per dollar in case of buying dollars to open letters of credit, then exporters will face difficulties.

Hatem also urged the government to ease business rules and reduce harassment of exporters to facilitate more trade. Reducing harassment would also work as an incentive for businessmen, he added.

Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association, also welcomed the move.

"In fact, I have been talking about introducing the crawling peg for many months as businessmen have been getting less due to the exchange rate," Khokon told The Daily Star over phone.

He added that the government should not interfere with the crawling peg system directly or indirectly.

Bangladesh adopted a floating exchange rate regime in May 2003 as part of a comprehensive medium-term economic programme to promote growth and alleviate poverty, according to the International Monetary Fund.

However, the floating rate was on paper as the central bank officially or unofficially directed the course of the exchange rate.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments