Banks go slow in raising interest rates even after BB cedes control

Bangladesh restored a market-driven interest rate regime after a gap of four years on Wednesday, allowing banks to price loans in line with demand.

However, most of the banks plan to adopt a go-slow strategy when it comes to revising the lending rates upwards and will continue to offer funds under the current rates.

The interest rates on consumer loans, forced loans and overdue loans are likely to go up rapidly in the upcoming months, however.

Forced loans are created when customers fail to make their LC (letter of credit) payments on maturity, and yet banks have to honour their obligations to foreign banks.

When borrowers fail to clear instalments on time, the loan is categorised as overdue.

Last week, the Bangladesh Bank scrapped the SMART formula to make interest rates fully market-based, less than a year after the Six-month Moving Average Rate of Treasury bills (SMART) was introduced and the 9 percent lending rate cap lifted.

Even before the SMART formula was abolished, the maximum lending rate was 13.55 percent, much higher than the ceiling that existed for more than three years.

Thus, most of the banks want to continue the current lending rates and plan to revise them after assessing the situation since a sharp rise in the cost of funds may make existing borrowers unable to pay back while the demand for fresh loans may fall.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, told The Daily Star that his bank would not hike the interest rates abruptly.

"We will revise the interest rate after assessing the market."

The private commercial lender plans not to increase the interest rate on industrial, agriculture and SME loans for now, said Rahman.

Some banks are likely to raise the interest rate now, but Rahman expects the cost of funds to come down to the expected level in the upcoming months.

"The central bank will actively monitor the market even though banks are allowed to fix interest rates. As a result, banks will not be able to set the rates at will."

Jamuna Bank Managing Director Mirza Elias Uddin Ahmed said the maximum lending rate at the private commercial lender is close to 14 percent and the rates will not go up rapidly.

"The lending rate will be fixed on the basis of demand and supply," he said, welcoming the central bank's move.

The CEO said now banks would be able to impose higher interest rates on bad borrowers and lower interest rates on good clients.

"This will encourage good borrowers to repay loans."

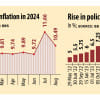

Last week, the central bank took three major decisions in line with the International Monetary Fund (IMF) prescription as it announced the market-driven interest rate and a flexible exchange rate and raised the policy rate to tame higher consumer prices.

Experts criticised the banking regulator, saying the decisions should have been initiated earlier since inflation has stayed above 9 percent for the past 20 months.

They said that the interest rate cap and the subsequent SMART formula made the banking sector volatile.

As per the new exchange rate-setting system known as the crawling peg, banks are permitted to determine the price of the US dollar by considering Tk 117 as the mid-rate.

Yesterday, most banks charged Tk 117.50 per dollar officially while opening LCs.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments