BSEC measures to prop up stocks backfiring

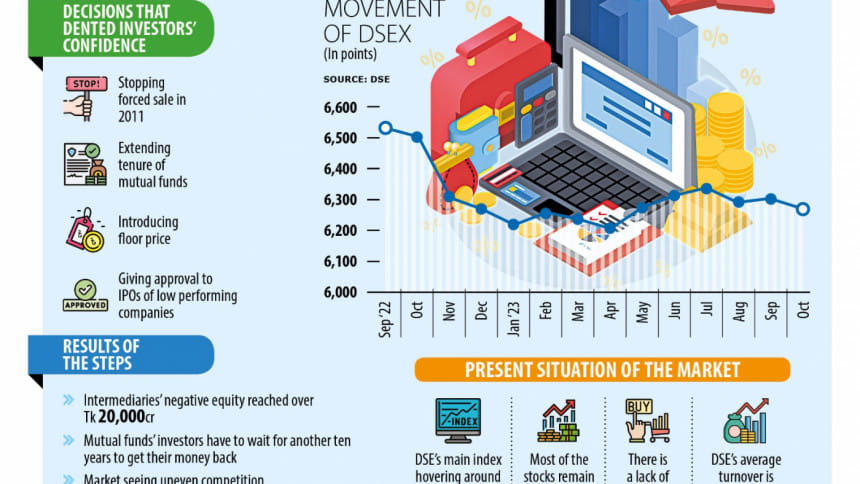

The main index of the stock market in Bangladesh has been hovering around 6,300 for the past year, with many shares remaining unsold amid scant investor participation, according to market analysts.

Besides, only junk stocks are performing well thanks to the prevalence of rumour-based trading, which is not a good sign for any market as it erodes investor confidence in the long-run.

But this is a common scenario for the country's share market due to the growing confidence crisis that has been exacerbated by some decisions of the Bangladesh Securities and Exchange Commission (BSEC).

Of these decisions, the move to stop market intermediaries from executing forced selling following the crash in 2010 and setting floor prices for all stocks in 2020 were the most impactful, they said.

And in 2018, the BSEC allowed fund managers to extend the tenure of closed-end mutual funds by 10 years, denting the confidence of foreign and institutional investors as many were awaiting returns.

Also, the market regulator's lack of restraint in giving licences to firms for operating as stock brokerages, merchant banks and asset management companies is not healthy for the market, they added.

Faruq Ahmad Siddiqi, a former chairman of the BSEC, said there is no doubt that these decisions have hurt investor confidence as people invest for mainly two reasons.

The first reason is that the stock market provides the scope to potentially turn a profit while the second is that it is a place where parked funds can be easily liquidated.

"However, launching floor prices has led to investors' funds becoming stuck even in blue-chip or other well-performing stocks," he said, adding that foreign investors will not be interested in such a market.

The BSEX introduced floor prices in 2020 to halt the freefall of market indices amid economic uncertainty brought on by the Covid-19 pandemic.

The floor price mechanism was gradually lifted in 2021 following criticism from most analysts and investors, but it was ultimately reinstated in mid-2022 after the Russia-Ukraine war began.

Another misstep was to bar market intermediaries from executing forced selling as investors would have otherwise at least gotten some money back and the intermediaries themselves would be left unscathed.

"Many intermediaries have become paralysed as they could not execute forced selling. So, their funds have become negative and they are still inactive in the market," Siddiqi said.

Forced selling refers to when an investor or business is compelled by their broker or financial advisor to sell assets or securities to create liquidity for repaying debts or meeting margin calls.

In 2011, the regulator verbally ordered all stockbrokers and merchant banks not to execute the forced sale of shares that were bought against margin loans in a bid to boost confidence in the market.

Take the case that an investor bought shares worth Tk 200 by taking a margin loan of Tk 100 from a stockbroker or merchant bank.

If the share price drops to Tk 150, then the market intermediary can order the investor to repay Tk 50.

And if the investor fails to repay the sum and the share price drops further, then the broker or merchant bank is allowed to sell his or her shares without consent in what is called forced selling.

However, the BSEC had ordered the intermediaries not to execute forced sales after the market became volatile due to a crash in 2010.

As forced sales were prevented, some investors defaulted on their payments to intermediaries instead of getting their invested funds back, the former BSEC chief said.

"These decisions are denting investor confidence, which it will take time to regain," he added.

A top official of a stock brokerage, preferring anonymity, said the decisions were primarily taken to improve investor confidence but ultimately failed as they were not based on market analyses.

Due to the non-execution of forced sales, the negative equity has risen to more than Tk 20,000 crore and the intermediaries are unable to invest.

"Another wrong decision was extending the tenure of closed-end mutual funds," he added.

Closed-end mutual funds are investment tools that pool a fixed amount of money from investors for a certain period to invest in stocks, bonds and other assents.

In the case of Bangladesh, the tenure of mutual funds is 10 years, after which the fund manager returns the investment and its profit to unitholders.

But in 2018, the BSEC extended the tenure of closed-end mutual funds by another 10 years, hurting investors who were already long awaiting to get back their funds with profit.

"The move badly dented the confidence of foreign investors," the stockbroker said.

A renowned fund manager, requesting not to be named, said extending the tenure of closed-end mutual funds and imposing floor prices were by far the worst decisions.

Other failures of the regulator include approving many low-performing companies to be listed with the stock exchange and its lax monitoring to control market manipulation.

At present, around 35 percent of all listed companies are low-performing, placing in either the Z or B categories, according to data of the Dhaka Stock Exchange (DSE).

"Another big blow was giving licences to a huge number of stock brokerages, merchant banks and asset management companies as it ultimately squeezed efficiency by creating uneven competition," he said.

Bangladesh has 402 brokers serving investors in the country while there are 314 in India, 67 in Nepal, 89 in Vietnam, 204 in Pakistan, 26 in Sri Lanka, 36 in Thailand, and 183 in Nigeria.

Likewise, Bangladesh is home to 68 merchant banks while India has 200, Nepal has 28, Vietnam has 17, Pakistan has 54, Sri Lanka has 21, Thailand has 50, and Nigeria has 32.

Mohammad Rezaul Karim, an executive director and spokesperson of the BSEC, said the commission did not officially order market intermediaries to stop forced sales.

Moreover, the regulator always discourages people from investing in stock using loans, he added.

Regarding the issue with closed-end mutual funds, Karim said the BSEC extended the tenure by 10 years by amending the rules.

"However, the extension was only for once," he added.

Giving logic behind the introduction of floor prices, Karim said the BSEC launched the mechanism in response to demand from investors as confidence was eroding and people were placing panic sales.

"We thought we would immediately lift the floor price when vibrancy returns to the market. However, we are still waiting for this," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments