Economic growth momentum at risk for global volatility: BB

The economy faces multidimensional challenges as the volatile global scenario threatens to create an adverse situation for the growth momentum of Bangladesh, the central bank warned yesterday.

"Looking ahead, headwinds to current growth momentum could emerge from unfavourable developments in global economies," said the Bangladesh Bank in its quarterly review.

"Compounding adverse effects of elevated global commodity and energy prices, and the recent price hike of petroleum and fertiliser prices in the domestic market may intensify the cost-push shocks to the economy."

The BB forecast a challenging outlook for the economy at a time when the spectre of the world falling into recession has intensified.

The common people in Bangladesh, like those in most other countries, are paying a heavy price for escalated petroleum costs, fuelled by the Russia-Ukraine war, and runaway inflation.

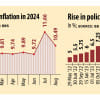

They now count Tk 109 for a litre of diesel and kerosene while the price of petrol has risen to Tk 125 and octane to Tk 130. Before August 6, a litre of diesel and kerosene cost Tk 80 each. It was Tk 86 for petrol and Tk 89 for octane.

"A significant depreciation of the taka against the dollar may also stoke the inflationary pressure further," said the BB quarterly for April and June.

The exchange rate stood at Tk 103 against the US dollar yesterday, down 20.7 per cent year-on-year.

"Mounting inflationary and exchange rate pressures due to high import prices and subsequent balance of payments adversities are prominent," the BB said.

"The rise in inflation, particularly food inflation, was much pronounced in rural areas, with a disproportionately higher impact on lower-income groups."

In July, inflation fell to 7.48 per cent from a nine-year high of 7.56 per cent in June. The government has not published the figure for August.

Bangladesh paid $82.49 billion for imports in the last fiscal year while it earned $49.2 billion by shipping goods abroad, causing the trade gap to rise to $33.2 billion.

Elevated global commodity and energy prices created significant challenges to the external sector of the economy.

Although the import decreased to some extent in July, it still surged to $5.86 billion, up 23.2 per cent from a year prior.

In order to limit excessive exchange rate volatility and help importers clear bills, the BB intervened in the foreign exchange market with net sales of around $7.4 billion in FY22. It has supplied more than $3 billion this fiscal year so far.

As a result, the foreign exchange reserve declined to $41.8 billion at the end of FY22 from $46.4 billion in FY21. It slipped further to $36.85 billion on September 21.

What's more, liquidity in the banking system maintained mostly a downward trend throughout the last fiscal year as banks bought dollars in exchange for the taka.

Besides, the rising growth of private sector credit and a declining deposit growth eroded the liquidity position in the banking sector, the BB said.

A rise in defaulted loans and provisioning shortfall, on the one hand, and advancement in profitability and maintaining adequate liquidity, on the other, reflected a mixed performance of the banking sector in FY22.

Defaulted loans hit an all-time of high Tk 125,257 crore in June.

In addition, the capital market witnessed some volatility with a downward trend in the final quarter of FY22 reflected in a downturn in price indices, market capitalisation, and turnover.

"The weak performance can be attributed to a downturn in the share price index in emerging market economies, commodity prices instability in both global and domestic markets, sharp depreciation of the taka, and financial tightening in advanced economies," said the BB.

The central bank has taken several measures to curb unnecessary and luxury imports. The rationing of power supply and the austerity policy of the government might provide some respites in terms of containing local demand.

The BB thinks that sustaining growth momentum, stabilising the exchange rate, and curbing inflation warrant prudent and coordinated fiscal and monetary policy actions.

The government and the BB have continued their supportive measures, including stimulus packages and refinance schemes for the productive sectors, improving the availability of essential products.

"This will help maintain price stability while keeping the growth momentum going," said the central bank.

The economy might face further pressure in the days ahead owing to the potential recession.

On Tuesday, World Trade Organisation Director-General Ngozi Okonjo-Iweala said she believes the world is heading towards a global recession due to multiple colliding crises.

Russia's war in Ukraine, the climate crisis, food prices and energy shocks plus the aftermath of the Covid-19 pandemic were creating the conditions for a world recession, she said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments