Firms’ falling profits testify to slowing business, economy

Businesses in Bangladesh went through a tough time in recent months due to a dearer US dollar that pushed up their costs of raw materials and a rocketing fuel bill that contributed to the surge in operating expenses.

The fear of an economic slowdown because of the dragging Russia-Ukraine war and the global energy crisis has made inflation-hit people more cautious, forcing them to tighten their purse strings that hurt the bottom line of companies.

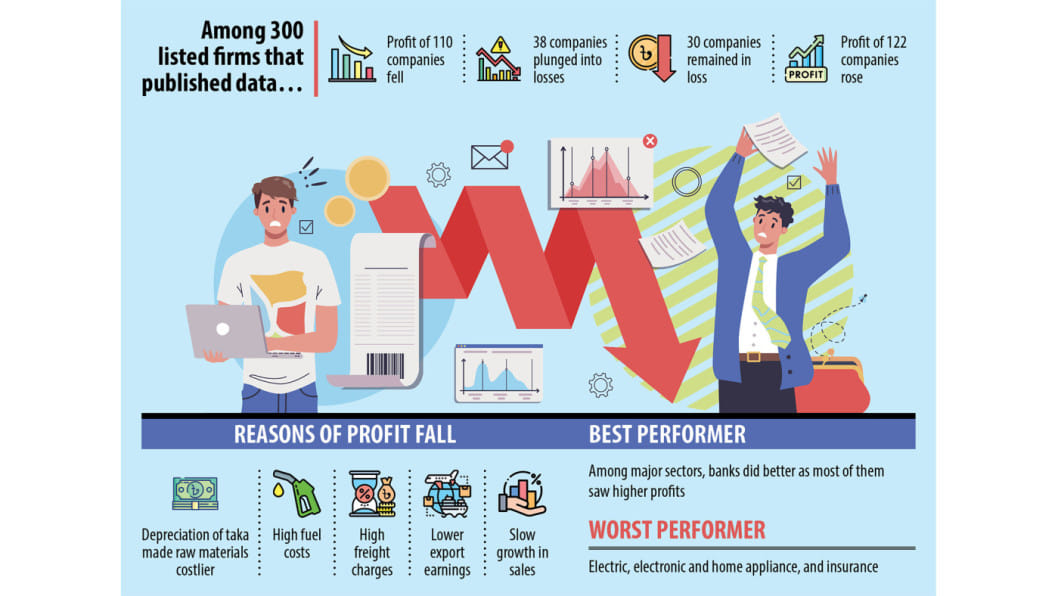

It was evident again in the financial performance of 300 companies listed on the Dhaka Stock Exchange in the July to September quarter of the current financial year of 2022-23. They represented almost all sectors of the economy.

Of them, 110 companies posted a reduced profit in the three-month period compared to the identical quarter a year earlier.

Thirty-eight companies slipped into losses for the first time while the losses for 30 firms widened in the quarter, data compiled by Sandhani Asset Management showed.

Some 122 companies showed higher profits despite the mounting challenges, at home and abroad.

"The performance was not surprising as the whole world is suffering because of the Russia-Ukraine war. We are also facing the heat of the global crisis," said Kazi Iqbal, a senior research fellow at the Bangladesh Institute of Development Studies.

Firms are facing monumental challenges on both the demand and supply sides.

On the demand side, people are buying less since their purchasing power has been squeezed for higher consumer prices, which surged to a decade high in Bangladesh in August.

People are also worried that the economy may slow down further since the factors responsible for the current global crisis and the strain facing Bangladesh's economy are still there. And there are little signs that they would disappear anytime soon.

On the supply side, the cost of production has gone up for the higher global commodity prices, the unprecedented US dollar rate, and the fuel prices locally.

Since November last year, the government has hiked the diesel price twice, sending it to Tk 109 per litre from Tk 65 to minimise the subsidy on petroleum products.

"All of the factors have combined to hit the businesses," Iqbal said.

Among the major sectors, the banking sector did comparatively better. The worst performers include electric, electronic and home appliance, and insurance sectors, the data showed.

"The export-based companies also suffered in the July-September quarter as the world economy and the export destinations of Bangladesh, especially, are seeing high inflation. So, demand for imported goods in these countries has dropped," said Rizwan Rahman, president of the Dhaka Chamber of Commerce and Industry.

Inflation in the 19-member eurozone surged to 10 per cent in September, the highest since records began. In the US, it was 8.2 per cent in the month, hovering near the highest levels since the early 1980s.

Amid the worsening cost-of-living crisis, nearly three-quarters of European consumers are cutting back spending on everyday items, including food, to make ends meet, according to IRI, a data analytics and market research company, reported Bloomberg recently.

The EU and the US together account for more than 80 per cent of Bangladesh's export earnings.

Exports from Bangladesh dropped 6.25 per cent year-on-year to $3.9 billion in September, the first fall in 14 months, leading to an overall slowdown in shipment.

The FMCG (fast-moving consumer goods) companies that serve the local consumers were also suffering from a lower profit since the cost of operation rose, said Rahman.

"The depreciation of the local currency against the US dollar sent the raw material costs soaring."

The taka lost its value by at least 25 per cent versus the American greenback in September compared to a year prior amid fast-depletion of the foreign currency reserves.

The insurance sector suffered significantly in the July-September quarter as the opening of letters of credit for imports dropped.

Providing insurance coverage to LCs is a major source of income for insurers, said Rahman, also a director of Eastland Insurance Company Limited.

Some large companies such as Walton Hi-tech Industries, Singer Bangladesh, Runner Automobiles, ACI Ltd, Ifad Autos, and Baraka Power incurred losses in the first quarter of 2022-23. They logged profits in the same period a year earlier.

Walton, the largest electric and electronic items manufacturer in Bangladesh, blamed the war, higher global inflation, the price hike of materials, higher freight costs, vulnerable market condition and devaluation of the local currency for the decrease in profits.

Abdul Matlub Ahmad, a former president of the Federation of Bangladesh Chambers of Commerce and Industries, the apex trade body in the country, said: "All businesses suffer due to the government's recent decision to reduce imports and the squeeze in spending by consumers."

In order to save the foreign exchange reserves, whose level fell by 25 per cent since the war began, the government has limited the imports of non-essential and luxury items.

But since manufacturers rely on foreign markets to buy raw materials, the import restriction has hit the economy, said Ahmad, also the chairman of Nitol-Niloy Group of Companies.

"People are cash-strapped so they are cautious against buying luxury items. As a result, the sales of the luxury items manufacturers have fallen."

Runner Automobiles said it posted losses in the first quarter for the shrinking sales, higher cost of production, import restrictions, and the overall economic downturn.

It has been further compounded by the war and its fallout on the world economy, it said.

Singer Bangladesh said economic activities remained depressed during the reporting period as freight, energy and food price shocks continued to impact adversely.

These adversities have created uncertainty and consumers have deferred purchase unless it is absolutely necessary, it said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments