Is higher inflation knocking at the door?

If you regularly follow the kitchen market or inquire a neighbourhood grocery about prices, you are likely to get an obvious answer: the prices of a number of commodities are on the rise.

The daily market price data compiled by state-run Trading Corporation of Bangladesh (TCB) will give a clearer picture of what is going on in the market. The prices of rice, flour, edible oil, pulses, and broiler chicken meat have gone up over the last one year.

For items such as rice and chicken, domestic farming is the main source. For the rest, Bangladesh is highly dependent on the international market, where commodity prices are going up.

Oil prices have already crossed $80 per barrel for supply disruptions and recovering demand from the coronavirus pandemic, reports Reuters.

The oil price rally to a three-year high is exacerbated by an even bigger increase in gas prices, which have spiked 300 per cent and have come to trade close to an equivalent of $200 per barrel due to supply shortages and low production of other fuels, it added.

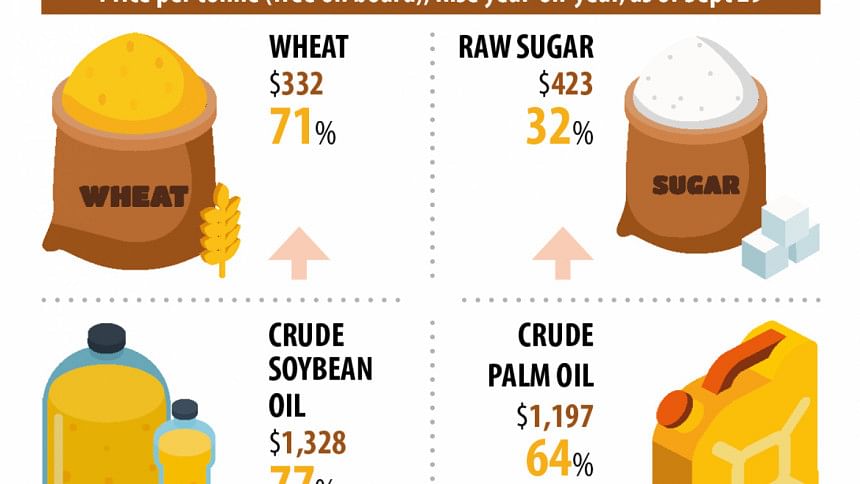

Apart from energy, prices of agricultural and food commodities – wheat, soybean oil and palm oil –soared over the last year in the international market.

It fueled price spike domestically.

A slow depreciation of the taka against the US dollar increased the import costs.

So, there is an apprehension whether higher inflation, which has already become a concern for many nations, is knocking at the door.

Economists say Bangladesh always remains vulnerable to import-induced inflation because of its reliance on external markets for key commodities.

Inflation has picked up around the world due to higher costs of raw materials, constraints on the supply of goods, stronger consumer demand as economies reopen, and prices bouncing back from drops during the pandemic in some sectors, said the Organisation for Economic Co-operation and Development (OECD) recently.

Prices in the G20 group of major economies will grow faster than pre-pandemic for at least two years, the leading global agency has forecast.

In the US, the cost of goods and services rose sharply in August and left the rate of inflation at a 30-year high, according to financial data portal MarketWatch.

Eurozone inflation hit its highest level in 13 years in September as the bloc battles surging energy costs.

In Bangladesh, petroleum and gas prices are administered. So, a lot lies on whether the government will increase prices of the two energy products.

And any price increase is likely to stoke inflationary expectations and adversely affect prices.

If not, the pressure on the public exchequer will mount for subsidising additional cost for oil and gas. The soaring import may also put pressure on the balance of payments.

"Overall, macroeconomic stability is under pressure. A macro-stability risk is rising," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

"Already there is a pressure on the exchange rate, and the cost of import will rise if the Bangladesh Bank allows major exchange rate depreciation and that could be inflationary."

Since the beginning of the current fiscal year, the value of the US dollar increased.

On July 5, the exchange rate was Tk 84.80 per USD. Three months down the line, the value has risen to Tk 85.5, Bangladesh Bank showed.

Atiur Rahman, a former governor of the BB, said Bangladesh had always been vulnerable to import-induced inflation.

"The exchange rate has to be kept stable. Otherwise, increased import cost will fuel inflation," he said, adding that the imports of luxury items should be discouraged.

In August, overall inflation rose 18 basis points to 5.54 per cent owing to the rise in demand and the abnormal hike in transport cost following the reopening of the economy from the coronavirus-induced lockdowns, according to the Bangladesh Bureau of Statistics.

Non-food inflation was the main driver while food inflation also contributed to the spike.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, says the economies around the world are trying to return to normalcy.

"As demand is higher than supply, a backlog is there," she added.

"As we are dependent on import for a number of commodities, there will be pressure of import-led inflation."

In fiscal year 2020-21, imports surged 20 per cent year-on-year to $65.59 billion. In July, overall imports grew 22 per cent $5.14 billion, BB data showed.

Fahmida Khatun thinks a lot will depend on domestic agricultural production, particularly rice and the government's procurement and distribution of food grains.

"Smooth supply chain will be important too to contain prices spikes."

Selim Raihan, executive director of the South Asian Network on Economic Modeling, says import demand will increase as the economy has regained pace.

"And the pressure on the exchange rate will increase."

"Despite the recovery in economic activities, the incomes of many people are yet to return to the pre-pandemic levels. So, the increased prices will affect them."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments