ICB traces 38 companies with IPO potential

Listing of Grameenphone on the stock exchange in 2009 had a huge impact as thousands of investors flocked to open beneficiary owner accounts to get shares of the high-performing company through the initial public offering (IPO).

It ultimately created hype among investors to pour funds into the equity market. After that, no company could create such hype and the market also remained depressed.

Analysts have for many years been urging the listing of companies with good performance records, as it could boost investors' confidence overnight. They state that at least profitable state-run companies should be listed.

Taking the cue, the Investment Corporation of Bangladesh (ICB) has traced 38 potential entities from among state-run, multinational, and local pharmaceutical companies that could go for IPOs.

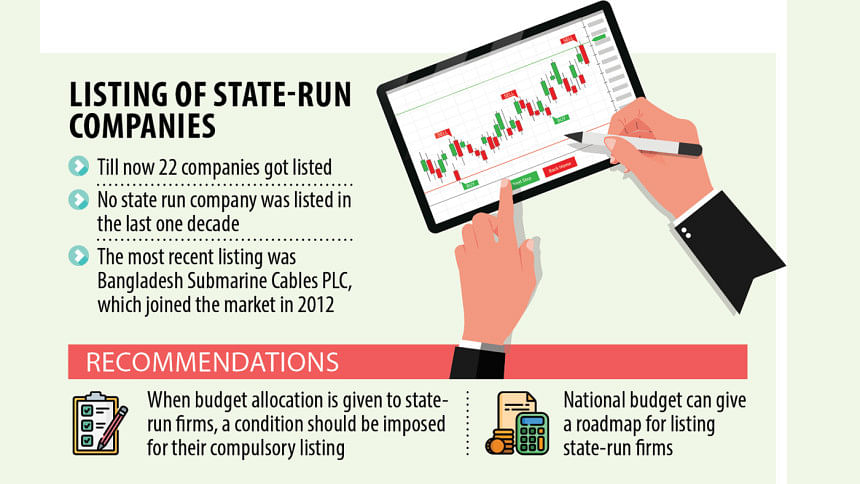

The Ministry of Finance should be serious about ensuring the listing of state-run companies and impose a relevant condition in the next national budget. Simultaneously, a roadmap is required for the listing of these companies, according to the analysts.

Of the potential companies, 12 are state-run, 24 multinational, and 38 pharmaceutical.

Mazeda Khatun, general manager of the ICB, identified these companies a couple of months ago considering their business nature, profitability, and income.

She provided the list to the Bangladesh Securities and Exchange Commission (BSEC), Financial Institutions Division, and Capital Market Development Committee, which is led by Anisuzzaman Chowdhury, who was appointed as the chief adviser's special assistant last month.

It is high time to enlist the state-run companies, as none can defer it during the tenure of this interim government, given such plans were postponed in the past for different reasons, she said.

"It is highly possible to enlist multinational companies too by giving all types of waivers that they seek in order to ensure a higher supply of good shares," she told The Daily Star.

"If they can offload shares in other countries, why will they stay shy in our country… there is no reason," she added.

Meanwhile, the BSEC has announced that it will focus on facilitating IPOs of well-performing local, multinational, and state-run companies in order to boost investors' confidence.

To attract good companies to the market, the BSEC is trying to ensure at least a 10 percentage-point difference in the tax paid by listed and non-listed firms through the upcoming budget.

It is also advocating for barring manufacturing companies from availing high amounts of bank loans if they have not yet gone public.

The Ministry of Finance should come forward to take responsibility for drawing well-performing companies, said Saiful Islam, president of the DSE Brokers Association of Bangladesh.

It can also offer budgetary allocations for companies that get listed within a specific period. There should also be a roadmap for getting all the companies listed within that period, he said.

Inclusion of the companies in the capital market will boost investor confidence, as most of them have been doing good business for years and have near monopolistic control of the market, he said.

For instance, Padma Oil, Jamuna Oil, and Meghna Petroleum have been providing handsome dividends for a couple of decades, said Islam.

There are several examples of companies with poor performance that failed to pay any dividends for years.

The government needs to change some policies regarding these companies, he said.

One way is by offloading a large number of shares for private investors interested in running those companies, as their infrastructure could turn out to be attractive, he added.

According to the ICB, Ashuganj Power Station Company Limited, Sadharan Bima Corporation, Jiban Bima Corporation, LP Gas Limited, Bakhrabad Gas Distribution Company Limited, and Jalalabad Gas Transmission & Distribution Systems Limited are among the potential state-run companies.

Other government-owned companies are Pashchimanchal Gas Company Limited, North-West Power Generation Company Limited, B-R Powergen Limited, Northern Electricity Supply Company (PLC), Dhaka Power Distribution Company (DPDC), and Gas Transmission Company Limited (GTCL).

The Awami League government tried hard to bring some companies to the stock market but failed. Sometimes, a political government cannot do many things that can be done by unique governments such as the current one. So, the matter should be taken up seriously, he added.

In 2010, former finance minister Abul Maal Abdul Muhith gave 26 state-run companies six months to get listed. However, none came to the market in the last 14 years, except for Bangladesh Submarine Cables PLC.

Anisuzzaman Chowdhury told journalists last year that the government was working on offloading state-run companies.

It is also trying to offload its portion of multinational companies' shares. "But we don't want to take any drastic decision because there might be side effects," he said.

The government is focusing on it and will try to allow companies with good governance into the market, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments